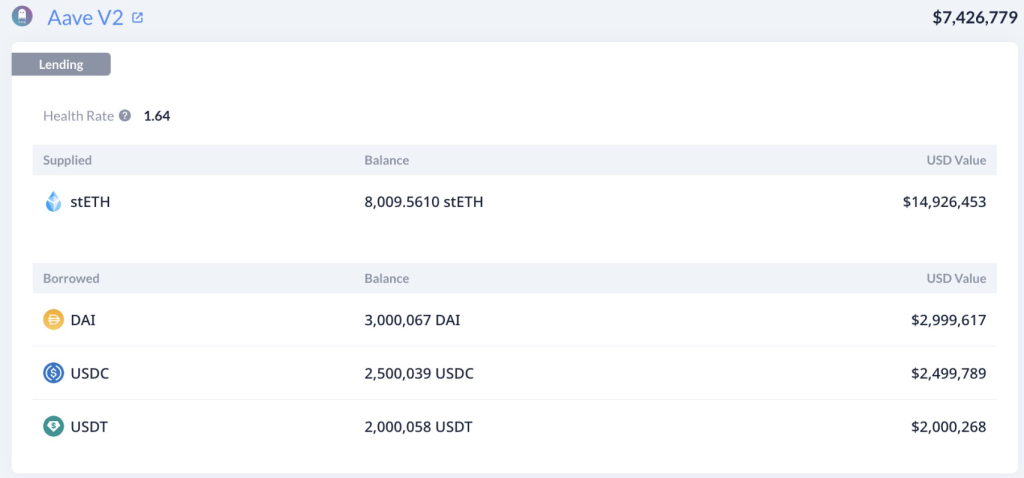

In the early hours of June 27, 2023, the crypto world witnessed a significant event. Two large-scale Ethereum (ETH) transactions were executed on the decentralized lending platform, Aave, likely by the same individual or entity. The total deposit amounted to 14,771 staked Ethereum (stETH), with a subsequent borrowing of $14.5 million in stablecoins.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The first transaction was traced back to a wallet address, which we’ll refer to as “Wallet A”. The owner deposited 3,991 stETH and borrowed 2 million Tether (USDT) and 3 million Dai (DAI). They then purchased 2,678 ETH at a rate of $1,867 per unit and converted these into stETH. This was followed by another deposit of 2,675 stETH and a borrowing of 2.5 million USD Coin (USDC). The cycle repeated with the purchase of 1,344 ETH at $1,860, conversion to stETH, and a final deposit of 1,343 stETH.

The second transaction was linked to another wallet address, which we’ll refer to as “Wallet B”. This wallet owner deposited 3,963 stETH and borrowed 5 million USDT. They then bought 2,687 ETH at $1,860 each and swapped these for stETH. After depositing 2,685 stETH, they borrowed another 2 million USDT. The process was repeated with the purchase of 1,073 ETH at $1,864, conversion to stETH, and a final deposit of 1,073 stETH.

These transactions highlight the dynamic nature of the crypto market and the strategic maneuvers of large-scale investors, often referred to as ‘whales’. By leveraging the revolving loan feature on Aave, these whales were able to make substantial trades, potentially influencing the market dynamics of Ethereum and the associated stablecoins.