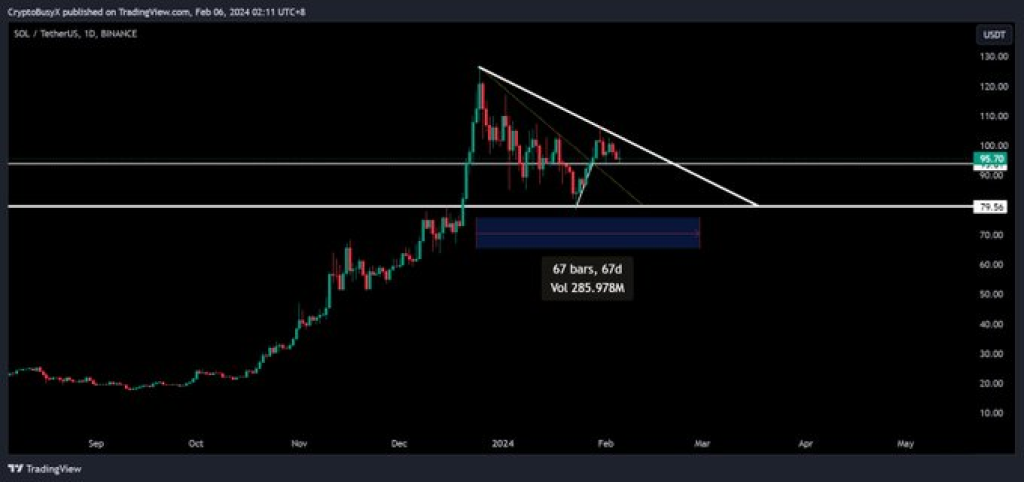

Solana’s price action continues to develop within a multi-month triangle consolidation pattern, just as a broader conviction has been waived across digital assets. However, with SOL gaining traction since its bullish upside breakout, analysts debate whether adequate momentum exists to power through macro turbulence.

According to crypto analyst Crypto Busy, SOL remains stuck, ranging between two key technical levels:

“Price could consolidate inside this huge triangle (45 days+) Current structure: – recently retraced from an uptrend market structure. Price might be inside a huge distribution phase.”

This points to further volatile swings and directional uncertainty in the short term. SOL could snap either above $100 resistance to confirm bullish continuation or break back below that level if selling pressure resumes.

According to analysis by altFINS, achieving back-to-back daily closes above $100 resistance validates the upside move, with initial targets around $125. This opens the door for SOL to continue repairing damaged long-term market structures. But failure to hold the newfound floor means ranges could prevail and trap bulls.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In essence, while Solana shows leadership credentials by taking out its recent descending channel, tenuous macro conditions mean trend change risks remain heightened. SOL now must build on its constructive base to regain $100 level.

Otherwise, the pullback risk towards retesting the low $80s endures as analysts debate the nascent recovery durability across crypto markets. Still, the improving short-term technicals bode well if cooperative markets persist. Solana is currently trading at $95.01, with a 1% drop in value over the last 24 hours.

You may also be interested in:

- Why is Arcblock Price Up By 140%? Analyst Warns ABT Investors Of This Metric

- Why Ronin’s Price Tumbled After a Major Exchange’s Listing Mix-Up: Will the RON Listing Lead to a Rebound?

- Presale grows and grows – Ripple (XRP) & BNB (BNB) holders continue the bull run in Pushd (PUSHD) presale as 2024 shows big rewards

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.