The price of XRP, the cryptocurrency associated with Ripple, has seen a sharp 20% decrease this week, plunging from $0.74 to $0.61 in just 5 days. This significant pullback has left many in the XRP community questioning the token’s prospects, especially as other blockchain projects like Solana print new highs.

@WenMoonTok, a vocal XRP critic, expressed frustration tweeting “XRP’s utility has left us out in a desert by ourselves to die. Meanwhile everyone in SOL is getting rich off the great memecoin renaissance of ’24. Make it make sense. Frustrating.”

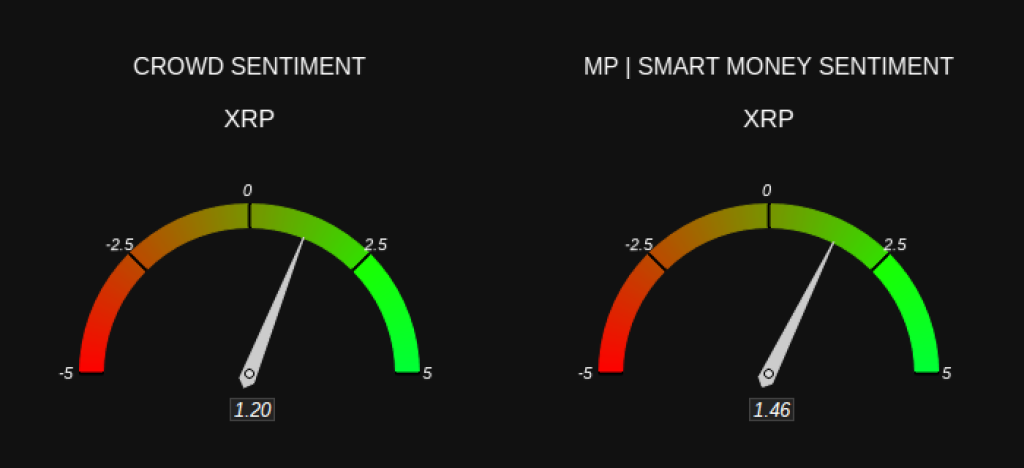

However, contrasting views point to underlying strength and bullish sentiment. @MarketProphit’s data indicates that both crowd sentiment and “smart money” indicators show bullish readings for XRP, suggesting potential for a rebound.

@Doctor_Magic_, an XRP analyst, views the latest dip as an opportunity to reload long positions. They have set a short-term target of $1.20 but expect XRP to break its prior all-time high in 2024, with momentum potentially carrying it even higher from there.

@RalstonMax, another XRP influencer, advocates trusting the long-term chart over taking cues from “riddlers” or “influencers.” Despite acknowledging the tweet may prove unpopular, they argue that XRP’s long-term candles look constructive and that “the market needs this pullback” before a continuation higher, proclaiming “We’re close.”

Amidst the polarized viewpoints, a key question emerges: How high could XRP climb in 2024 if the bullish projections prove accurate? While $1.20 has been floated as a nearer-term target, expectations of surpassing previous all-time highs imply XRP could potentially trade well into the $3-$4 range this year in an extended bull run.

As the Ripple saga continues to unfold and traders digest the latest 20% decline, keeping a pulse on evolving market sentiment will be crucial for those looking to capitalize on XRP’s next major move.

You may also be interested in:

- Why Bitcoin (BTC) Price Could Reach $1 Million This Year or the Next

- Is Maker (MKR) Poised for Correction Amidst Upcoming Launch? Bullish Whale Bets vs. Technical Warning Signals

- Binance Coin (BNB) Investors Join New $0.0018 Altcoin Predicted 1000% Growth

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.