It’s been so long since we experienced the “bloody Monday” phenomenon that, even though everyone is aware of the bear market we are currently in, yesterday caught most of us by surprise. The day started off with most altcoins bleeding pretty decently before the mild drip turned into a veritable bloodbath.

Strong red candles could be seen across the entire market and we managed to see the entire crypto market cap fall beneath 200 billion USD for the first time since nearly a year ago. USDT managed to overtake Cardano with its own market cap, and all of these signs are clearly showing that we are getting very close to price capitulation. So let’s take a look at how the market leaders fared throughout this latest slaughter.

Bitcoin (BTC)

We turned to WBM_Team for today’s analysis of BTC:

“So time is tough. The bad news is that we have to wait but the good news is that there is no much room for further drop down. We still think we won’t drop down below $5800 level but till that time the price can swing and we have to be PATIENT. That is the key.”

While reminding people to not make any hectic movements, they reminded us to stay aware of the bigger picture in order to be ready for the bounce up. The sentiment is indeed rather dire at the moment and the price will move upwards when optimism comes. They also included this chart and following TA:

“First of all, we are nearly $300 dollars below TenkanSen. As we claim, over that level for good (more than 1 bar for sure) there is a time to enter. Not earlier.

Moreover, there too many shadows on recent bars. It seems bulls are out of strength in favour of bears.

MACD took a turn but it is far away from bull’s cross –simply we have to wait.

RSI looks pretty good as it is strongly oversold but… we can stay in such state for a while so don’t be hot–headed.

Weis Volume Indicator says everything. We have a tremendous red wave and only one small green bar. We have to wait for a reversal of such a situation. In other words, supply should be decreasing and at the same time demand should arise.”

So the market may be rather horrible at the time, but this is a long-term game after all.

Ethereum (ETH)

Ethereum has fared much worse than BTC, and being the main altcoin it pretty much set the tone for the rest of the market. With this latest drop of nearly 20%, ETH is down 187% from its ATH’s. We checked out what TheChartGuys had to say about its technicals:

“ETH last night was at some of the most extreme oversold conditions we have seen in 14+ months. Hourly RSI single digits, 4 hour RSI 12, Daily RSI 17. We clearly have an influx of supply as ICO -8.00% projects are dumping and adding to the panic. The bears have complete control but I personally would not dare enter a short down at these levels.”

So things are looking rather bleak for Ethereum, as the market is completely ruled by sellers. Analysts feel that once the balance between sellers/buyers shifts we will see a slight bounce, but much will also depend on BTC setting the proper mood.

Ripple (XRP)

As for XRP, traders are very split on it at the moment. Some feel it has no support left whatsoever and is floating in no-man’s land, attempting to discover its price. Others are still bullish, as they at least expect a short term recovery:

“since June 22, XRP sellers tried to break through an important price zone of 0.43-0.48$ and lower the price to the liquid zone of 0.23-0.25 $. The previous two ideas (“Juicy Short” “I do not believe in the global long” have run out and it’s time to look for opportunities to buy this coin. Buy zone 0.23-0.25 $. Of course, there may be failed low and consolidations that will go outside from this zone. I will correct the idea more detalied conserning the trading of this coin. After a sharp fall, I expect a rebound to 0.33-0.35 $ and then I want to see an aggressive reaction from buyers to predict the global growth of this coin,” posted petro90 on TradingView.

Bitcoin Cash (BCH)

Bitcoin Cash’s analysis was provided by investorgains and it was rather concise:

“Plenty of Shitcoins will die, but this one will survive”

His sentiment is probably correct, unless Bitmain decides to dump its 600 million USD worth of BCH on the market.

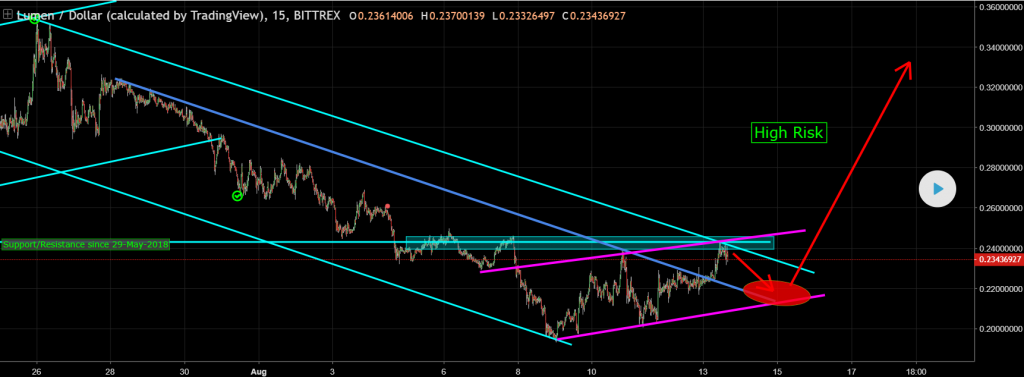

Stellar Lumens (XLM)

Stellar Lumens was analyzed by TradingView’s TotoParasca:

“XLM is at the upper line of the downward trend. There are high chances that it will fall even more then maybe retract. There are prospects for a reversal, but the news environment has to change for this to happen, and it didnt happen yet.“

Conclusion

Clearly the market is still too weak to expect any form of recovery. BTC’s dominance rises by the day as the investor positive sentiment keeps dropping. This is sort of good, as weak hands will get shaken out along the way and stronger support levels will be formed. For now, the feeling is that we are finally starting to capitulate; we’ll just have to wait and see where the capitulation ends.