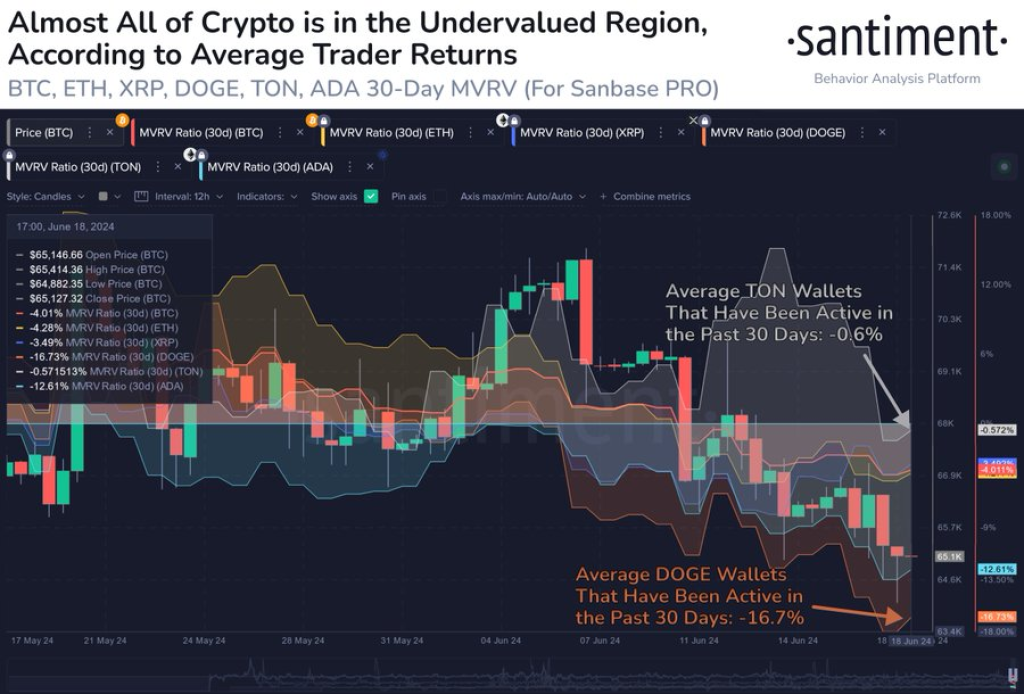

Santiment has shared insights on the 30-day Market Value to Realized Value (MVRV) ratios of several top cryptocurrencies. The MVRV metric is used to assess the average profit or loss of investors who purchased a given asset within the past 30 days.

According to Santiment’s analysis, the lower a cryptocurrency’s 30-day MVRV, the higher the likelihood of a short-term price bounce.

What you'll learn 👉

Bitcoin (BTC) and Ethereum (ETH) Show Mild Bullish Signs

Source: Santiment – Start using it today

Bitcoin (BTC) and Ethereum (ETH), are currently displaying mild bullish signals based on their 30-day MVRV ratios. Bitcoin’s MVRV stands at -4.0%, while Ethereum’s is slightly lower at -4.3%.

These negative values indicate that, on average, investors who purchased BTC or ETH within the past 30 days are currently holding unrealized losses. However, this situation also suggests that there may be a higher probability of a short-term price bounce for both assets.

XRP Mirrors Mild Bullish Sentiment

XRP, the native token of the Ripple network, is also showing mild bullish signs, with a 30-day MVRV of -3.5%. Similar to Bitcoin and Ethereum, this negative value hints at a potential short-term price recovery for XRP.

Dogecoin (DOGE) and Cardano (ADA) stand out among the analyzed assets, with both displaying very bullish indicators based on their 30-day MVRV ratios. Dogecoin’s MVRV is lower at -16.7%, while Cardano’s stands at -12.6%.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +These highly negative values suggest that investors who bought DOGE or ADA within the past month are currently sitting on substantial unrealized losses. However, according to Santiment’s analysis, this situation also indicates a higher likelihood of a short-term price bounce for both cryptocurrencies.

Toncoin (TON) Remains Neutral

Toncoin (TON), the native token of the Telegram Open Network blockchain, presents a neutral outlook based on its 30-day MVRV of -0.6%.

This value, which is closer to zero compared to the other analyzed cryptocurrencies, suggests that TON investors who purchased the token within the past month are, on average, neither at a major profit nor loss. As a result, the likelihood of a short-term price bounce for Toncoin is considered neutral.

Read more: Top Crypto Unlocks This Week: SPACE ID (ID) and Merlin Chain (MERL) Joins the Top 7

The Market Value to Realized Value ratio is a valuable metric for assessing the overall market sentiment and potential short-term price movements of cryptocurrencies. By comparing the current market value of a token to its realized value (the average price at which each token last moved on-chain), the MVRV ratio provides insights into the profit or loss status of recent investors.

When the MVRV ratio is negative, it indicates that many recent investors are holding unrealized losses, which may suggest a higher probability of a short-term price bounce as these investors are less likely to sell at a loss.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.