The cryptocurrency market has been abuzz with the recent surge in the RWA (real-world asset) sector, fueled by the launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL). This groundbreaking initiative by the world’s largest asset manager has thrust RWA-based projects into the spotlight, with investors and traders alike scrambling to identify the most promising opportunities in this rapidly evolving space.

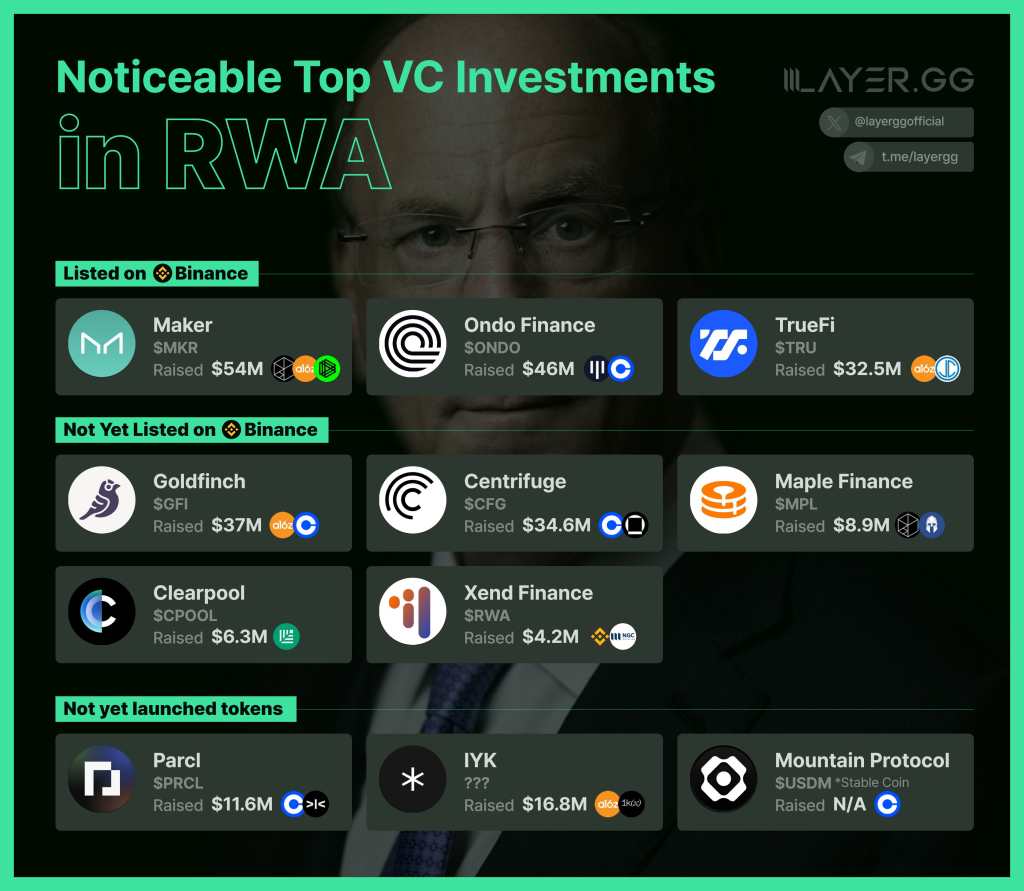

As the RWA sector continues to gain traction, prominent crypto analysts and venture capitalists (VCs) have been closely monitoring the landscape, keen to uncover the next big winners. Among them is Layergg, a highly respected crypto analyst with a formidable following of nearly 100,000 on X (formerly Twitter). In today’s tweet, Layergg shed light on the RWA projects capturing the attention of top VCs, highlighting their unique value propositions and potential for growth.

What you'll learn 👉

Top RWA Crypto Coins

One of the standout projects mentioned by Layergg is MakerDAO ($MKR), known for its decentralized stablecoin DAI. MakerDAO’s innovative approach to RWA exposure through its Multiple Collateral system allows users to earn a staggering 15% annual percentage yield (APY) simply by staking DAI.

Additionally, the upcoming launch of SPK, a new token designed for DeFi whales to farm, has further piqued the interest of investors. MakerDAO’s highly anticipated “Endgame” event, slated for the summer of 2024, promises a new brand identity and a token redenomination, adding to the project’s allure.

Another project that has caught the attention of VCs is Ondo Finance ($ONDO). Layergg highlights Ondo’s three RWA-backed products – USDY, OUSG, and OMMF – which offer an average APY of 5%. Notably, Ondo boasts the “world’s first tokenized U.S. Treasuries,” packaging BlackRock’s Treasury ETFs, positioning it as a prime contender for adoption by the institutional giant.

- TrueFi DAO ($TRU) has also made significant strides in the RWA space with the launch of its Trinity lending platform. This innovative platform enables crypto loans using tokenized RWAs as collateral, offering products like the USD-based TRI and the T-bill product tfBILL, which can yield up to 15% APY.

- Goldfinch ($GFI), founded by former Coinbase employees, has garnered attention for its USDC-based credit lending platform, offering approximately 8% APY. Despite its relatively low market cap, Goldfinch’s solid team and RWA exposure have piqued the interest of VCs.

- Centrifuge ($CFG), with its RWA products like loans and U.S. Treasuries yielding 4-8% APY, is another project on Layergg’s radar. The platform’s upcoming “Centrifuge Prime” and on-chain asset management features have further fueled anticipation.

- Maple Finance ($MPL), an institutional lending platform offering up to 15% APY, has also garnered attention, particularly with its recent expansion into the Base ecosystem and the promise of new product announcements on March 27th.

- Clearpool Finance ($CPOOL): RWA lending platform offering up to 17% APY + $OP rewards. Recently expanded to MANTLE ecosystem.

- Xend Finance ($RWA): Rebranded as the “world’s first RWA L1 solution.” Threefold increase since rebranding but still low market cap.

- Parcl ($PRCL): Ongoing Parcl Points season 3. Upcoming TGE after season 3 conclusion.

- HOA NFT (@hoa_nft): NFT holders receive points boosting rewards. Novel approach bridging NFTs and RWA exposure.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Conclusion

As the RWA sector continues to gain momentum, fueled by the entry of institutional players like BlackRock, the projects highlighted by Layergg and other prominent analysts offer a glimpse into the future of this burgeoning space.

With innovative products, solid teams, and compelling value propositions, these projects are poised to capture the attention of both retail and institutional investors alike. However, as with any investment opportunity, thorough research and due diligence are paramount.

You may also be interested in:

- Bitcoin’s Bearish Signals Suggest Potential for Prolonged Correction: Analyst Cautions That BTC is Set to Move Lower

- Internet Computer (ICP) And Chromia (CHR) Prices Pumping: Here’s Why

- Why Meme Coins Like Floki Inu and Dogecoin Should Be Worried About Leading Crypto Presale Scorpion Casino

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.