Cryptocurrency lending platform, Celsius Network, has started selling off a variety of its altcoin holdings in a notable move following its recent bankruptcy declaration.

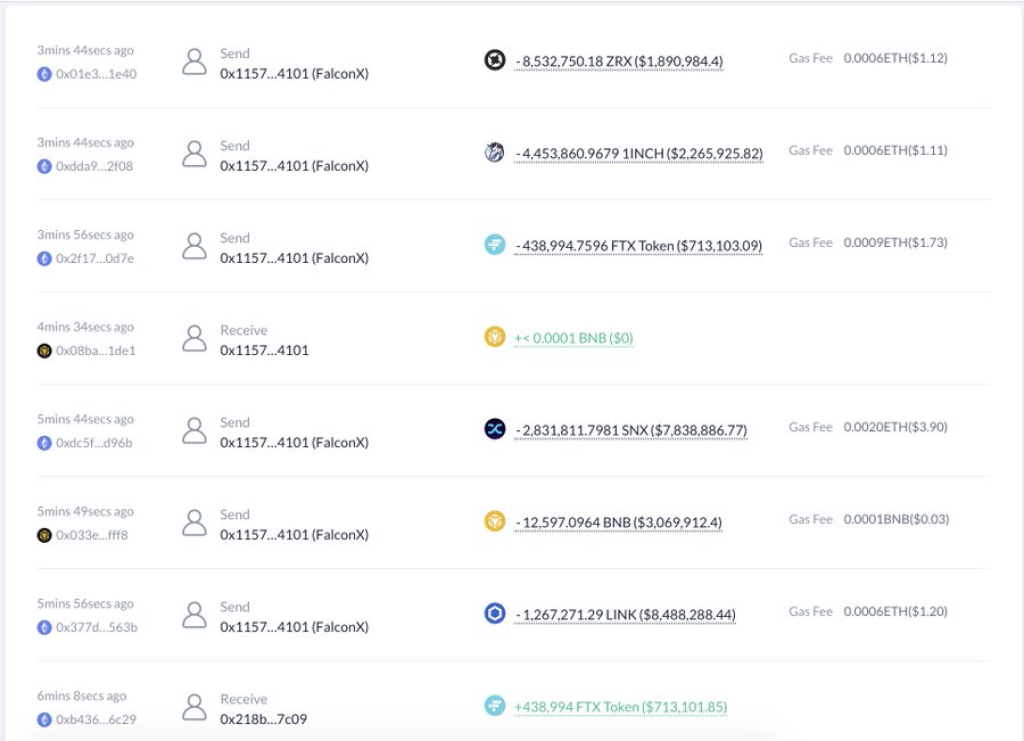

According to data from blockchain analytics firm Lookonchain, 1.27 million Chainlink (LINK), 2.83 million Synthetix (SNX), 12,597 Binance Coin (BNB), 4.45 million 1INCH, 8.53 million 0x (ZRX), and 439 thousand FTX tokens were transferred to digital asset trading service FalconX. An additional 186,149 BONE tokens were deposited into cryptocurrency exchange OKEx.

Interestingly, Lookonchain notes that Celsius appears to be swapping these altcoins for Bitcoin (BTC) and Ethereum (ETH), hinting at a possible pivot in their asset strategy amidst this challenging period. A significant amount of these altcoins were moved to an address identified as “0x4131”. Furthermore, Celsius has swapped 1,393 StaFi (rETH) for an equivalent amount of ETH through Wintermute Trading, evidencing this trend.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Celsius reportedly still holds around $164.5 million worth of altcoins on the Ethereum Virtual Machine (EVM) blockchain. Notably, FalconX has started depositing the received altcoins into Binance, presumably for sale.

Bankruptcy Filing Impacts Celsius Operation

The massive altcoin sale follows Celsius Network’s recent declaration of bankruptcy, filing for Chapter 11 protection in a bid to restructure its debts. The news was confirmed after the company’s lawyers began notifying regulators in individual U.S. states about their intended plans.

Celsius made headlines a month ago after freezing customer accounts due to “extreme market conditions”. This move added the firm to a growing list of high-profile cryptocurrency companies that have declared bankruptcy.

In a surprising turn of events, Celsius selected the bid from Fahrenheit, a consortium that includes Arrington Capital, to establish and manage a new entity owned by its creditors. As part of the agreement, Fahrenheit will provide the capital, management team, and technology to establish and operate this new venture.

Customers who had collateral locked on the Celsius platform have reportedly been unable to retrieve their funds. Bankruptcy records reveal that Celsius failed to return collateral to borrowers even after they repaid their loans. As the bankruptcy-induced liquidation of Celsius’ altcoin holdings proceeds, analysts anticipate that this could exert more selling pressure on the overall cryptocurrency market.

Celsius initiated an auction to find a buyer who could lead its crypto lending and Bitcoin mining businesses out of bankruptcy. The bids received so far include those from Fahrenheit and the Blockchain Recovery Investment Committee (BRIC), affiliated with Gemini Trust.