Bitcoin remains in limbo. Yesterday we saw it act up a bit as the price went south for a while, falling from $6400 levels to just above $6200. The drop was caused by a strong increase in selling volume and a strong increase in shorts, but Bitcoin managed to hold on the hidden wall of $6230, according to @TheCryptoDog.

Another massive five figure #Bitcoin sale order just came in. It looks like the next hidden wall is holding at $6230.$BTC $BTCUSD #Bitcoin pic.twitter.com/yFyOaN7uzL

— The Crypto Dog? (@TheCryptoDog) August 20, 2018

Same trader felt that this price action was a result of a single Bitcoin bear whale unsuccessfully attempting to break down the price by borrowing Bitcoin from lenders and heavily shorting the market. The price did go down strong but the drop didn’t have enough bear support to break the previously mentioned resistance and we soon saw Bitcoin bounce back above $6400. Let’s check out what other market analysts had to say:

Bitcoin (BTC)

Sherem from TradingView centered his analysis around the upcoming ETF decision that will hit the markets on August 23rd. He mentions how companies applying for ETF’s is a bullish sign on its own and notes that these requests will start getting approved sooner rather than later. After all, a “soft” instrument called ETN – backed by the issuer, not the asset behind it (which is the case with ETF’s) – has been approved just days after VanEck ETF was delayed; this implies that other similar instruments are just a matter of time.

August 23rd will be the day when a decision will be made on the latest, ProShares ETF’s. These debt instruments are based on CME and CBOE futures markets and this bodes well for the ProShares request, feels Sherem.

“CME and CBOE both have the blessing of the SEC and are approved and regulated by the SEC for their Bitcoin Futures contracts. I read an article about some of the SEC concerns with the Winklevoss ETF and why it was denied. Different scenario, completely.”

He rounds off his thoughts with these words:

“It’s in the interest of all the major players to have another bull run. According to some stats on Coinbase. Coinbase trading activity has fallen by 80%. Similar stats are on Bitstamp and others. Coinbase made over a BILLION dollars last year. Lack of interest in Crypto kills their cash cow. They need price to increase so people are interested again. All of these major players are going to put a price floor in crypto. While I believe 6k is a perfect spot to do it and the ETF approval would be extremely bullish. The thing I am certain of is that I doubt it’s going much further down than 4k if it even gets there.”

Check out his complete analysis here to learn more about his trading strategies and gain a deeper insight into his thoughts on the matter. Meanwhile, Turningmecard gave us more details on the technicals of the recent movements. He notices that BTC broke out of a massive ascending triangle it was building up for the last week or so.

“So we can further drop to 6.1~5.8k, or we would defend 62, but very violent over the days as marked in yellow box in the chart. Now BTC is making a little move upwards from 62, so it needs to overcome 63.8 with good volume. Now, little doubtful. If it does not overcome 63.8 another drop may come to 6200ish, or even below to 6k zone.”

Check out their analysis here to see their recommended short/long entries and to learn more about their thoughts on the upcoming ETF decision.

Ethereum (ETH)

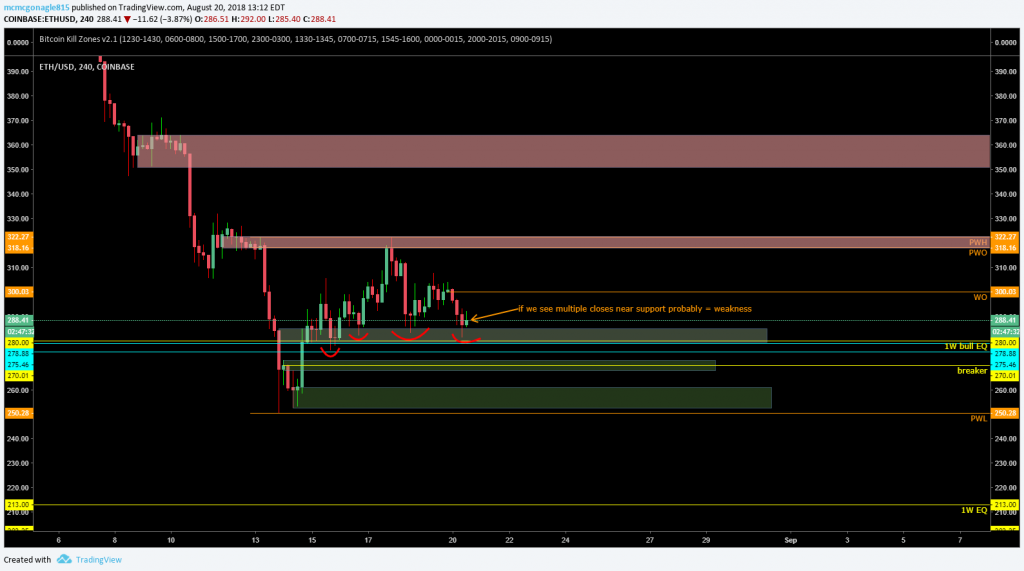

For the Ethereum insight we checked out what mcmcgonagle815, an up-and-coming trader from TradingView had to say. He starts off his analysis by offering his thoughts on the currency’s weekly/daily charts before getting into the 4H timeline:

“I like this set up a lot here. You can see ETH has found support several times at the 1W bullish EQ 0.00% , monthly lows + 1D OB area. There is a nice 4H breaker just below this area around $270. I love trying to play that area if we get some kind of sell off. This is also around a .7 fib retrace from the prior long term low to the recent high we saw. More on this in trade ideas. Above you can also see a bearish block(this is actually from a 12H chart) that will probably act as resistance on the next test.”

Check out the complete analysis here to learn more on his weekly/daily thoughts and his trade ideas. At the same time, Cryptosphere_ thinks this is a good opportunity to short Ethereum:

“Last prediction to $338 was SMASHED to find support at the $250 region. Eth is currently making its way downwards to the $220 region. There may be some consolidation at the 280 region and a spike to the 300s again, however overall this move is looking very bearish . Below $220 is possible as well, but predicting beyond that at this point is just a guess.

A BEAUTIFUL retest of the prior idea’s trendline as showed also!”

Ripple (XRP)

HiTech gives insight into the recent XRP action:

“Ripple has been on a steady rise against the Bitcoin since 14th of August. Price has increased from the 4160 satoshis, where price formed the bottom, up to the 5725 satoshis in just 4 days, resulting in a 37% gains over the BTC. After hitting the 5725 high, XRP has corrected down and fond the support at 4950 satoshis, which is the support level confirmed by two Fibs. The 5k satoshis area, could also be a strong psychological support area, from where Ripple could start moving much higher.“ He further continues:

“But first, it has to reach and then break above the nearest resistance, which is seen at 88.6% Fibs, that is 6000 satohsis. At this stage more consolidation is possible and price could be ranging near the 5k satoshis area. But this also could provide a good buying opportunity for the short term. Considering the long term scenario, if Ripple will break above the 6k resistance with confidence, the trend could change the direction, where XRP will continue to outperform BTC.”

Other thoughts

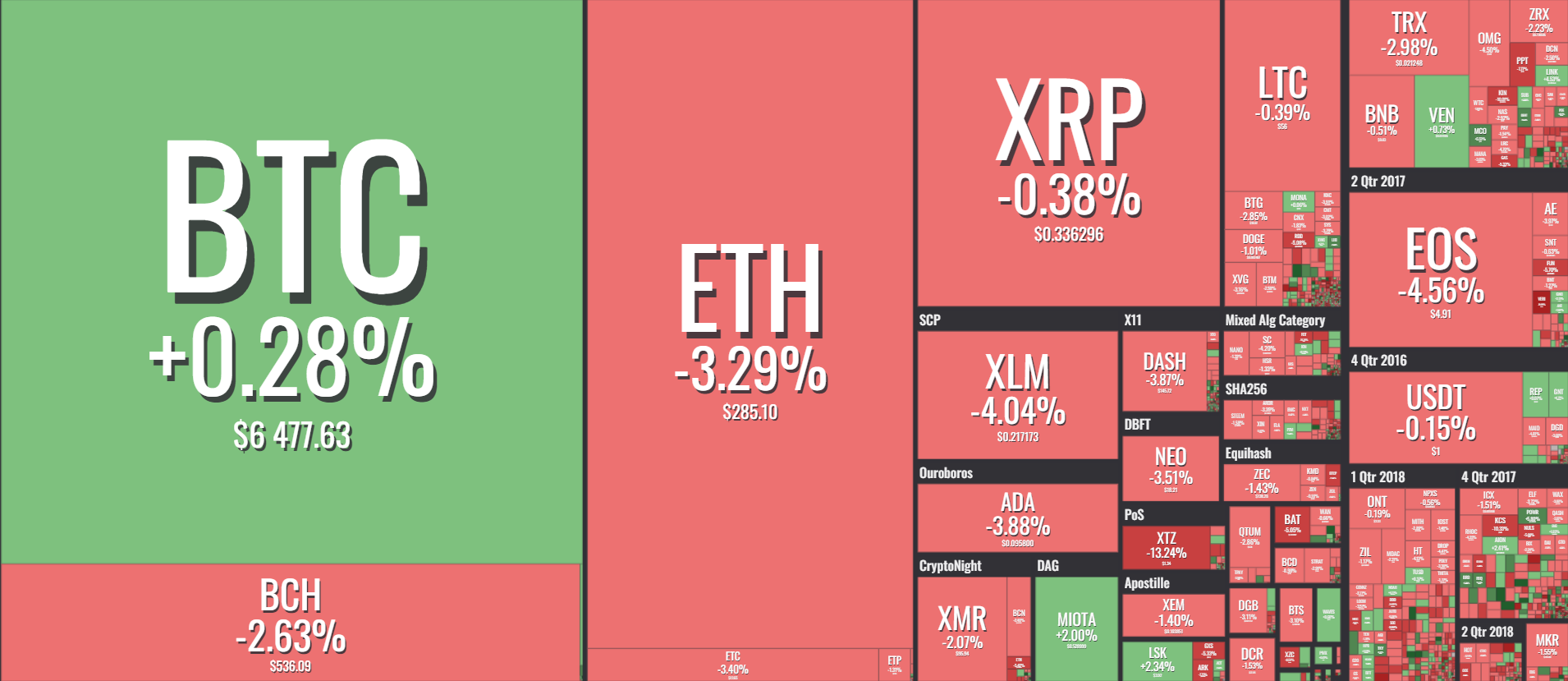

The rest of the market reacted in a way it was expected to react. Alts rubber-banded after Bitcoin and recorded smaller losses across the board, with yesterday’s top gainers Tezos and Veritaserum, along with Bitcoin Private, losing more than 10% on the daily. Meanwhile, a couple of coins managed to stay afloat, with ChainLink, Golem and VeChain growing slightly more than 5% individually. Eternal Token did record a significant 25% breakout but on a volume so small that it’s probably not worth mentioning. The overall sentiment remains similar as yesterday; as long as BTC remains in the $6000-$6500 range, no stronger movements are expected. The ETF decision might help the market leader decide in which direction it wants to take us next.