Stablecoins are very popular on crypto exchanges. They offer traders the opportunity to secure their profits after a rally – without exchanging the money for Fiat. However, this only works if the stable coin remains stable. There are negative examples in both the crypto and the Fiat world.

Stablecoins are one of the hypes dominating the year 2018. Like tokenized assets, they promise a bridge between the classic financial world and the crypto market – and they provide a certain stability. This is necessary because the monthly volatility of the Bitcoin/US dollar pair ranges on average between three and six percent. For comparison: the euro’s volatility, again related to the US dollar, is less than one percent. Even that of the Turkish lira is at two percent.

However, to accept the stability of stable coins as given uncritically is somewhat optimistic for various reasons. Let’s ignore the Tether saga per se and put the focus on the problem of stability itself. We can learn a lot here from the world of Fiat currencies. Concepts like stable coins have been around for a long time. 25 currencies peg their exchange rate to that of the euro. There are even more with the US dollar, we are talking about 66 currencies. Examples of currencies pegged to the euro are the Danish krone, the convertible mark of Bosnia and Herzogovina and the CFA franc of the West African monetary union.

Such a coupling of two currencies means that the exchange rate is constant. By buying and selling government bonds, a central bank can influence the exchange rate of its currency. This works well as long as little happens. In the case of abrupt price fluctuations, it can happen that the central banks are unable to react sufficiently to the price shake despite the sale of all government bonds. In part, they then try to improve the situation by printing money, which in part led to hyperinflation. This is not a hypothetical sword of Damocles over fiat currencies, Argentina or Greece are tragic examples that such things can happen.

Nubits: A warning sign for Stablecoins…

Even the Stablecoin world is not free of such events. Nubits, one of the oldest Stablecoin experiments, started in 2014. In addition, it was the first Stablecoin whose course was managed by so-called seignorage shares: If the value increased too much, new Nubits tokens were automatically sold until the price reached the desired level again. If the price dropped too much, the system should proceed the other way round.

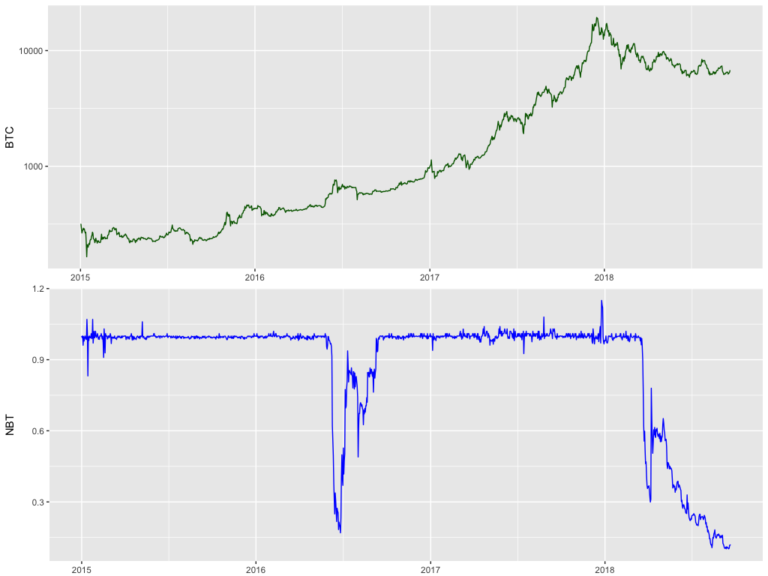

Unfortunately, the calculation did not work. Not only once, but twice the Nubits price deviated dramatically from the target price:

The price fell by almost 80 percent for the first time in 2016. It took three months to reach a stable exchange rate of one US dollar again. At the same time, Bitcoin rose after moving sideways since early 2016. One possible interpretation is that Nubits-Holder wanted to capitalize on this situation. They sold their Nubits tokens to buy Bitcoin. The Nubits algorithm could not cope with this large sell-off and could not compensate for the associated fall in prices.

This crash is reminiscent of the previously discussed scenarios in the fiat world. Instead of regulating the exchange rate by buying and selling government bonds, a direct buying and selling of tokens should solve the stability problem.

Since the beginning of 2018, the price has fallen into the abyss. At the end of 2017, the market capitalisation of Nubits began to rise dramatically. In the chart we can see from the spike shortly before New Year’s Eve that money was not simply printed here, but that there was real demand. They wanted to meet this demand and eagerly issued Nubits tokens. The market was flooded with them. When the interest in Nubits dropped, the team lacked the necessary reserves to buy back the tokens at reasonable prices. Since the team had Bitcoin reserves for hedging purposes, it may be possible that these were also bought at the end of the year. Over time they lose value and could no longer buy enough Nubits tokens.

… a lesson for developers and investors!

In summary, the mistakes of Nubits seemed to have been that they had not secured themselves with a diversified portfolio and that they had a too small cash box. The crypto community can learn from the past. The people behind the Stablecoins can take the lessons of Nubits to heart. The simple trader/investor can incorporate gretchen questions into his due diligence. If both sides, developers and users alike, don’t forget the lessons and adopt a healthy critical attitude towards stablecoins, they can undoubtedly be very helpful!