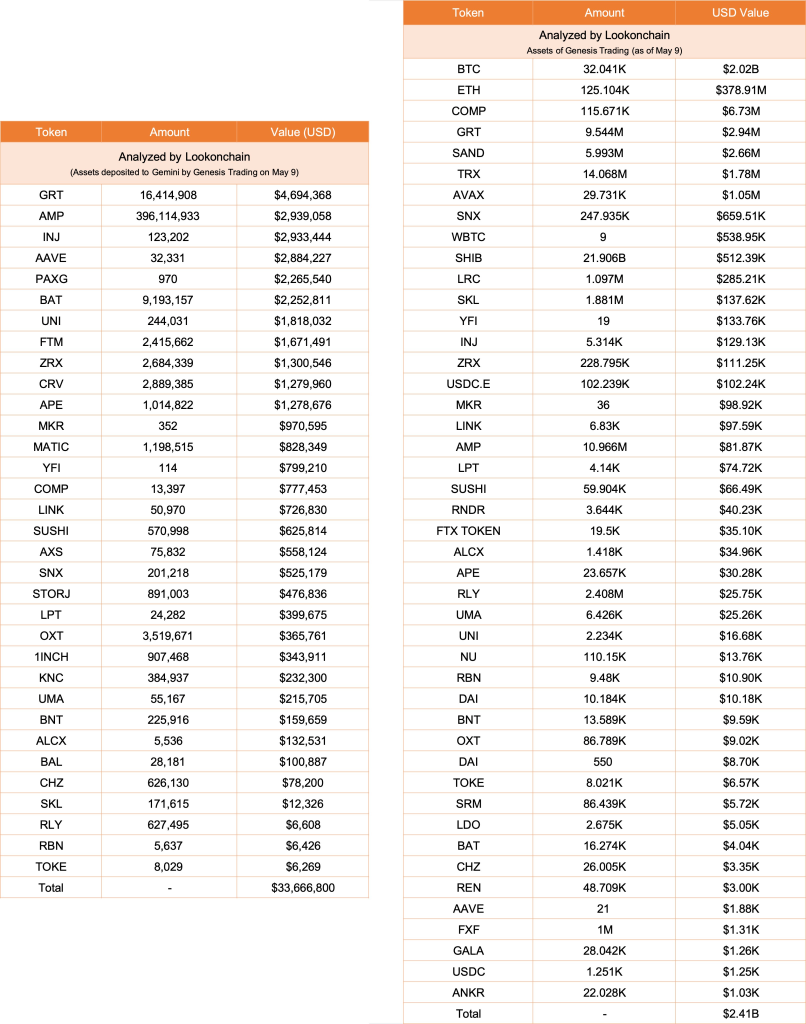

Genesis Trading, a prominent cryptocurrency trading firm, has recently deposited a substantial amount of digital assets to the Gemini exchange. According to a tweet by Lookonchain, a blockchain analytics platform, Genesis Trading transferred $33.67 million worth of cryptocurrencies to Gemini just six hours ago.

The deposited assets include a diverse range of tokens:

- 16.4 million The Graph (GRT) tokens, worth $4.69 million

- 396 million Amp (AMP) tokens, worth $2.94 million

- 123,000 Injective Protocol (INJ) tokens, worth $2.93 million

- 32,331 Aave (AAVE) tokens, worth $2.88 million

- 970 PAX Gold (PAXG) tokens, worth $2.26 million

- 9.19 million Basic Attention Token (BAT) tokens, worth $2.25 million

The transfer of such a large amount of assets from Genesis Trading to Gemini has raised questions about the firm’s motives and the potential impact on the market. Some speculate that the move could be related to liquidity management, risk adjustment, or preparations for future trading activities.

What you'll learn 👉

Genesis Trading’s $2.41B Portfolio Dominated by Bitcoin and Ethereum

In addition to the recent deposit, Lookonchain also revealed that Genesis Trading currently holds $2.41 billion worth of digital assets in its portfolio. The firm’s holdings are heavily concentrated in Bitcoin (BTC) and Ethereum (ETH), with smaller allocations to various altcoins.

Genesis Trading’s current portfolio breakdown is as follows:

- 32,000 Bitcoin (BTC), worth $2.02 billion

- 125,100 Ethereum (ETH), worth $378.91 million

- 115,670 Compound (COMP) tokens, worth $6.73 million

- 9.54 million The Graph (GRT) tokens, worth $2.94 million

- 5.99 million The Sandbox (SAND) tokens, worth $2.66 million

The significant holdings in Bitcoin and Ethereum demonstrate Genesis Trading’s confidence in the long-term value and growth potential of these two leading cryptocurrencies. The firm’s portfolio also showcases its diversification strategy, with investments in various promising altcoin projects across different sectors of the crypto ecosystem.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Also read: Do Dogwifhat (WIF) and Meme Coins Face a New Competitor? This Low-Cap Gem Surged 20,000%

Market Impact and Future Implications

The recent deposit of $33.67 million worth of digital assets from Genesis Trading to Gemini has the potential to impact the market in several ways. The influx of such a large amount of tokens could increase liquidity on the Gemini exchange, potentially affecting the price and trading dynamics of the deposited assets.

Moreover, the move could signal a shift in Genesis Trading’s investment strategy or market outlook. As a prominent player in the cryptocurrency industry, the firm’s actions are closely watched by investors and traders seeking insights into market trends and potential opportunities.

The revelation of Genesis Trading’s $2.41 billion portfolio also highlights the growing institutional interest and investment in the cryptocurrency market.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.