Since the inception of financial markets and instruments people have been scouring the landscape to find the most reliable ways of achieving financial independence. The approach to this issue has mostly been two-pronged:

- some prefer to “stash” their hard earned money for longer periods of time in an instrument and have it grow organically with the instrument, aka investing

- others prefer to be more active and buy instruments on a cheap while selling them on a high, aka trading

No matter which one of these approaches people prefer, the instruments they get to pick have mostly been the same. There are various asset classes on offer out there and they include both stocks and, as of recently, cryptocurrencies. Even though you can invest and trade both of these, there are some stark differences between them that need to be pointed out.

What you'll learn 👉

The Stock Market

A stock is a part of the company’s equity which is divided among its owners and can be divided into shares (which are smaller portions of equity that can be sold to general public with lower investment potential). These stocks can be both invested in and traded on a stock market. Investing in shares of a company means that in return you expect to gain some benefits as long as the company is operating profitably. You hold shares and are given a part of the earnings and assets of the company in which invested.

Stock markets function on the basis of stock exchanges, aka centralized entities which connect the stock brokers and traders and allow them to buy and sell stocks. The stock prices are created by an order-matching engine as a reflection of the stock supply and demand; they are usually very stable and fluctuate in single-digit percentages per year.

Stock markets of today are computerized, internet connected, heavily regulated order-matching engines which are designed to conjoin the supply and demand and let them exchange money for stock and vice versa. Every member of the stock market needs to be verified by fitting certain requirements which are a direct result of years of experience with stock buying/selling. Just like every company needs to provide certain proof that it is capable of generating a set amount of revenue per year, every potential trader needs to provide proof that he possesses a certain amount of capital which he can invest into stocks. This way, stock market makes sure that both the capital and the stocks that are shown on its supply/demand charts are real. Stock markets charge fees for validating its members, processing their orders and selling past order data to interested brokers who want to analyze the market movements and predict the future ones.

?Read: Best Cyptocurrency Exchanges 2018

People don’t directly invest in these exchanges; instead they give their money and investment instructions to brokers who are registered and licensed to trade on a desired exchange. The broker represents & “vouches” for you at the stock exchange and holds your trading cash and stocks. The stock market system usually functions by having one (regional) stock exchange company as the only venue allowed to trade stocks issued by companies registered in its jurisdiction — e.g. all Brazilian companies with publicly available shares are traded on the B3 exchange). The situation in USA is somewhat different, as there are 11 registered stock exchanges operating on its territory. In order to protect the trading public, US regulators have initiated creation of price protection mechanisms: the result is that all US exchanges are networked to see each other’s best prices and will forward their orders to an exchange engine that is currently “hosting” the best price.

In Europe there are 3 stock trading exchanges but these trading venues are not networked to forward orders to each other. Since the brokers compete for clients’ business, the brokers are incentivized to connect to each venue and utilize Smart Order Routing (SOR) applications to achieve the best prices for their trades.

Therefore, whenever you “trade” stocks from the comfort of your home, you are communicating to a broker who is in turn communicating with the stock exchange in your name. The entire system is heavily regulated both by its participants and by the government, which usually stays away from investing into stocks. These centralized sets of regulatory measures give everyone trust in the stock markets.

The Crypto Market

A cryptocurrency is a digital currency in which various encryption techniques are used to generate the units of the currency and to verify its transactions. This encryption is done thanks to a network of miners and nodes, making the entire system decentralized and out of the hands of a centralized entity.

Investing in a cryptocurrency means that you are investing in the project itself. There are many different currencies which have all sorts of applications. If more people share the belief that a currency has a good project and good application behind it, then the demand for the currency grows and makes it more expensive. The implementation and adoption of a currency are the major deciding factors for the market value of its coins, and the company behind them.

Crypto prices are also created by the supply and demand meeting and deciding on how much they are willing to take/pay for a cryptocurrency. These prices are almost by rule very volatile; we have seen many cryptocurrencies rise or fall by 100% in a matter of days. The creation of these prices is much different than the one that we have in the stock markets, mostly due to the decentralized nature of the crypto markets and the lack of regulations on crypto price manipulation.

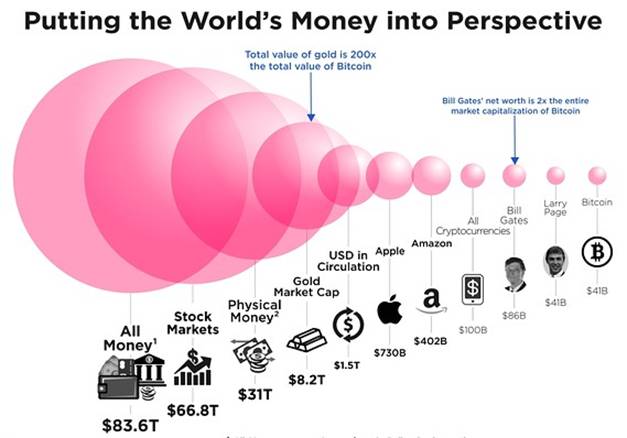

Cryptocurrency markets function thanks to crypto exchanges, which offer people a chance to turn their fiat into crypto and to turn their crypto into other kinds of crypto (there are currently over 1000 active cryptocurrencies out there). Every crypto market offers a certain amount of cryptocurrencies for investment/trading; this depends on the exchange. For every Coinbase which is somewhat forced to strictly control what it sells on its platform (due to strict US. Financial laws which have recently started expanding into crypto) there are at least a dozen wild Chinese exchanges which offer the wildest variety of possible coins to invest in. It seems like almost every day we hear about a new crypto exchange popping up; we even have “classical” stock trading platforms like eToro catching the crypto bug and implementing crypto trading. Eventually, the demand for trading/transacting cryptocurrencies might end up leaving the traditional stock markets in the dust. For now, cryptos are still way behind the biggest money markets out there.

Crypto markets function similarly to the stock markets, with one simple exception: you are the one doing the investing and trading. There are no brokers, no intermediaries; you are the one who is required to educate himself/herself on the ins and outs of using a crypto market platform.

?Learn how you can create a paper wallet – click here to read more about cryptocurrency wallets.

Another thing that makes these platforms (and crypto in general) stand out from the centralized stock markets are the blockchains of cryptocurrencies involved. These blockchains are basically ledgers publicly accessible to all parties which contain data about every mined coin and every transaction ever made with one of those coins. This ledger is created and maintained thanks to the efforts of the decentralized network of miners in such a way that no one individual or group can counterfeit any portion of the blockchain. Thanks to this fact, everyone can trust that the blockchain hasn’t been tampered with and that the data and the coins on it are legitimate. There is no need for centralized entities that will create and control the currency as power and regulation are in the hands of people.

Some more notable differences

- Price fluctuations

Crypto markets are extremely volatile; price hikes and price downfalls can be very drastic and brutal for your portfolio. This happens for many reasons: lack of regulations, price manipulations by bots and whales, pump and dump schemes etc. All of these were previously present while investing in regular stocks; stock markets and governments have realized that fairness would be beneficial to all actors and have implemented rules and laws against these shady practices. Mostly thanks to this lack of regulation are cryptocurrency markets moving at much faster rates than the regular stock markets.

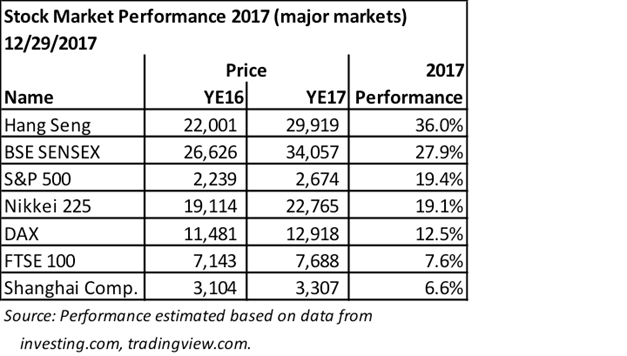

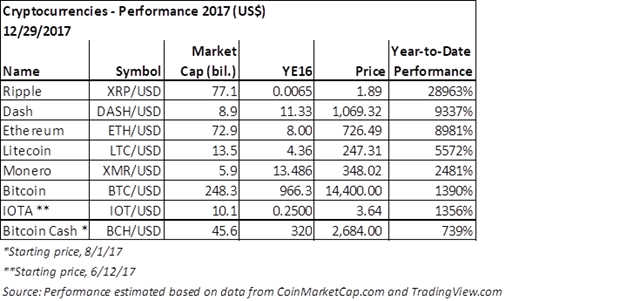

Stocks vs Cryptocurrencies performance in 2017

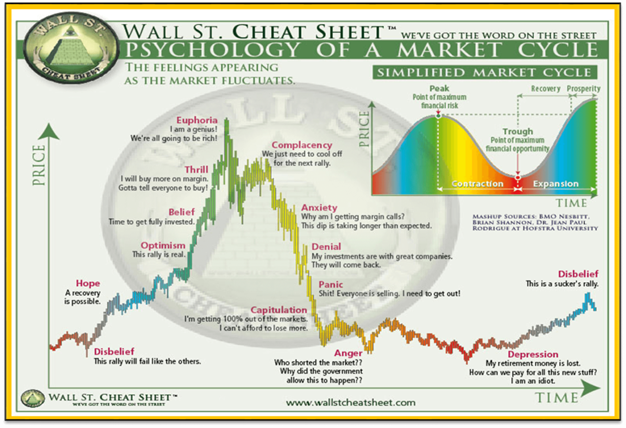

Another reason for the price volatility is lack of informed investors. As with any new, booming market, you have people who heard about this new Bitcoin craze and decided to put some money into it just for the hell of it. You also have people in dire financial situation that took out mortgages and sold the shirt of their back to invest into Bitcoin, expecting it won’t stop growing. However, as soon as the first hike on the road to the moon appeared those people got scared and started selling, which in turn caused the price to drop even harder. The complete psychology of this is nicely summed up in the following chart.

As “weak hands” sell all their holdings and the market consolidates around newly-increased liquidity and informed investors, a new positive cycle and decreased volatility is expected.

- Advantages for the developing world

Crypto can provide superior alternative for people in the developing world looking for reliable digital payment channels. India, Australia, Greece, Venezuela, not to mention many African countries, have all recently experienced issues with fiat money which many people relieved by investing into the more stable cryptocurrencies. Investing in stocks isn’t an option in most of these countries, as there is a distinct lack of financial intermediaries which can handle people’s money in a trusted way.

- Turnover of currencies

Source: https://news.bitcoin.com

Cryptocurrencies have much higher turnover rate (rate at which old ones die and are replaced by new ones) than stocks, largely because creating a cryptocurrency is extremely easy. A new company with advanced technology can easily overshadow more traditional, conventional tokens which have stayed true to their cause. There has been talk of Bitcoin “going down” due to its ancient technology and issues with throughput and scalability; its developers have responded by implementing the Lightning network and Rootstock, thus increasing the longevity of the most famous cryptocurrency in the world.

In the stock market, old businesses cannot die out at the pace we see in the cryptocurrency market. Stocks actually have dedicated investors with generations’ worth of trust, image, brand recognition and market presence which make it difficult for a company to go under.

Another issue related to turnover are the ICO’s (initial coin offerings), which are sprouting left and right recently. It seems like any old company can slap the “blockchain” moniker next to its name and announce an ICO. This has resulted in quite a few scam ICO’s in the past, putting the spotlight of the financial authorities on these new flashy tokens. China, Korea and USA have banned their investors from participating in ICO’s in an attempt to stifle the rampant scamming in the ICO industry. It is clear that the market is still full of bad ICO’s which will eventually go down and take its investors’ money with them.

This issue is much milder in the world of stock trading, where a company needs to jump through many hoops to organize an IPO (initial public offering) and become available for public trading on a stock market. Regulations and requirements are set in place to ensure that only the best companies that are capable of long-term profitable existence will be traded on the stock market. Something similar needs to happen on the crypto markets as well in order to finally get rid of the overload of “sh*tcoins”.

- Legal Rights of Token/Shareholders

Source: http://expertlegalreview.com

Investing in stocks/shares can give a lot of legal rights to the shareholder. He is actually considered an owner of a small fraction of the company he invested in. Some shares come with voting rights which allow the shareholder to take a part of shareholder meetings, where the future of the company is discussed with the managers and the rest of the company’s top echelon. If the company liquidates or goes bankrupt the true extent of his ownership rights comes to light; the creditors will be the first ones to get dibs on the company’s assets, followed by bondholders, then preferred shareholders, and finally the common shareholders.

?Buying crypto instantly is easy these days – click here to see how to do it.

This is not the case if you own cryptocurrencies: owning a cryptocurrency doesn’t give you any legal rights. It is just a coin or token that has value based on the fact that people are willing to give it that value. The companies behind cryptocurrencies make it a point to emphasize that cryptocurrencies don’t come with any actual rights. Otherwise they enter the territory of securities and the regulations are very strict for anyone who wants to operate there. If the company liquidates, token holders won’t get anything from the liquidation mass.

Conclusion

There are many differences between the stock and crypto markets that go far beyond those listed above. However, probably the most important distinction comes down to profits vs risks. Crypto is a much more risky asset which comes with a chance for getting rich overnight. Those overnight profits won’t happen just like that; it will depend on how well you evaluate a coin and its company and will also require just a little bit of luck. On the other hand, stocks are much safer but offer smaller returns. While their prices do fluctuate, it is to a much lesser extent. Ultimately what you choose to invest in is up to you. Set your investment goals and find the market that suits those goals the best, and hopefully enjoy your profits.