Memecoin (MEME) was recently listed on Binance, sparking interest from blockchain analysis firm Lookonchain to investigate Memecoin’s tokenomics and on-chain activity following the listing.

What you'll learn 👉

Token Supply and Distribution

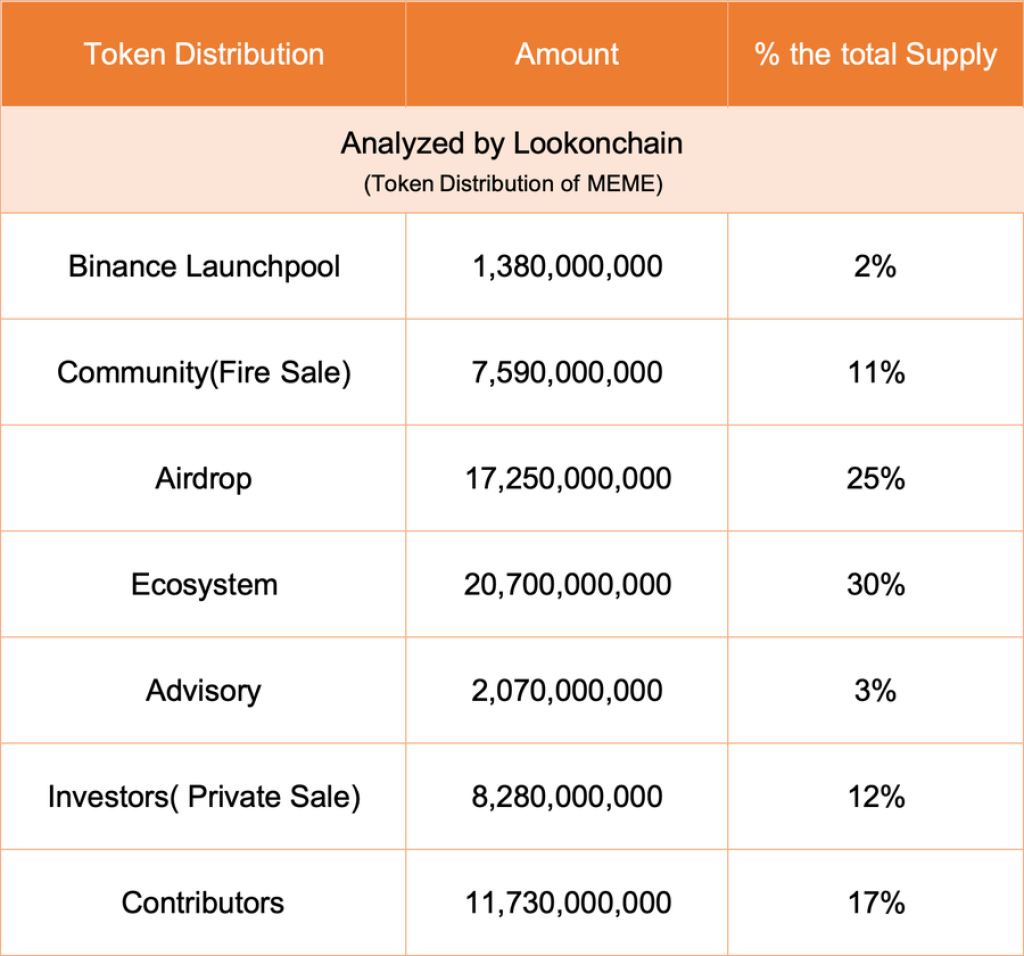

According to Lookonchain, the total supply of MEME is 69 billion. On listing, the circulating supply was 8.8 billion MEME, equal to 12.75% of total supply.

Lookonchain provided a breakdown of the token distribution:

- 2% (1.38 billion MEME) to Binance Launchpool, deposited to Binance 6 days pre-listing

- 11% (7.59 billion) for Community Fire Sale at $0.001 per token

- 12% (8.28 billion) to private sale investors at $0.001 per token

- 25% (17.25 billion) for airdrop campaigns

Post-Listing Token Flows

Analyzing the top 10 airdrop recipients, Lookonchain discovered 7 of them quickly transferred 214.88 million MEME (worth $4.8 million) to exchanges after receiving the free tokens.

Read also:

- Top Analyst Reveals Top 3 AI Cryptos with Huge Potentials that He’s Buying in November

- Top Analyst Sees XRP Exploding to $18.22 – Here’s His Ripple Outlook

- eTukTuk’s mission towards zero emission paves $TUK token

Additionally, the Memecoin team moved 10 million MEME to DEXs for liquidity and deposited 670 million MEME (worth $15 million) across major exchanges like Binance, OKX, Bybit, KuCoin, Gate.io, and Huobi likely for market making purposes.

In summary, Lookonchain’s on-chain investigation revealed where Memecoin tokens were distributed before being listed on Binance and that majority of airdropped tokens were swiftly sold, providing insights into the tokenomics and flows.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.