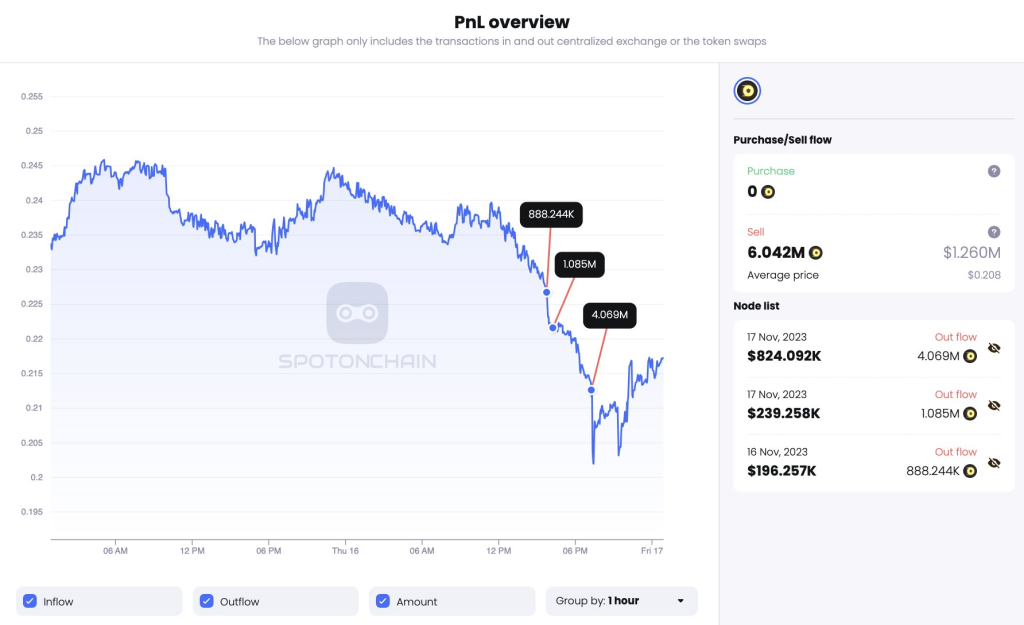

The price of Rollbit (RLB) has crashed significantly in the last 24 hours after a major whale dumped their entire holdings according to a report from Spot On Chain shared on X (former Twitter) around 6 hours ago. RLB has dropped 13% and is now trading around $0.20.

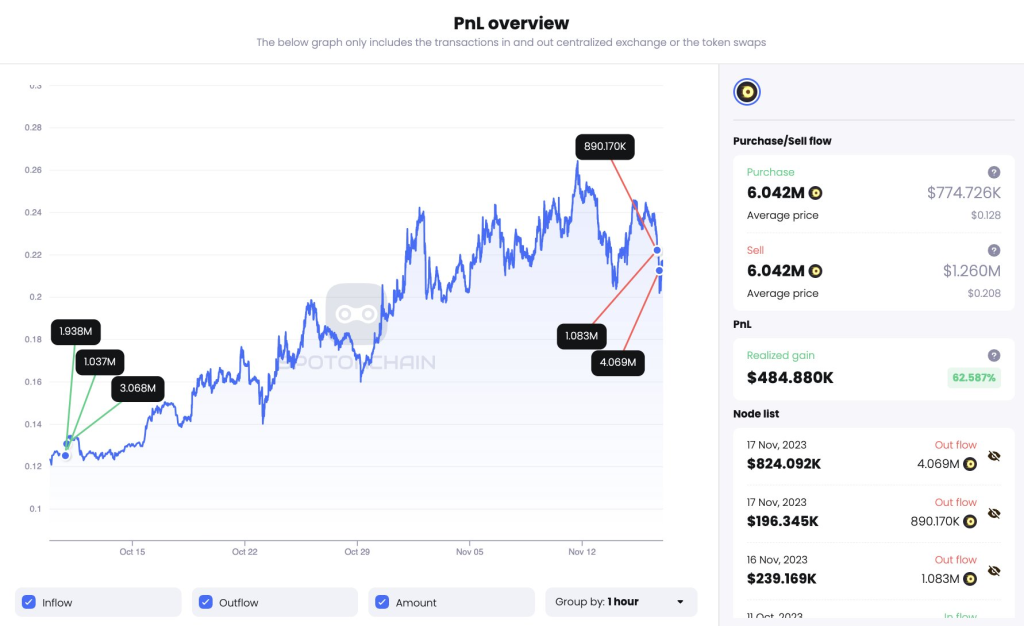

The plunge came after whale wallet 0xd08 sold all 6.042 million RLB for 1.26 million USDC. The whale executed this massive sell order in two tranches, first selling 3.8 million RLB around 18 hours ago, followed by another 2.2 million RLB around 15 hours ago. The average selling price was $0.208.

Just one month ago in October, this same wallet purchased the 6 million RLB for 774,000 USDC at an average price of $0.128. By dumping the entirety of their holdings near the all-time high, the whale pocketed a profit of $485,000 – a 62.6% return in just one month.

This huge amount of selling pressure from a single wallet accelerated the downward move in RLB’s price.

The RSI indicator on the daily chart is now reading 39, moving towards oversold territory below 30. If the selling pressure subsides and RLB can find a bottom, the oversold conditions could spark a relief bounce. However, caution is still warranted as technical indicators alone do not determine when a bottom is in place after such a swift move down.

Read also:

- Why QUBIC’s 10,000% Explosion Outperformed Even Solana’s Meteoric Rise

- Why is PIVX Coin Pumping? Here Are Reasons Behind the 160% Pump

- Can the Cronos Rollercoaster Soar to $1.00? After Raising $1.5M, Is This the Next Top 100 Crypto?

This whale behavior illustrates the dangers of holding smaller cap cryptocurrencies with low liquidity. Single entities with large holdings can significantly influence prices when they decide to unload their stakes. The RLB community will be hoping the worst of the selling pressure is now over, but the technical damage has been done. RLB will likely take some time to repair the breakdown of its parabolic advance if buyers can step in.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.