A high-stakes gamble on Ethereum comes to an end as a crypto whale closes a short position, incurring a substantial loss.

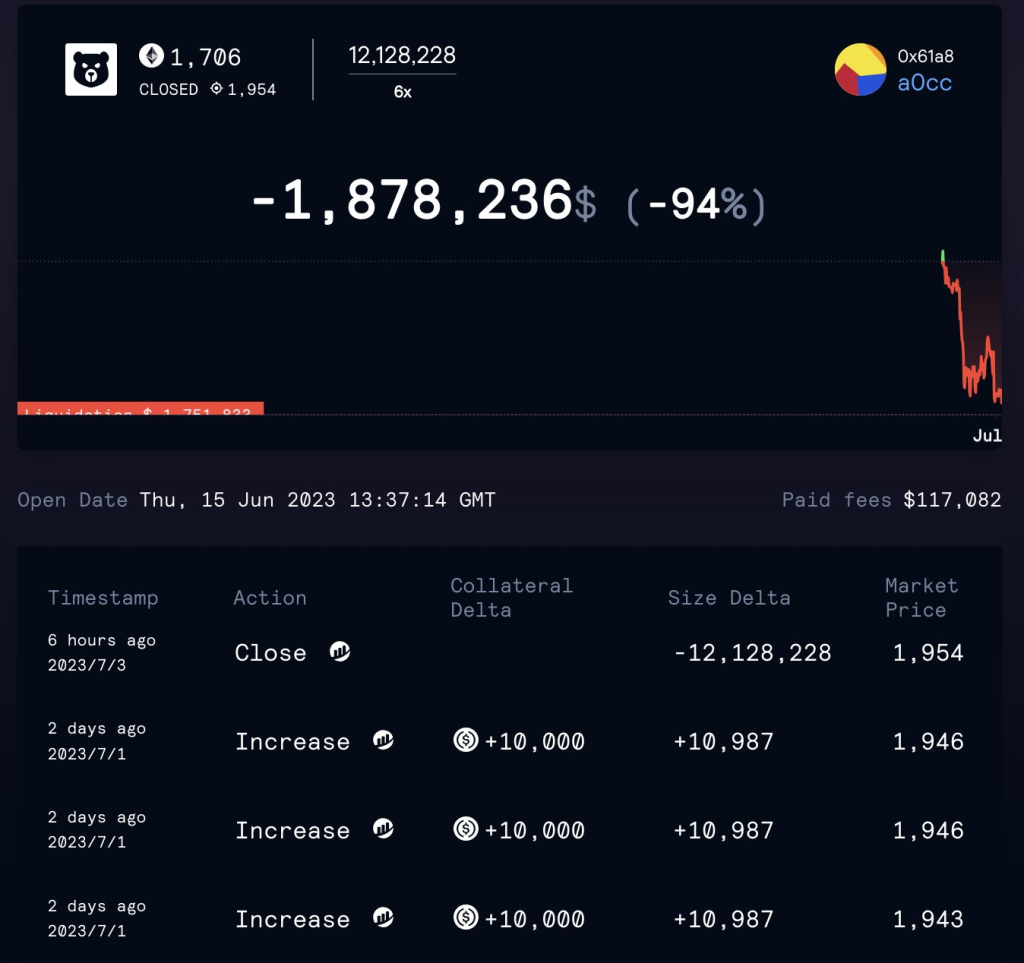

In the volatile world of cryptocurrency trading, a crypto whale has recently faced the harsh consequences of a high-risk short-selling strategy. Approximately eight hours ago, the whale terminated a short position on Ethereum (ETH), suffering a loss of around $1.88 million.

The anonymous trader initially shorted Ethereum on June 15th, betting that the price of the second-largest cryptocurrency by market capitalization would decline. However, as Ethereum’s price continued to ascend, the whale progressively augmented their position, hoping to eventually capitalize when the tide turned.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This strategy, known as “doubling down,” involves increasing one’s position in an asset as its price moves in the opposite direction of the initial bet. It is a high-risk approach that can either result in significant gains if the market reverses or substantial losses if it continues to move against the trader.

In this instance, the market did not favor the whale’s gamble. The continued bullish trend of Ethereum forced the trader to eventually capitulate and close the short position to prevent further losses.

The transaction details, available on GMX, a decentralized exchange, reveal the scale and timeline of the whale’s trading activities. The link provided in the original Twitter thread directs to a page that meticulously documents each trade made by the whale, from the initiation of the short position to its eventual closure.

As the cryptocurrency market remains highly unpredictable, this event serves as a reminder of the risks involved in trading, especially when employing aggressive strategies. It also underscores the importance of diligent risk management and the potential perils of short-selling in a predominantly bullish market.

For investors and traders alike, this incident is a cautionary tale that emphasizes the necessity of thorough research and a well-thought-out trading plan.