Bitcoin is down 1.5% over the last 24 hours to around $51,100, after briefly surging above $52,000 earlier this month. The move above $52,000 had some claiming the 4-year cycle that Bitcoin tends to follow was no longer valid. However, crypto analyst CryptoCon pushed back on those assertions in a recent tweet thread.

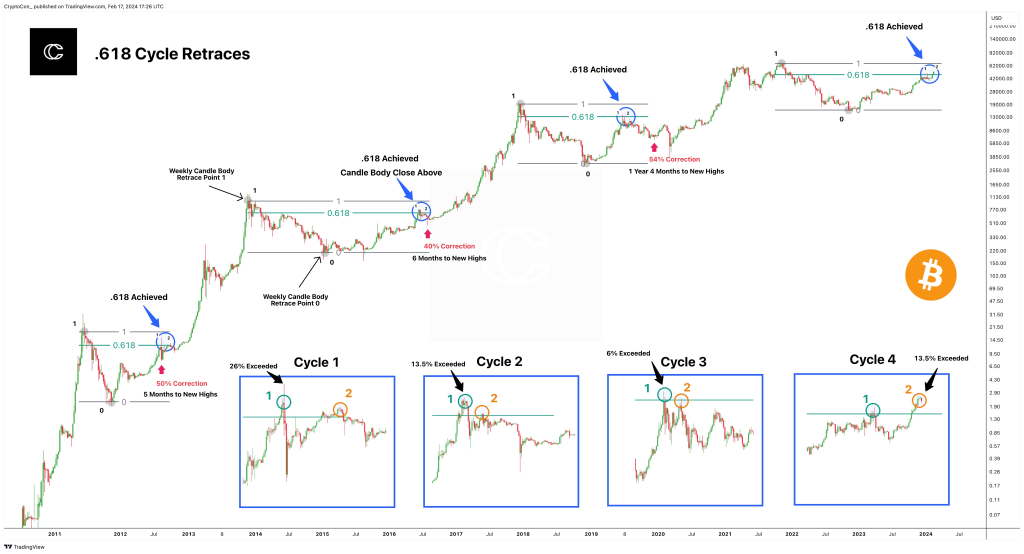

As CryptoCon explained, “With the recent move to 52k+ prices, some have claimed the #Bitcoin 4-year cycle is now out of the question. Their evidence, the .618 cycle retrace. This retrace has marked the mid-top for each cycle, a point that comes in the middle of the cycle and brings large corrections (40 – 54%) and sideways periods.”

Indeed, Bitcoin had surpassed the .618 Fibonacci retracement level from its last cycle high, leading some to believe the cycles were broken. But CryptoCon contends otherwise:

“There is a chance it may be. The best way to measure these retraces is from weekly candle bodies, which allows us to include Cycle 1. When we do this, we find that cycles have always made two primary tops above the .618. This would have made 49k the first, and the second is in progress.”

So in CryptoCon’s view, $49,000 was likely the first top above the .618 level for this cycle, and the move above $52,000 represents the second top which he says is typical based on previous cycles.

CryptoCon notes that “The amount that each cycle has risen over the .618 has been between 6 and 26%. This cycle is at 13.5%.” So while unusual, the move above the .618 retracement level does fall within historical norms. He also points out that even a weekly candle close occurred above the .618 level in 2016, “making our close above not out of the ordinary.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In conclusion, while Bitcoin’s surge above $52,000 makes it appear like the 4-year cycle may be invalidated, the analysis from CryptoCon suggests otherwise. The cycles are still in play according to historical data, with the move above the .618 retracement level not entirely unusual. Still, Bitcoin faces a crucial test here to see if it can sustain above $50,000 or if a deeper correction is still ahead.

You may also be interested in:

- Bitcoin Bound for $150K? These Key BTC On-Chain Metrics Point to Potential Breakout

- How One Trader Made $150,000 with Just $198 Ethereum in 18 Hours

- Avalanche and Chainlink Climb Impressively While Investors Anticipate Huge Returns on Rebel Satoshi’s DEX Launch

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.