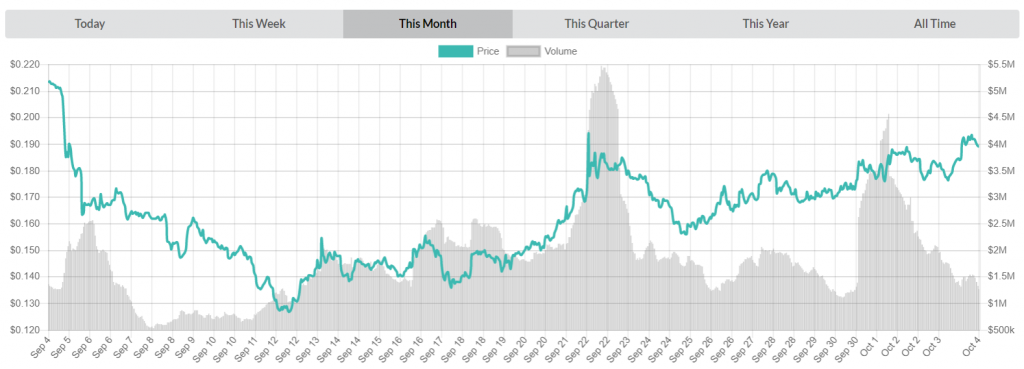

Polymath had its ups and downs in the mast month or so. The currency fell off sharply of September 5th, going from $0.2113 to a monthly low of $0.1267 on the 12th. A short uptrend was initiated from here onwards, which ended up with Polymath peaking at $0.1940 on 22nd. The same day saw the currency’s daily trade volume spike sharply to almost $5.5 million. The following days brought some corrective action, both price and volume-wise, before the currency entered another uptrend.

Polymath can be purchased for $0.185387 USD (-1.68% drop in the last 24 hours)/0.00002830 BTC (-1.34% drop in the last 24 hours). This valuation is a lot lower (-88.75%) than the currency’s all-time high of $1.66. The daily trade volume is rather low with $1,398,923 USD/213.52 BTC exchanging hands in the last 24 hours, most of it on LATOKEN (24%) and Binance (20%). With a market cap of $52,799,501, Polymath is currently the world’s 104th most valuable cryptocurrency.

Trader atrochet46 sees bullishness in Polymath’s technicals:

“Even if we are currently at resistance, I really think we can break out. PA looks like accumulation to me. First target (if we break the bearish trend line) would be in the next blue zone. SL under previous low.”

Check out the complete analysis here. CryptoStation was also positive on the currency’s short term future in their own overview.

Polymath is focused on the global securities market. In a world where regulators are tightening up their grasp on the tokens and currencies that exist out there, more and more projects are in danger of being declared as “securities”. At the moment this is a potential death sentence for any crypto token out there as no crypto trading establishment possesses the licenses required to trade such financial instruments.

What are bitcoin forks anyways?

This is where Polymath platform joins in, providing tools for professionals, businesses and developers to own blockchain-based assets and investment opportunities that are classified as securities. The platform links several major participants of the crypto space:

Issuers, who can post bounties in POLY tokens to encourage legal delegates and developers to bid on providing services towards the issuance.

Investors seeking to purchase security tokens, who can pay a POLY fee to KYC providers for verification.

Developers, who can earn POLY tokens for creating STO contracts.

Legal delegates, who are able to earn POLY tokens by (i) proposing bids on security token issuances and (ii) being selected by the issuer to take responsibility for the issuance. Along with their bids, they can specify how long they are willing to lock up their bounty.

KYC providers, who pay a POLY fee to join the network and look for clients who want to be verified after paying a set fee.

The connecting link here, as you can see, is POLY, ETH-based ST20 token designed for processing security tokens. The above was a short overview of Polymath. Medium user Paradigm just recently released a post titled “Polymath: Detailed review on the project” which goes much deeper, offering an overview of Polymath’s technology, use cases, products, team, contributors, partnerships, clients, competitors, roadmap information and much more.

Overall, Polymath is straight up embracing the future where crypto projects will be classified as securities and is offering a solution to those “unfortunate” enough to get this tag attached to them. While security tokens will lose out on several good perks, including being tradable on any crypto exchange out there, they will gain SEC backing and a level of legitimacy that non-securities don’t have. This could eventually make these tokens more desirable investment targets to institutions and smart money, who are itching to have the crypto Wild West filtered a bit and cleared of bad, non-profitable projects. Ultimately, projects like Polymath will be at the forefront of this action and could, as a result of that, experience some very positive price movements in the future.