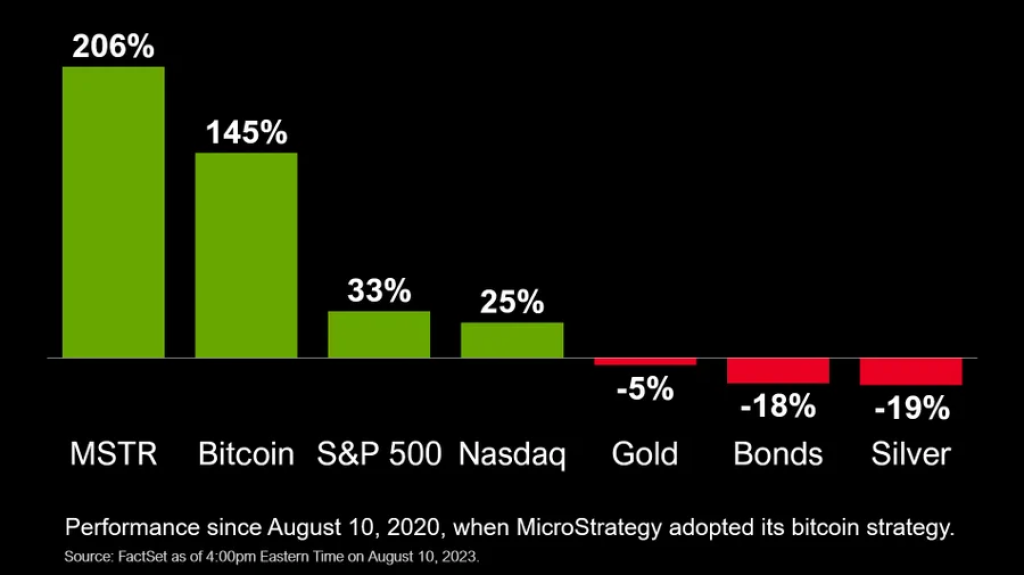

Michael Saylor, the founder of MicroStrategy, recently highlighted a significant milestone for MicroStrategy.

This tweet underscores the strategic decision made by MicroStrategy three years ago, which has since proven to be a wise investment. Given the current value of Bitcoin, it’s evident that MicroStrategy’s bet on the cryptocurrency has paid off big time.

The data clearly shows that MicroStrategy’s decision to invest heavily in Bitcoin has yielded significant returns. Their initial investment of $250 million to purchase 21,454 BTC at an average price of approximately $11,653 per Bitcoin highlights their foresight and confidence in the digital asset. As Bitcoin’s value has surged over the years, this move has undoubtedly contributed to the company’s financial success.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +MicroStrategy’s journey with Bitcoin has been both strategic and noteworthy. Here’s a brief overview of their Bitcoin accumulation history:

- Initial Investment: As highlighted by Michael Saylor’s tweet, MicroStrategy made its initial Bitcoin purchase three years ago, acquiring 21,454 BTC for $250 million, averaging around $11,653 per Bitcoin.

- June 2021 Acquisition: MicroStrategy announced the purchase of approximately 13,005 bitcoins for approximately $489 million in cash, with an average price of approximately $37,617 per Bitcoin.

- August 2023 Update: As of August 1, 2023, MicroStrategy holds a total of 152,800 Bitcoin. During July 2023 alone, they added 467 Bitcoin, spending about $14.4 million to augment their holdings.

- Overall Accumulation: As of August 26, MicroStrategy holds 108,992 Bitcoins, acquired at a purchase price of $2.918 billion, averaging around $26,769 per Bitcoin.

- Market Impact: MicroStrategy’s Bitcoin holdings have experienced significant market fluctuations. For instance, their Bitcoin holdings took a record hit of $3.4 billion.

- Leading the Corporate World: Michael Saylor’s MicroStrategy has been at the forefront of corporate Bitcoin accumulation, setting a precedent for other enterprises.

From these data points, it’s evident that MicroStrategy has been consistently bullish on Bitcoin, making significant investments over the years. Their strategic accumulation and holding of Bitcoin underscores their belief in the cryptocurrency’s long-term value proposition.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.