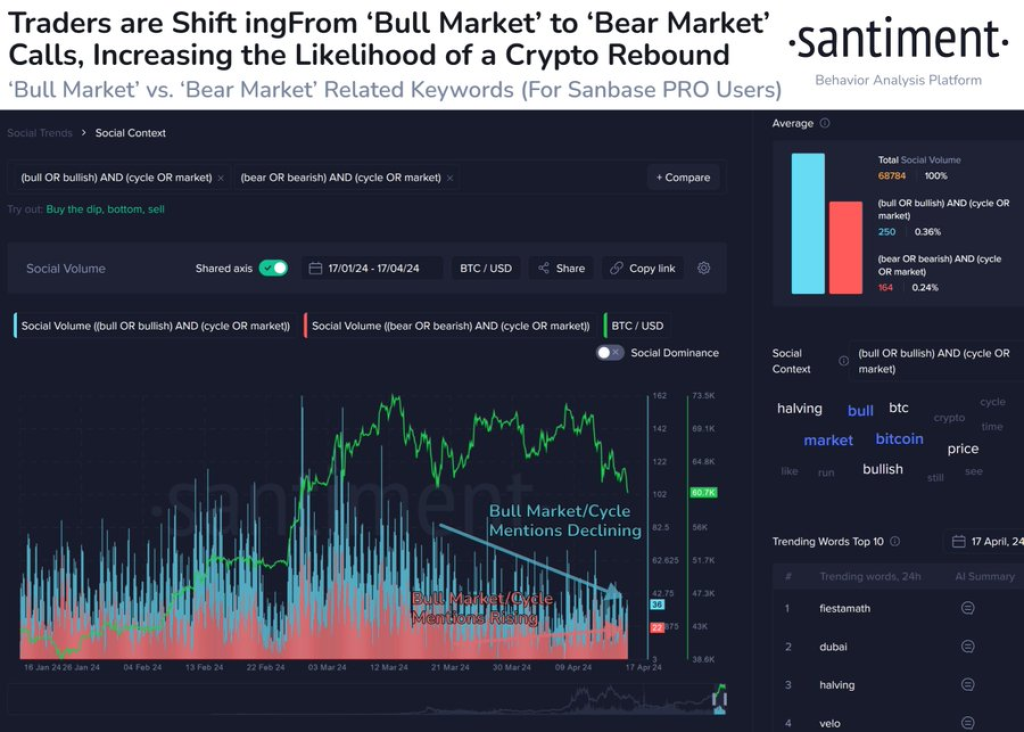

According to data from the crypto analytics firm Santiment, sentiment among cryptocurrency traders appears to be shifting from bullish to bearish following Bitcoin’s recent 16% drop from its all-time high of $73,600 reached on March 14th, signaling the bear market has essentially “come to an end.”

Santiment, which tracks various on-chain metrics and social media trends related to cryptocurrencies, noted a significant increase in mentions of the term “bear market” across their data sources. Conversely, references to a “bull market” have declined sharply.

For those unfamiliar, a bull market refers to a period of sustained price increases driven by strong demand and positive sentiment. A bear market is the opposite – a prolonged downtrend characterized by pessimism and selling pressure.

The firm suggests that this shift in crowd sentiment, with fear, uncertainty and doubt (FUD) rising as euphoria (FOMO) wanes, could potentially signal an upcoming recovery for Bitcoin and other cryptocurrencies.

Santiment’s data indicates that historically, cryptocurrency prices have often moved counter to the prevailing sentiment among traders. As the old Wall Street adage goes, “buy when there’s blood in the streets.”

Milei Moneda is a new meme coin inspired by the political and economic views of Javier Milei, an Argentine president known for his libertarian and pro-Bitcoin stance. You have an opportunity with the ongoing low presale price to get in early!

Sponsored

Show more +The analysts posit that the combination of fading bull market exuberance and a notable rise in bear market speculation could set the stage for a rally, possibly before or shortly after Bitcoin’s next halving event scheduled for early 2024.

For the uninitiated, Bitcoin halvings are pre-programmed events that occur every four years, reducing the rate at which new bitcoins are minted and introduced into circulation. This controlled supply squeeze has often catalyzed bull runs in the past.

Whether the current bout of negative sentiment proves to be a contrarian buy signal or the start of a more protracted bear phase remains to be seen. Crypto markets are highly volatile and sentiment can shift rapidly.

Traders and investors would be wise to rely on fundamentals and proven analysis techniques rather than basing decisions solely on the amplitude of bullish or bearish voices across social media.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

Check $RECQ Meme Coin

ICO stage, offering tokens at a discounted price

Facilitates a smooth and efficient economy within the arcade, supporting both arcade and in-game transactions.

Grants access to a diverse range of gaming experiences in the Rebel Satoshi Arcade,

Contributes to a decentralized, community-driven RebelSatoshi platform that integrates gaming with elements of revolution, freedom, and unity, appealing to users who value such principles.