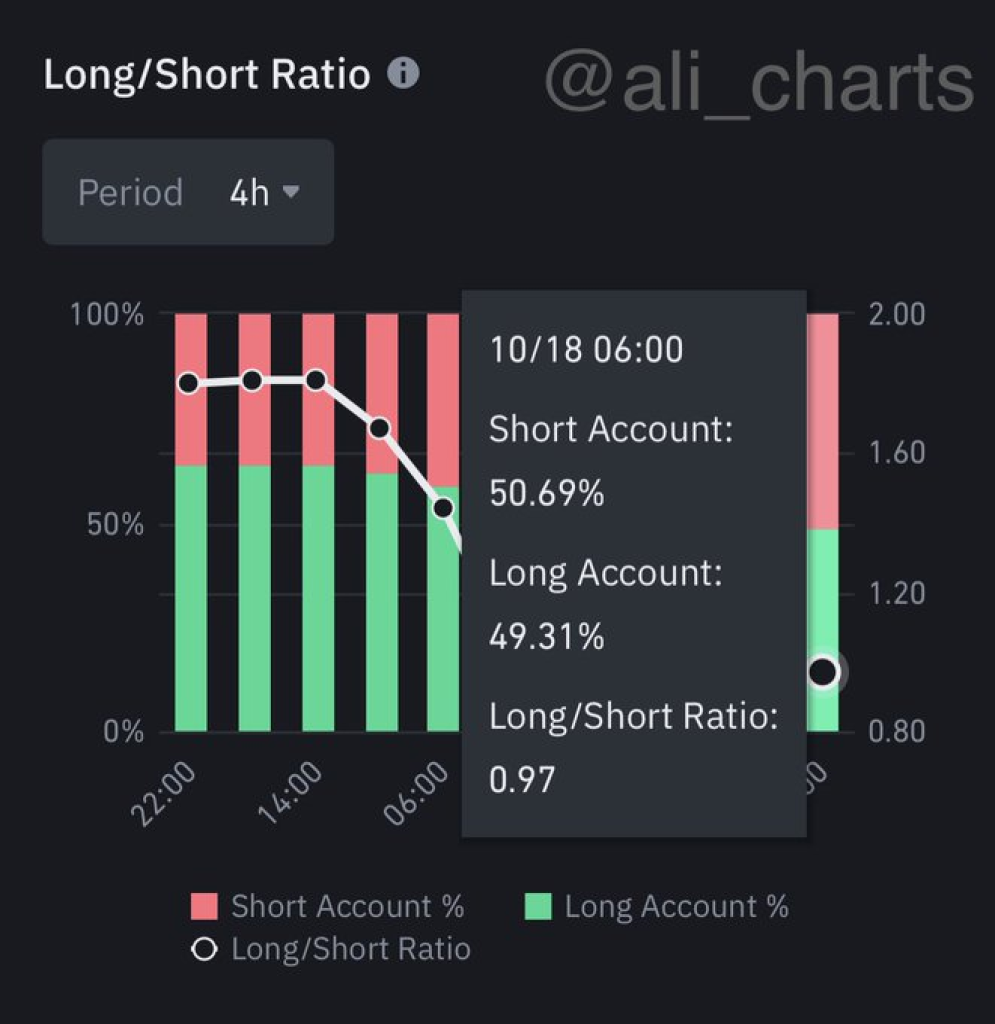

According to a recent tweet by crypto trader Ali, 51% of Binance accounts trading Bitcoin futures currently have open short positions, betting on a price decline.

This data comes as the price of Bitcoin approaches $29,000, after the recent surge to $30,000 following the recent fake Bitcoin ETF approval report. The price of BTC immediately dropped to the $28,000 level after it was confirmed that the report was fake.

The predominance of shorts suggests most active futures traders believe Bitcoin is overbought at current levels and expect an impending drop.

When traders take short positions in crypto futures, they are betting on the price going down. They borrow the asset, sell it at the current market price, and hope to buy it back later at a lower price to pay back the loaned amount, profiting on the difference.

These speculative short positions add selling pressure weighing on any further upside move. Crypto derivatives exchanges like Binance allow traders to short and bet against rising prices using leverage. This can accentuate move dynamics and increase volatility.

Seeing the majority adopting a short stance illustrates the cautious market sentiment around Bitcoin staging a deeper recovery without significant pullbacks.

However, heavily skewed positioning also raises the chance of a short squeeze if prices continue defying expectations on the upside. A cascade of short covering could propel a rally.

As Bitcoin tests resistance around $29,000, the mood of futures speculators provides useful perspective on the delicate psychology of traders at present. But with diverse views on direction, execution remains crucial.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.