Popular crypto analyst Lookonchain recently posted a Twitter thread examining why the price of Solana’s SOL token increased around 80% over the past month. Let’s take a look at the 5 key reasons outlined in Lookonchain’s insightful posts.

What you'll learn 👉

Solana’s Annual Conference Boosts Hype

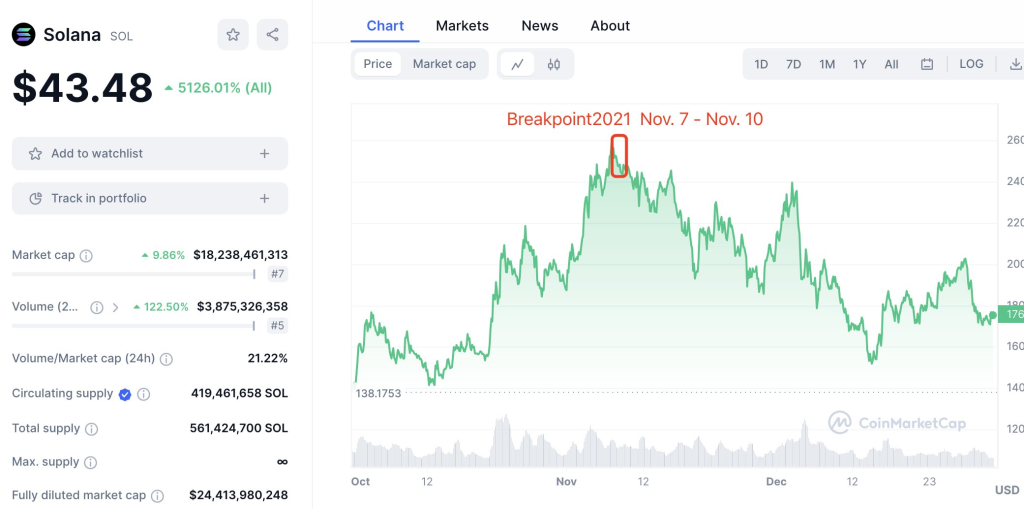

First, Lookonchain noted that the rise in SOL prices seems related to Breakpoint 2023, Solana’s annual conference held in Lisbon from November 1-4. Analyzing historical price data, Lookonchain found that SOL tends to pump leading up to Breakpoint, hitting a peak price around the time of the conference, before falling back down afterwards. This hype cycle effect is likely a key driver behind the recent 80% monthly gain.

Speculation of Insider Pumping Before Selling

Second, Lookonchain speculated that someone could be artificially pumping up the SOL price before selling their holdings. This follows recent reports that crypto exchange FTX had been steadily selling off their SOL reserves. Lookonchain wonders if these SOL sales were timed to take advantage of insider-fueled price rises.

Expanding on the FTX selling activity, Lookonchain’s post notes that FTX transferred 2.14 million SOL (worth $94 million) over the past 10 days to sell off. FTX currently holds around 4.8 million SOL (worth $211 million), with 850,645 SOL ($37 million) left in their wallet and 3.96 million SOL ($174 million) still staked. This steady selloff of what were likely substantial SOL holdings applies downward pressure on prices.

More Traders Going Long Than Short

Third, Lookonchain examined trader positioning data from Coinglass to determine if the price rise was fueled by increasing leverage. The data revealed SOL longs outnumbered shorts, with a long/short ratio of 1.2134 on Binance. This signals bullish sentiment is driving up prices as more traders bet on continued upside.

Reviewing Solana’s Token Supply

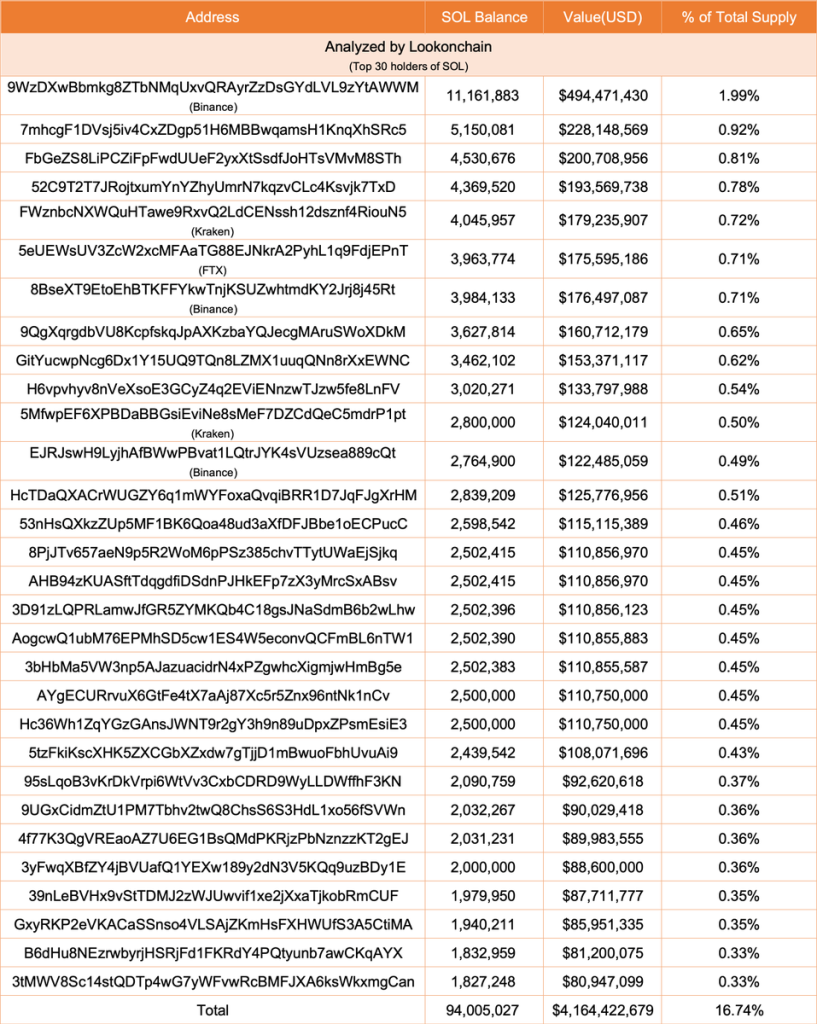

Fourth, a look at Solana’s token circulation provides useful context on the price movement. The total supply stands at 561.4 million SOL (worth $24.7 billion) with 419.5 million SOL ($18.45 billion) circulating. Meanwhile, 406.6 million SOL ($17.9 billion) are being actively staked and earning rewards. With over 90% of total supply minted and 71% of tokens staked, Lookonchain’s analysis shows demand is heavily outweighing new SOL being created.

Examining Distribution of Top Holders

Finally, Lookonchain points out the top 30 SOL holders control 90 million tokens, worth $4.16 billion. This represents a substantial 16.74% of total supply concentrated in just 30 addresses. The distribution of SOL among top holders is important to monitor to gauge whales’ power to potentially move prices through large sell orders.

Read also:

- Top Analyst Reveals Top 3 AI Cryptos with Huge Potentials that He’s Buying in November

- Top Analyst Sees XRP Exploding to $18.22 – Here’s His Ripple Outlook

- eTukTuk’s mission towards zero emission paves $TUK token

In summary, Lookonchain provided insightful technical and on-chain analysis to explain the powerful 80% Solana pump over the past month. The posts demonstrate how tracking key metrics like conference hype cycles, exchange flows, leverage ratios, circulating supply, and holder distribution can provide clues into the complex forces behind crypto price moves.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.