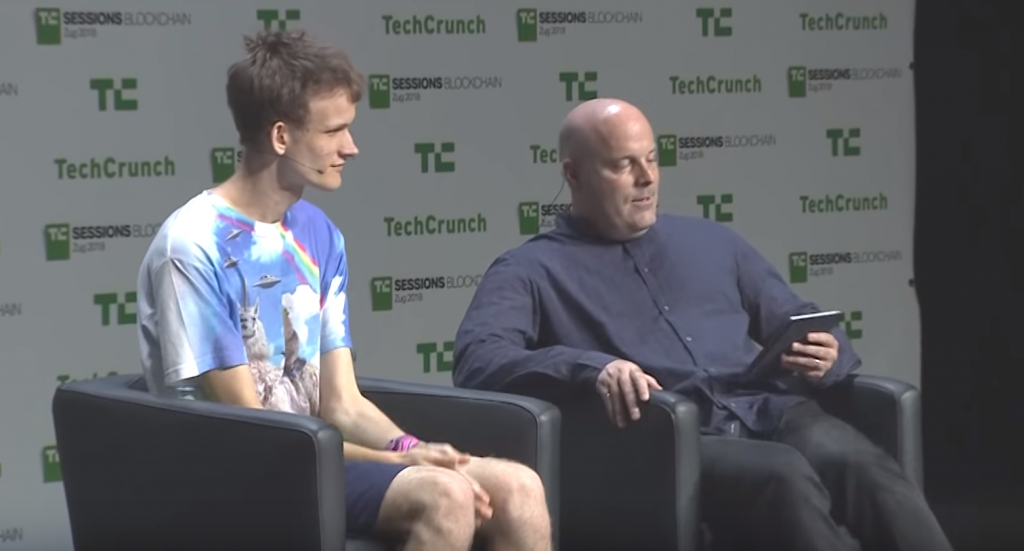

Vitalik Buterin, the famous eccentric Ethereum founder, recently spoke with Jon Evans of TechCrunch Sessions during an event dedicated to blockchain technology. Aptly named “TC Sessions: Blockchain 2018,” this event hosted other influential crypto-related people including ChangPeng Zhao of Binance, Guy Zyskind of Enigma and Balaji S. Srinivasan (the CTO of Coinbase). Vitalik touched upon a number of topics with his host, including Ethereum and the issues of centralization in crypto.

When asked if he feels that the criticism of PoS algorithms as being too centralized is fair, Buterin went on to explain that those issues are exaggerated and that PoW ones suffer from centralization much more. He pointed out that Bitmain and a couple of related mining pools currently own over 40% of Bitcoin’s hashing power and immediately further expanded on this point:

“Back in 2013, when GHash had 51 percent everybody freaked out. It’s happening a second time and people aren’t really talking about it this much.”

The issue has been brought to light after recent flooding issues destroyed thousands of crypto mining rigs across China’s Sichuan area. It became apparent that these mining rigs belonged to a small number of concentrated actors who simply purchased insane amounts of hardware and employed it to mine Bitcoin for them. Buterin feels it’s very likely that currently active and popular mining pools operate on this model and questions their ownership and geographic centralization.

“Proof of Work is rich get richer squared”, concludes Vitalik, seemingly avoiding to address PoS/DPoS centralization issues that have been exposed with the latest EOS mainnet launch. He did however reiterate that Ethereum foundation is focused on decentralization:

“The Ethereum Foundation tries very hard to be a decentralized organization,” he said. “We try very hard not to have a very hard divide, such as you’re on the inside and you’re on the outside.”

He also stated that it’s currently impossible to achieve total decentralization and mass adoption at the same time. The main problem here is user authentication. Users on Ethereum blockchain can generate private keys and manage their funds in a decentralized way, until they one day lose their keys or their passwords. We all know how easy it is to forget even the simplest login information so Vitalik’s point does ring true here.

Dead accounts are an important issue that cannot be addressed without a certain degree of centralization. Buterin claims that social recovery schemes impress him and named WeChat’s system – which lets you select a couple of trusted contacts on your phone’s contact list to vote on you recovering access to your account – as one of his preferred ways of handling this problem. He also mentioned that a creation of a secondary blockchain where your funds simply get hard spooned/airdropped onto your account is a possibility. In his typically socially awkward way, Buterin cracked a joke to end his presentation on accounts:

“If all fails we’ll all use Coinbase — that’ll be less fun.”

Mentioning Coinbase led him to comment on the centralized/decentralized exchanges debate. His position was pretty direct and simple to understand:

“I definitely hope centralized exchanges go burn in hell as much as possible.”

He explains his stance by claiming that centralized exchanges have massive “king-making” power and are currently alive simply because they serve as fiat-to-crypto intermediaries. These exchanges sometimes take millions of dollars to list a coin and have a lot of regulatory hoops they need to jump through, and Vitalik sees decentralized peer-to-peer trading as something that will become an important part of the future.

“The more we can get away from that (centralized) world and into something that satisfies the blockchain values of openness and transparency, the better,” concludes Buterin. The TechCrunch “Fireside Chat with Vitalik Buterin” had many more gems of crypto wisdom and I recommend that you watch the full video on the provided link.