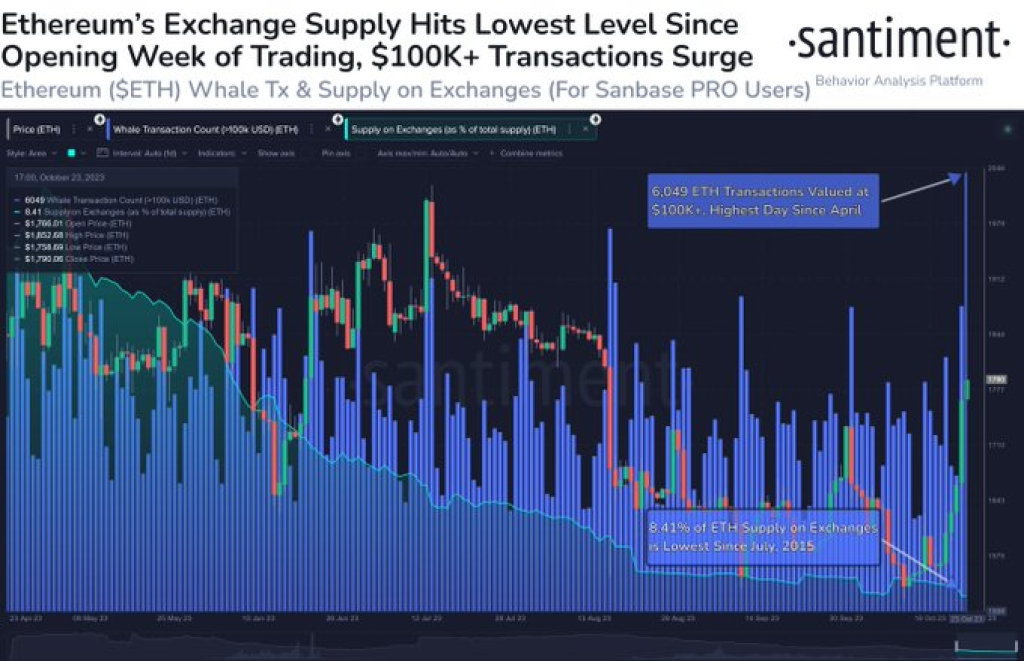

The price of Ethereum (ETH), has seen a notable uptick in recent days amid a wider market surge. According to market data, ETH crossed the $1,850 threshold on October 25th for the first time since August 15th.

Accompanying the price rise is increased on-chain activity for the world’s second largest cryptocurrency by market capitalization. Data from analytics firm Santiment shows that only 8.41% of the total supply of ETH is currently held on cryptocurrency exchanges. This is the lowest percentage going back to the genesis of the Ethereum blockchain in 2015.

Source: Santiment – Start using it today

Furthermore, Santiment noted that the number of large ‘whale’ transactions on the network hit a 6-month high. This points to renewed interest from institutional and high net worth cryptocurrency investors.

The confluence of recovering prices and spikes in on-chain activity could signal growing confidence in Ethereum’s long-term outlook. However, the cryptocurrency market remains highly volatile. ETH prices are still down substantially from their all-time high of nearly $4,900.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.