So far, XRP has had a mixed year. Since the beginning of the year, XRP experienced a decent drop that saw its price fall nearly 44% in USD and 54% against BTC.

There have been a couple of positive news around Ripple Inc and their new partnerships with banks (more on that below) which might be an impetus for the latest positive price action of XRP token. It is still perplexing how the market and holders look at Ripple and XRP as a single entity, even though the former puts a lot effort into disconnecting itself from the XRP token.

What you'll learn 👉

Total market cap analysis

Let’s take a look at what the overall market is doing. It is a well known fact that all coin prices are highly correlated with bitcoin’s price action and by extension with the whole market. Every time we see a surge or plunge of the total market cap, it spills over to the individual coins and their prices.

Market has made a mild recovery two days ago and it hovers around the newly acquired levels today, as it defended the support at $206 billions and is now at $214 billion while attempting to test a sturdy resistance at $219 billions (data by Tradingview, CMC data is off by approx +$8 billions).

Should the market break through the $219 billion zone, we could see a swift move up to the $240 billion zone, area from which we saw this horrific drop in the last week of September.

Read our updated review of Coinmama exchange here.

XRPUSD Price Analysis

- Major Support Level: $0.256

- Major Resistance Level: $0.283

- 23.6% FIB Retracement Level: $0.283

- 38.2% FIB Retracement Level: $0.326

- 62% FIB Retracement Level: $0.396

XRP moved by 1.24% today which makes it 10% up on the week.

When we zoom in to the 60 min chart, we can XRP attempting to break through the tough resistance at $0.283, a confluence point of two Fib lines. You can see XRP touching and even piercing it for a 2 hours yesterday but it then fell back down to to $0.27 and EMA20 which now acts as a dynamic support line.

The volume needs to pick up if we are to see a break through of this resistance.

If XRP manages to close above the resistance at $0.283 on a strong volume, it will probably blast the $0.32 resistance and might reach the sturdy and long-standing resistance at Fib618 and $0.396.

On the downside, XRP has couple of support zones to land on in case of a stumble, first one being at support level of $0.25 and then Fib236 at $0.23.

XRPBTC

Weekly chart shows XRP recovery against bitcoin, having closed green candles in the last 4 weeks in a row.

Daily chart illustrates XRP crushing the 3000 sats resistance and confidently moving towards the next Fib level at 3600 sats.

- Support level: EMA And Fib786 at 3000 sats

- Resistance: MA200 and Fib50 line at 4000 sats

- Potential upside scenario: blasting through the resistance at 4000 to reach the local high at 5783 sats.

- Potential downside scenario: dropping back to the MA50 around 2700 sats.

- Most likely scenario: hovering in the 3000-4000 sats zone, waiting for a market-wide impulse and volume increase before conquering new/old highs at 4000+ sats.

Social metrics

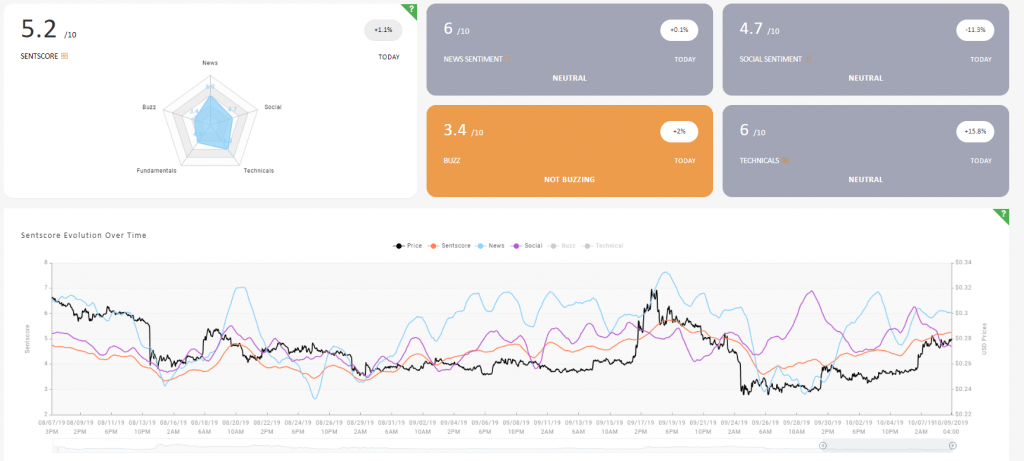

XRP’s sentiment score, measured by the market analytics firm Omenics, paints a neutral picture.

Read our updated guide on crypto trading bots.

Omenics wraps its analysis up into a single simple indicator known as the SentScore, which is formed from the combination of five different verticals:

- News

- Social Media

- Buzz

- Technical Analysis

- Fundamentals

Interpreting the SentScore’s scale:

- 0 to 2.5: very negative

- 2.5 to 4.0: somewhat negative zone

- 4.0 to 6.0: neutral zone

- 6.0 to 7.5: somewhat positive zone

- 7.5 to 10: very positive

XRP currently has a Sentscore of 5.1, with a slight recovery to yesterday of 1.1%. Technicals and buzz are picking up a bit while social sentiment took a dive by 11% in comparison to yesterday.

Read our updated guide on best XRP wallets.

Other Ripple News

Today Ripple announced a collaboration with Finastra which could significantly extend the footprint of RippleNet. The deal will allow Finastra clients to use RippleNet blockchain technology for cross border payments. Finastra is a major technology provider to financial institutions. It has more than 9,000 clients, including 90 of the 100 largest banks. Only a fraction of the clients work with Finastra for payments.

Finastra’s revenues are $1.9 billion, and the firm provides a wide array of solutions to financial institutions, some of which relate to payments.

The deal relates to RippleNet, not XRP.