A new contender is emerging to challenge the reigning champions of the money markets, Aave and Compound. This contender, Radiant Capital, is not just another player in the game but a potential game-changer, poised to become the new sovereign of crypto money markets.

Aave and Compound, with their total value locked (TVL) at $5 billion and $2 billion respectively, are currently the largest money markets in the crypto world. However, Radiant Capital, through its relentless innovation and strategic moves, is positioning itself as a formidable competitor to these established giants.

Find High-Potential Token, yPredict, powered by its native token $PRED, is emerging as a significant player in the crypto space. The presale YPRED, which is ongoing at ypredict.ai, has already raised over $2.25 million in seed round funding from early investors. As a new low market cap coin currently on presale, it powers an AI-based tool that predicts market movements and identifies high-potential tokens. The token also offers added utility for holders, unlocking access to a suite of analytics tools, including in-depth research into the tokenomics of upcoming crypto games and NFT projects. Get in on the Ground Floor and Unlock Exclusive Analytics Tools!

Show more +Radiant Capital has already amassed a TVL of $260 million across Arbitrum and Binance Smart Chain. It stands out as the first functional cross-chain money market, allowing users to lend on one chain and borrow on another. This innovative approach, coupled with its imminent launch on Ethereum and zkSync, sets Radiant apart from its competitors.

Moreover, Radiant is swiftly adding more collateral like ARB, while other money markets are moving at a slower pace. Its token design is optimized for demand and protocol growth, further strengthening its position in the market.

Aave and Compound yield just 1-2% on stablecoins, which is less than treasuries. With over $100 billion in stablecoin market cap and more than $10 billion in stablecoins once in money markets now idle, this untapped liquidity presents a massive opportunity. As the 10-40% stablecoin yields from Radiant, an audited and year-old protocol, become more widely known, a significant growth in TVL can be expected.

When Radiant’s mainnet dApp launches, the second biggest opportunity will be Ethereum and liquidity-sensitive derivatives (LSDs). Currently, $4 billion is in Compound and Aave, but Radiant’s sustainable, incentivized yield can capture a significant market share. Furthermore, many non-stETH LSDs worth billions lack money markets, and Radiant can be their first choice.

Radiant is one of the largest beneficiaries of ARB and will be incentivizing one-year liquidity providers. No other money market has listed ARB yet besides Radiant. Given Radiant’s Lindy effect, continued inflows can be expected, allowing the $2 billion of ARB to find a home for single-side yield.

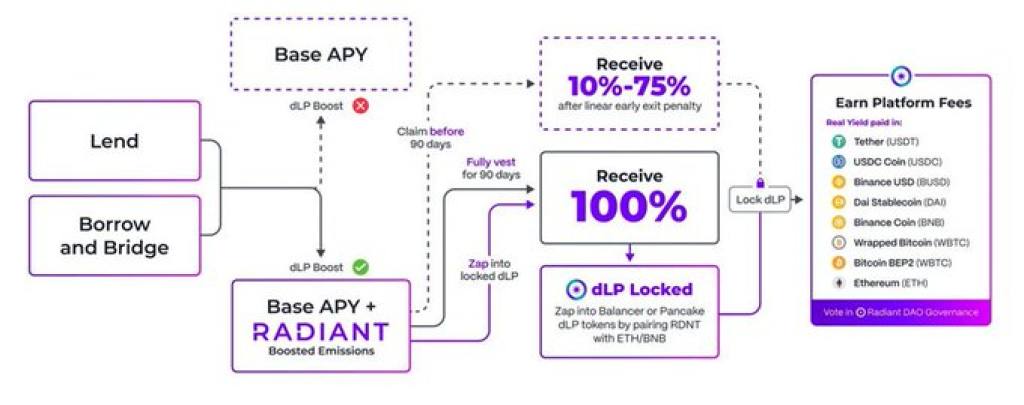

A significant driver of Radiant’s growth has been its V2 Tokenomics flywheel upgrade. This upgrade has boosted the value of its incentives war chest while directing more sustainable emissions to long-term protocol-aligned users.

In conclusion, Radiant Capital, with its innovative strategies and unique offerings, is not just challenging the status quo but is on a path to redefine it. The crypto money market throne awaits its new sovereign.