Financial giant BlackRock has announced the launch of a digital asset fund called “BUIDL” backed by $100 million in USDC on the Ethereum blockchain. This is an important move in the burgeoning real-world asset (RWA) tokenization industry. Notably, Coinbase has been selected as the key infrastructure provider for this fund, marking a significant collaboration between major players aimed at driving the RWA space forward.

The “BUIDL” fund aims to maintain a stable value of $1 per token while providing daily accrued dividends directly to investors’ wallets in the form of new tokens each month. This partnership signals BlackRock’s commitment to exploring blockchain technology and the tokenization of traditional assets, potentially unlocking vast opportunities within the multitrillion-dollar RWA market.

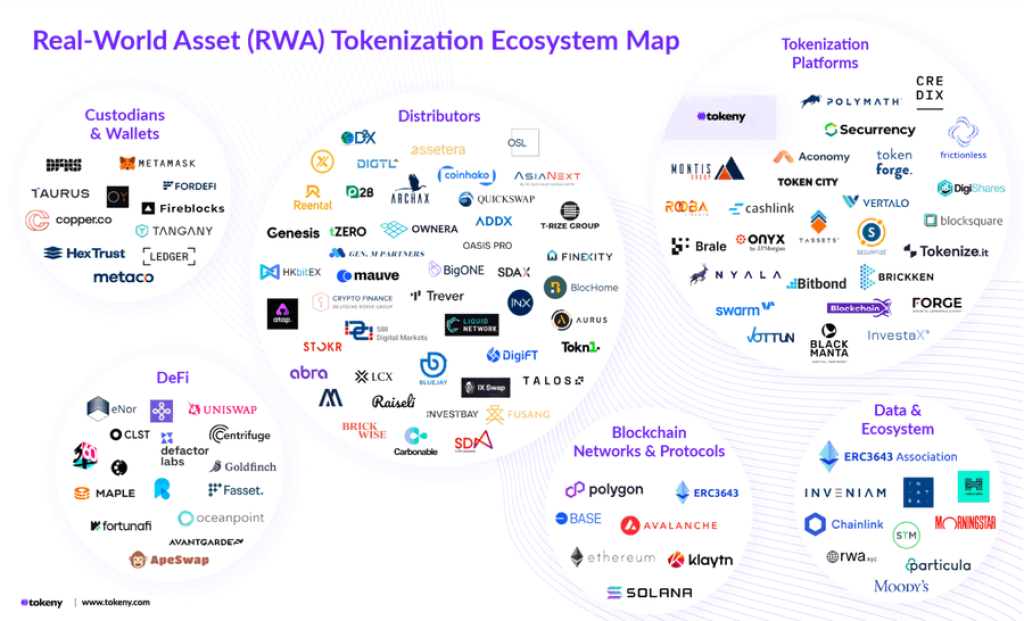

As the RWA industry continues to gather momentum, several promising projects have emerged as potential market leaders. According to the analysis made by AlΞx Wacy on X, these RWA tokens could experience staggering gains of up to 100 times their current valuations as mainstream adoption accelerates. Here are six notable RWA projects:

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +- Grandbase (GB): A decentralized market for synthetic RWAs, allowing exposure to real-world assets without holding the underlying asset itself. With Coinbase’s potential support and a promising $5B fully diluted valuation, GB could be a compelling choice.

- Polytrade (TRADE): A secure marketplace for buying, selling, and managing RWAs, including fractionalized assets. Polytrade has partnerships with major RWA protocols like Ondo Finance and Clearpool, positioning it as a key player in the space.

- IXSwap (IXS): Dubbed the “Uniswap for RWAs,” IXSwap merges DeFi with traditional finance compliance, enabling secure trading of security tokens and fractionalized NFTs across global jurisdictions.

- Realio (RIO): A fully compliant Layer 1 blockchain built with the Cosmos SDK, designed specifically for tokenizing and storing RWAs in a secure, decentralized network.

- Ondo Finance (ONDO): Focused on democratizing access to institutional-grade financial services, Ondo offers exposure to short-term US Treasuries through its yield-bearing stablecoin, USDY.

- Clearpool (CPOOL): Introducing a DeFi ecosystem with a permissionless marketplace for institutional liquidity, Clearpool allows institutions to raise capital and DeFi lenders to earn returns through single-borrower pools and a compliant borrowing/lending platform.

As the RWA industry continues to expand, driven by increased institutional involvement and regulatory clarity, these projects could play pivotal roles in shaping the future of asset tokenization and unlocking new opportunities within traditional finance.

Remember, while the potential for growth is substantial, conducting thorough research and adhering to a well-defined investment strategy is crucial when navigating this emerging market.

You may also be interested in:

- Bullish Catalysts Line Up for FLOKI and Shiba Inu (SHIB): Why You Should ‘Start Paying Attention’ to These Tokens

- Crypto Expert Explains How Bitcoin (BTC) Will Determine the Start of Altseason, States When to Expect 100x Gains

- Decoding the 67000% Jump of Launchpad Token for This Bull Run’s Forecast

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.