You’ve probably heard of meme scam coins and low-quality airdrop campaigns in the cryptocurrency world. It can be overwhelming to navigate through all the noise and find quality protocols worth exploring.

But fear not, because we’ve got you covered with the best crypto projects that still don’t have tokens, potentially leading to upcoming airdrops.

These protocols require some level of understanding and carry risks, but they have solid teams and a commitment to delivering quality products. Instead of gambling on meme rug coins, it’s worth exploring these protocols for potential gains.

In this article, we will highlight the top protocols that still don’t have tokens, so you can stay ahead of the game and potentially score some upcoming airdrops.

| Protocol | Summary |

|---|---|

| 📈 Opyn | A decentralized options trading platform that allows users to hedge their risks in the DeFi space. The team behind Opyn is highly experienced, and the platform has recently integrated with Compound Finance. |

| ⚡ Voltz | A complex protocol that offers a decentralized options trading platform. It attracts fewer users due to its complexity, but this also means potential airdrop opportunities for those who understand and use the platform. |

| 🌊 SWELL | A protocol that aims to provide liquidity to the Ethereum network. Users can deposit ETH and receive swETH in return, which can then be used to earn interest. |

| 🏦 Rabby Wallet | A user-friendly protocol that offers wallet features for making swaps using their in-house wallet swapper. It doesn’t have a token, so transactions are tokenless. |

| 🎨 Zora | A unique platform that allows for NFT creation and marketplace integration. It offers an innovative hybrid model for NFT ownership, where creators can retain partial ownership of their creations and receive a percentage of future sales. |

| 💼 DeFi Saver | A protocol that manages liquidity positions in lenders and offers swaps. It operates on non-custodial smart contracts, meaning users have full control over their funds at all times. |

| 🌉 LiFi Protocol | A protocol that uses LiFi technology to create their bridge TransferTo, allowing users to move assets between different blockchains with low fees and fast transaction times. |

| 🔗 Socket | A bridge aggregator similar to Jumper. It’s still in development but has potential applications in the DeFi space. |

| 📊 Polynomial | A new smart contract that aims to provide solutions for a wide range of potential use cases, including DAOs, yield farming, and NFTs. It’s currently in the development phase and has not yet released a token. |

What you'll learn 👉

9 Best Protocols that still don’have a token

If you’re tired of sifting through low-quality airdrop campaigns, check out these quality protocols that haven’t yet released a token.

Exploring potential airdrop opportunities can be a great way to earn some extra tokens, but it’s important to evaluate the quality of upcoming protocols before interacting with them.

These nine protocols have been vetted and deemed high-quality by the community, making them a good place to start. However, it’s important to understand the risks and benefits of interacting with new DeFi products.

Some of the protocols listed, like OPYN and VOLTZ, are complex financial products that require a deep understanding before depositing any funds.

Others, like Zora and Rabby Wallet, are more user-friendly and offer a more straightforward onboarding process. Regardless of the protocol, it’s important to do your own research before interacting and only deposit what you can afford to lose.

By taking these precautions, you can potentially earn some extra tokens while still protecting your assets.

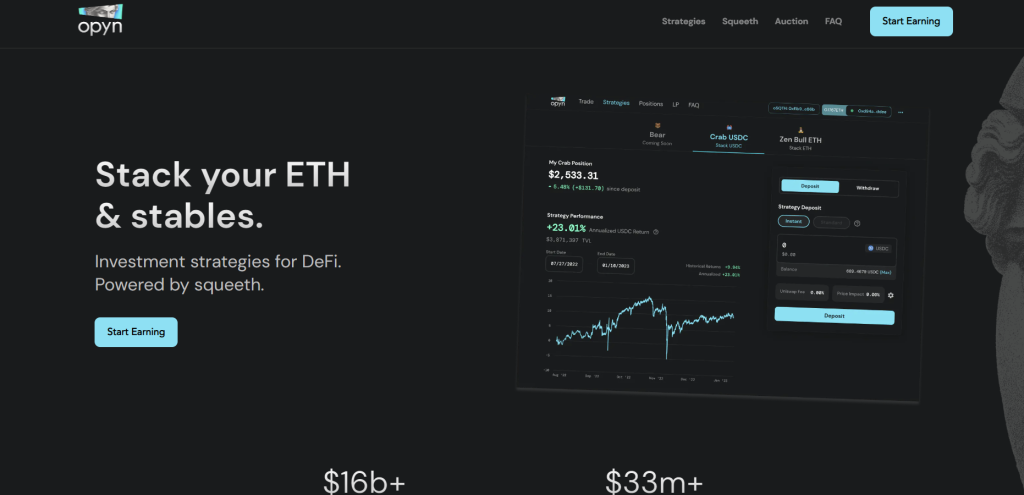

Opyn

You’re probably tired of sifting through low-quality airdrop campaigns, but have you taken the time to understand Opyn’s complex financial DeFi product and potentially reap the benefits of a bigger airdrop due to fewer users?

While there are risks involved in interacting with Opyn, such as the need to deposit only what you can afford to lose, the potential for growth and impact on the DeFi ecosystem make it worth considering.

Here are some key points to keep in mind when considering Opyn:

- Opyn offers a decentralized options trading platform, allowing users to hedge their risks in the DeFi space

- The team behind Opyn is highly experienced, with members previously working at top companies such as Google and Coinbase

- Opyn’s recent integration with Compound Finance further solidifies its place in the DeFi ecosystem

- While Opyn is a complex product, taking the time to understand it can lead to a better understanding of DeFi as a whole

- Opyn is still in its early stages, meaning there is potential for significant growth in the future.

Overall, while Opyn is not without its risks, it is a promising protocol that could have a significant impact on the DeFi space. By taking the time to understand and interact with Opyn, users could potentially reap the benefits of a larger airdrop due to a smaller user base.

Voltz

Have you considered exploring Voltz, a complex protocol that offers a decentralized options trading platform, and potentially benefiting from a larger airdrop due to fewer users, while keeping in mind the risks involved and conducting your own research?

As one of the more complex DeFi products out there, Voltz attracts fewer users than some of the more straightforward protocols. However, this also means that there could be potential airdrop opportunities for those who are willing to take the time to understand and use the platform.

It’s important to note that the risks involved with Voltz are significant, and it’s crucial to only deposit what you can afford to lose. Before interacting with the protocol, make sure you fully understand how it works and the potential risks involved.

However, for those who are comfortable with the risk and willing to do their research, Voltz could be an interesting option to explore in the search for potential upcoming airdrops.

SWELL

As you explore the DeFi landscape, consider checking out SWELL, which recently launched their LSD product and opened deposits to the general public, offering a potentially trippy experience for those who are willing to take on the risks involved.

The protocol, which aims to provide liquidity to the Ethereum network, allows users to deposit ETH and receive swETH in return. This swETH can then be used to earn interest by lending it out to other users on the platform.

SWELL’s LSD product comes with its own set of potential risks, as with any financial product in the DeFi space. However, the protocol’s unique features, such as its use of flash loans to provide liquidity and its focus on community governance, could make it an attractive option for those looking to diversify their DeFi portfolio.

With user adoption still relatively low, those who take the time to understand and use the protocol may stand to benefit from any potential airdrops in the future.

Rabby Wallet

If you’re looking for a DeFi protocol with a simple and easy-to-use interface, check out Rabby Wallet.

This protocol offers wallet features that allow users to make swaps using their in-house wallet swapper. One of the best things about Rabby Wallet is that it doesn’t have a token, so you don’t have to worry about tokenless transactions.

This is because the platform is designed to work with a variety of different tokens, without the need for any specific token to be involved in transactions. Rabby Wallet also takes crypto security measures seriously.

The platform is built on top of the Ethereum blockchain, which is known for its security and reliability. Additionally, the team behind Rabby Wallet has implemented a number of security measures to ensure that users’ funds are safe and secure at all times.

These measures include multi-signature wallets, cold storage, and regular security audits. Overall, Rabby Wallet is a great option for anyone who wants to make simple and secure swaps without the hassle of dealing with tokens.

Zora

Moving on from Rabby Wallet, let’s explore Zora, another promising project that has yet to release a token.

Zora is a unique platform that allows for NFT creation and marketplace integration. With Zora, you can create and sell your own NFTs or purchase NFTs from other creators. The platform also offers customization options for your NFTs, allowing for personalized and unique creations.

Here are three things to keep in mind about Zora:

- 1) The team behind Zora includes some reputable names in the crypto space, such as Trevor McFedries and Cooper Turley.

- 2) The platform offers an innovative hybrid model for NFT ownership, where creators can retain partial ownership of their creations and receive a percentage of future sales.

- 3) Zora has potential for tokenization in the future, which could lead to exciting developments for the platform and its users.

Overall, Zora presents a promising opportunity for NFT enthusiasts and creators alike.

DeFi Saver

Let’s check out DeFi Saver, a solid protocol that manages liquidity positions in lenders and offers swaps. The platform allows users to manage their liquidity positions in lenders, including MakerDAO and Compound, and make swaps between different tokens.

However, it’s important to note the smart contract risks that come with using any decentralized finance platform. As with any other DeFi protocol, it’s crucial to do your own research and understand the potential risks associated with interacting with the smart contracts.

DeFi Saver offers an intuitive interface and a range of features, including automated debt repayment, collateral management, and liquidation prevention. The platform operates on non-custodial smart contracts, meaning users have full control over their funds at all times.

While the platform does not currently have a native token, it’s still a promising project to keep an eye on. If you’re looking for a solid DeFi protocol to try out, DeFi Saver may be worth considering.

LiFi Protocol

LiFi Protocol, which uses LiFi technology to create their bridge TransferTo and recently rebranded it to Jumper, is a promising project to explore for those interested in bridging assets.

The team behind LiFi Protocol has been working on the technology since 2018 and has already achieved success in applying it to their TransferTo bridge.

Jumper Exchange, the rebranded version of the bridge, allows users to move assets between different blockchains with low fees and fast transaction times.

One of the main features of Jumper is its ability to support multiple assets, including stablecoins and popular cryptocurrencies.

The platform is easy to use and has a simple interface for bridging assets.

Compared to other bridge aggregators, Jumper also has the advantage of being built on LiFi technology, which has the potential to provide faster and more secure transfers.

As LiFi Protocol continues to develop and expand its offerings, it may become a valuable tool for those looking to move assets between different blockchains.

Socket

If you’re looking for a bridge aggregator similar to Jumper, Socket may be worth exploring as they also bridge assets and have a simple interface for making swaps.

While still in development, Socket has potential applications in the DeFi space and could be a strong contender in the bridge aggregator market. It’s important to note that Socket does have competitors in this space, such as LiFi and TransferTo, so it’s worth doing a thorough competitor analysis before deciding which bridge aggregator to use.

Socket’s development progress can be tracked on their GitHub page, where they regularly update their code. While there is no official launch date for their token, keeping an eye on their development progress can give insight into when an airdrop may occur.

It’s important to remember to only deposit what you can afford to lose when interacting with new DeFi protocols, even if there is potential for an airdrop. Always do your own research on the risks and benefits of using a new protocol before making any deposits.

Polynomial

You may want to tread cautiously with Polynomial, as it’s a new smart contract. Putting assets that you can’t afford to lose at risk is like walking on thin ice. However, if you’re willing to take the risk, Polynomial might be worth exploring.

The project is a decentralized platform that aims to provide solutions for a wide range of potential use cases, including DAOs, yield farming, and NFTs. According to the project’s website, they are currently in the development phase and have not yet released a token.

However, the team is actively engaging with the community through their Discord channel and Twitter account. While there is no guarantee that an airdrop will occur, keeping an eye on Polynomial’s development progress and community engagement may be a wise investment of time for those interested in potential upcoming airdrops.

Read also:

- Airdrop Hunting Tools – How To Catch FREE Airdrops

- How Are Crypto Airdrops Taxed? Implications, Reporting, Record Keeping

- How To Get Cosmos Airdrops? Claiming Airdrops On ATOM Blockchain

- 3 Best Places to Find Airdrops

Conclusion

In conclusion, exploring the best crypto projects that still don’t have tokens is a wise choice for potential upcoming airdrops. With so much noise in the cryptocurrency world, it’s refreshing to focus on quality protocols that have solid teams and a commitment to delivering quality products.

While these protocols carry risks and require some level of understanding, they offer a better alternative to gambling on meme rug coins. Opyn, Voltz, SWELL, Rabby Wallet, LiFi Protocol, Socket, and Polynomial are all protocols worth exploring.

Each of these projects has a unique approach to solving problems in the cryptocurrency space, and they have the potential to yield significant gains through upcoming airdrops. By taking the time to research these protocols and understanding their underlying technology, you can position yourself for potential success in the cryptocurrency market.

So, instead of blindly following trends and hype, consider these quality protocols without tokens for your next investment.