The price of XRP has been stuck in a narrow range for the past month, going from around $0.50 to $0.51, frustrating investors who were expecting more upside.

There was a lot of buzz in the XRP community that the price was poised to “explode” after Ripple scored a major legal victory against the SEC in July. A federal judge rejected the SEC’s bid to appeal its loss against Ripple, rejecting claims that XRP should be considered an unregistered security.

However, the expected price surge never materialized. XRP is still trading near the $0.50 level as of October 6, 2023.

What you'll learn 👉

XRP On-chain Analyses

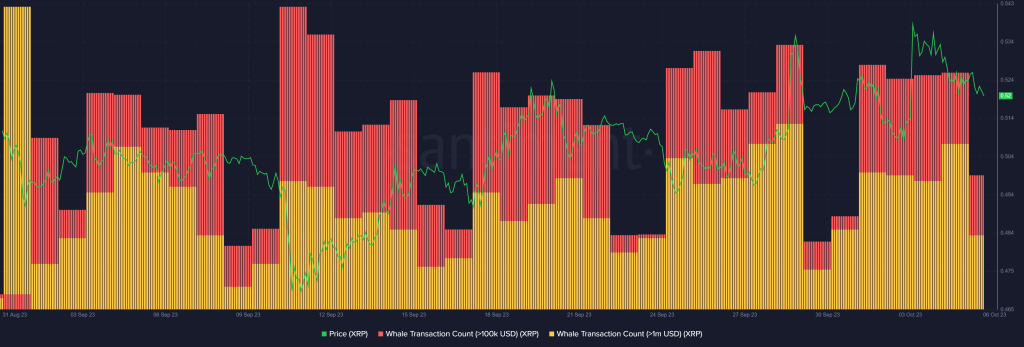

On-chain data also does not suggest an imminent breakout. Daily active addresses are currently at yearly lows of under 10,000. Whale activity, referring to the biggest XRP holders, also seems muted according to data from Santiment. This suggests key players are not anticipating major price swings in the near-term.

Source: Santiment – Start using it today

The ratio of daily on-chain transaction volume in profit to loss compares the amount of XRP being transacted at a profit versus the amount being sold at a loss each day.

A ratio above 1 indicates more coins are being transacted at a profit rather than a loss, which is a bullish sign for price. It means holders are feeling confident to realize gains.

However, when the ratio falls below 1, it means more transactions are happening at a loss compared to a profit. This suggests holders are capitulating and selling their coins even at a loss, which is bearish for price.

The fact that this ratio has been below 1 for XRP over the past few days signals that sellers are dominating. Holders are not waiting for higher prices to sell. This adds to the bearish short-term outlook for XRP based on current on-chain activity.

Source: Santiment – Start using it today

Technical Indicators

From a technical perspective, momentum indicators are mixed. The MACD line is above the signal line, which is bullish. But the RSI is around 50, which is neutral territory.

Nearest support is at $0.45, while resistance is at $0.55, the previous support level. Further overhead resistance is seen at $0.68 and $0.92.

While Ripple has seen some positive developments like increased adoption and a favorable legal ruling, analysts are not convinced XRP’s price action will get more interesting in the short-term. The Economy Forecast Agency predicts a sideways trend, with prices potentially closing at $0.30 by end of 2024.

So for now, XRP continues to lack clear directional bias. Impatient investors may need to wait a bit longer for the next big move.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.