Rarely does a day pass where an average crypto “enthusiast” doesn’t hear the word scam being mentioned in the same breath as his favorite past time. Whether it came from reading an article about a fresh new exit scam or hearing a friend ask for the umpteenth time “is that Bitcoin thing legit”, there is quite a lot of notoriety circling the world of crypto. While there are plenty of quality projects that want to create a functional product which will better their investor’s fortunes, scams designed to part said investors with their hard earned money are definitely roaming the markets in worrying numbers. Exclusive Crypto Aware data indicates that $1.7 billion worth of cryptocurrencies was lost to hacks and scams from 2011 to 2018. Notable losses since the start of the year include the $400 million hack of the Japanese cryptocurrency exchange Coincheck in January and a $170 million hack of the cryptocurrency exchange BitGrail in February.

These issues are sadly part and parcel of introducing new asset classes which start producing apparent overnight millionaires. While this might seem like how everyone got rich in crypto, the truth is that most people either got in way early or worked hard to build their crypto wealth. Hearing the news of people multiplying their investments hundredfold makes people greedy for a piece of that cake. Scammers know this and will look to exploit this human emotion by offering deals which sound too good to be true. While most people will stay away from such deals, some will “FOMO” in and invest their money into projects that are seemingly destined for greatness. However, this potential is short lived; the scammers will sooner or later run away with their money, leaving their followers with bags of dirt around their necks.

Just recently, US Securities and Exchange Commission released a statement in which they confirmed that scamming is rampant in the crypto world and signaled their intention to work hard on implementing regulations which will fix these issues. Until these regulations come, navigating the minefield that is crypto investing might be a tough task for a beginner. To lift some of this heavy burden from our newbie reader’s shoulders we’ve decided to list some of the most common cryptocurrency scams out there and instruct you how to deal with them.

What you'll learn 👉

Giveaways

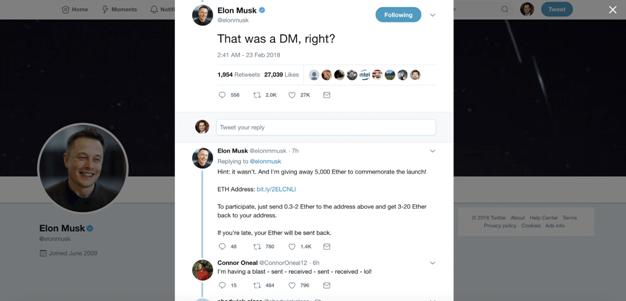

Nothing screams “have some free money” like a cryptocurrency giveaway. You’ve seen these plenty of times, even if you don’t use social media sites like Twitter or Facebook that often. The scam usually works along the following lines:

- A popular social media personality posts something random on their account

- A fake impersonator account with a slightly changed name posts in the comments, claiming that the original poster is conducting a giveaway

- This giveaway usually requires you to send a certain amount of cryptocurrency to an address posted in the scammers comment, to “verify your own address”

- This amount is usually relatively small but still somewhat substantial (no self-respecting scammer would scam people for free, would he)

- Scammers comment promises to send you your share of the giveaway after your address is verified, which is usually multiple times larger than the amount you had to initially send

- These comments point out that only a limited number of people will get to join the giveaway, encouraging those who read them to act quickly without thinking.

- The scammers will also use bots to upvote, share the comments and post encouraging comments pretending they are real people who won cryptocurrency in the giveaway

These scams might seem too simple to fool you, but there are plenty of people who legitimately fall for them. Scammer posts usually don’t survive longer than half an hour before getting reported and deleted; still, they manage to fool enough suckers to warrant reposting the same scam over and over again from different accounts. Once the greed and “FOMO” (fear of missing out) kick in, naive people will send their cryptocurrency to the scammers’ wallet, expecting to multiply their investment in a single click of a button. The only thing that will be multiplying is the amount of cocktails the scammer will be able to afford in his exotic beach resort.

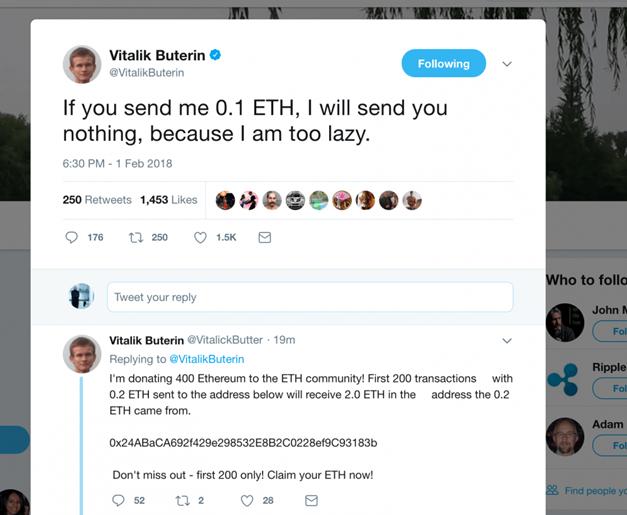

Funnily and sadly enough, scammers will post these comments even on posts which explicitly claim that the account in question will never do such giveaways.

Vitalik Buterin, the lead developer of Ethereum, has been targeted by these attacks so often that he recently changed his Twitter name into Vitalik “Not Giving Away Ethereum” Buterin. Scammers will sometimes directly contact people, without posting the scam details publicly. Individuals aren’t the sole victims of these criminal activities, as various exchanges and crypto related projects have seen a fair share of doppelgangers.

Note the double underscore in the above images; original Cryptopia and CEX.IO accounts don’t have them

For now, there isn’t a clear way to deal with this threat immediately. Every scammer account is just a regular user account in the eyes of social media service providers. Their posts will keep appearing inline and will keep scamming people until some sort of protection mechanism is implemented. A unique ID system that would give each poster a distinguishable ID could help. The best course of action is to report these and similar posts and hope that the social media moderation staff will swoop in fast enough to prevent any innocent people losing their money.

ICOs

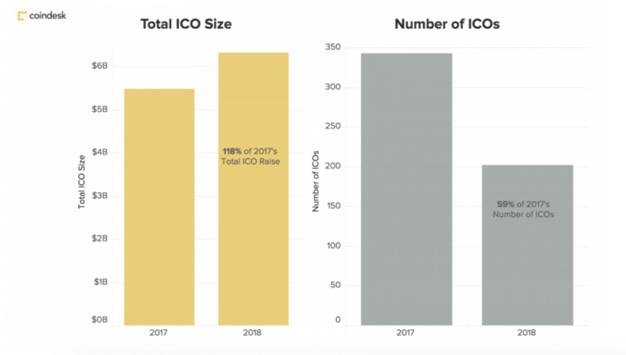

Initial Coin Offerings (ICOs) are the IPOs of the cryptocurrency world. They started gaining traction in early 2017, when multiple projects started pre-mining cryptocurrency tokens and offering them to investors as a way of raising money. While government regulation had stopped people in USA, China and other countries from taking part in some ICO’s, the ICO market has still kept growing. Even though the recent crash of Bitcoin caused significant crypto market stagnation in Q1 of 2018, more money was collected for ICO’s during that period then throughout the entire year of 2017.

Source: coindesk

While a lot of quality projects implemented this model of financing, many malicious players noticed its potential for scamming people. With the rise of Ethereum and its ERC-20 token model, all a company needs to do in order to start selling its tokens is to create a smart contract on the Ethereum platform. Naturally this drew in scammers, as very little investment is required to create an ICO for a completely fake project. There is also a lack of government involvement in this sector, meaning that the regulation is very lax and scammers can get away with almost anything.

Almost every ICO is selling tokens that don’t have any real value yet. Projects that have a fully working product are rare (and usually good investments), meaning that investors are mostly buying potential. Therefore many companies tend to overpromise and over-value their tokens, resulting in people feeling scammed when the project stalls in development and token prices drop after the ICO. No one likes to be promised an increase of their investment just to have it lose 50% of its value in a matter of days. This isn’t necessarily a sign of a scam, as good teams can genuinely misjudge their roadmaps and their projects value. Actual scams will of course massively overpromise, as they will look to woo in naïve and easily impressed people. They will take as much money as possible and run away with it just when people start figuring out their real intentions.

Ultimately, an ICO will be successful only of the token achieves mass adoption. Most projects make it a rule to point out that their tokens aren’t securities and that they don’t offer any stake in the company that launched them. This means that a company could enjoy massive financial success while the token stays underwater.

There are many other signs that imply you are dealing with a fraudulent ICO:

- Generalized claims, guarantees and use of buzz-terms like “our project is changing the world” or “your investment will be increased x-fold” that don’t have backing in real world

- Massive bonuses for early investors

- Shady looking whitepaper filled with copy-pasted or flat-out false material

- Website and documents written in bad English (not necessarily a sign of a scam, as many foreign projects struggle with English)

- Lack of information about the company, the team and financial backers behind the project

- Lack of social media presence and communication with investors

- No real reason for establishing the token economy

- Positive media coverage from people known for promoting scams

- Evidence of market manipulation and insider trading

- Negative press from government agencies, independent supervisors and cryptocurrency experts

During the last year and a half we have heard stories about many ICO’s that scammed their investors. Pincoin and iFan were horrendously ran from the beginning and ended up being exposed as multi-level marketing scams in the end. However they still managed to fool around 32 thousand people and collect over 660 million dollars, which is believed to be the biggest scam in ICO history.

Bitconnect is a recent MLM scheme that launched in January of 2017 and collected millions of dollars from its investors. The scam fell apart when SEC and similar government institutions around the world shut down its operations. All that the market was left with were worthless bags of BCC tokens and some quite hilarious memes related to Carlos Matos, the project’s most famous promoter.

BITCONEEEEEEEEEECT

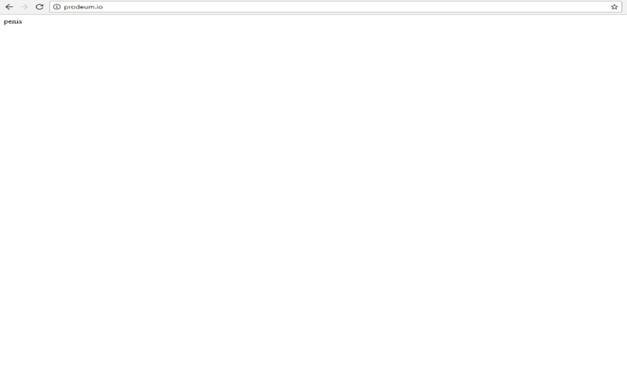

One of the more silly ICO scams was an Ethereum start-up called Prodeum. Upon launching their ICO, they managed to collect a massive sum of 11 dollars before twitter exposed their team members pictures as being fake. The scam organizers simply paid people on fiverr to pretend they are Prodeum developers/investors and expected no one would notice. However people did notice on time and once the scammers realized the jig was up, Prodeum website disappeared and the homepage was replaced with a short but clear message.

The project name was a clear indicator of things to come

Prodeum was the second Ethereum-related scam and came right after a somewhat more sinister one, named Confido, took off with around 374 thousand dollars.

To finish off the ICO segment I can’t pass to mention the most recent “scam” that has left the crypto world in bewilderment. A German cryptocurrency startup called Savedroid vanished from the web on April 18th, leaving behind a “South Park” meme which said: “Aannnd it’s gone.”

The meme that was left on the Savedroid’s website

Just moments later the company’s CEO, Yassin Hankir, posted a tweet of himself holding a beer on a beach with the words “Thanks guys! Over and out…” underneath.

Just a day later, at the moment when most Savedroid investors were probably figuring out the most painless ways of committing a suicide, in a bizarre turn of events Savedroid and its founder came out with an announcement that the project in fact wasn’t gone. The entire thing was apparently a PR stunt that was designed to raise awareness about fraudulent ICO’s that are rampant in the crypto community. Needless to say, the market didn’t take too kindly to such behavior and the project and its team got trashed all over the social media. It remains to be seen what comes next for Savedroid but some rough times are definitely expected in near future.

These ICO’s have done nothing but given a bad name to the entire industry. They ride the crypto wave and once they bail out, the entire community is affected and smeared. The crypto skeptics are given ammunition to fuel their skepticism and authorities are motivated to clamp down harder on the markets. As these examples show, scammers will find ways to sell an ICO and trick people into buying in. The best way of avoiding them is to do your research and watch out for red flags before investing.

Ponzi schemes

It is a good idea to dedicate a section of the article to expand on what exactly are multi-level-marketing schemes, as they have been around for quite some time and were once rampant in the non-crypto markets as well. Most of them utilize the same scamming principles and shockingly enough, people keep falling for them over and over.

MLM or Ponzi schemes got their name for Charles Ponzi, a man famous for duping thousands of Americans into investing in a postage stamp related scheme in the 1920’s. These schemes are a staple of new and unregulated markets, making the crypto world perfect for them to flourish. A Ponzi scheme usually follows the same development path:

- An investment scheme offers unusually high payouts to new investors

- These investors are encouraged to spread the word and get new investors to buy in

- With an MLM, the payouts are a result of new investments coming in, meaning that old investors get paid what they were promised thanks to new investors

- Every investor is given a referral link

- If a new investor registers over this link, the old investor gets paid a fraction of the new investment

- Older investors start earning more and more as new people keep pouring in through their referrals

- New investors see these earnings and start FOMOing in

- Ultimately the influx of new investors slows down

- The scheme collapses at this moment, as there is no new money for future payouts

- The oldest investors run away with the remaining money while the newest ones remain holding bags of nothing

Ponzi schemes are relatively easy to spot. Unusually high rates of payouts, promises of insane growth on your investment, lack of registration with proper financial supervisors, lack of information on the team, unusually high motivations for getting new people in are just some of the most common MLM symptoms.

While the returns a Ponzi promises can be very tempting it is best to stay the hell away from such arrangements. Some people think they can push their luck but the issue is that one can never tell if the scheme is nearing the breaking point. Usually, when the scheme reaches the public eye, the government will swoop in to see what this new suspicious thing that promises a ROI of 40% per month is. This is when the cease and desist orders will start falling, the organizers will disappear and the token holders will start regretting their investments.

Pump and dumps

Pump and dump groups are also a staple of the regular markets that has swooped in to exploit the unregulated crypto markets as well. A pump and dump group organizes price pumps and dumps on certain tokens, designed to fool outside investors to FOMO in and buy high, expecting the price to keep rising.

A pump and dump scam usually functions in the following way:

- The group is founded on Facebook, Telegram, Discord or some other popular chat application

- It can be joined for free or for a certain payment

- Coins which will be pumped are either voted on or chosen by the group leader

- A date of the pump, its duration and the dump target are set

- Once the pump begins, group members start buying the token at the low price

- A sudden rise in demand causes the price to go up

- People that aren’t in the group notice the rise and start buying in themselves, further raising the price

- At the dump target, the group members instantly sell off their holdings, causing the price to plummet due to a sudden increase in supply

- The group members profit, leaving the people who FOMOed in to hold their low-value bags

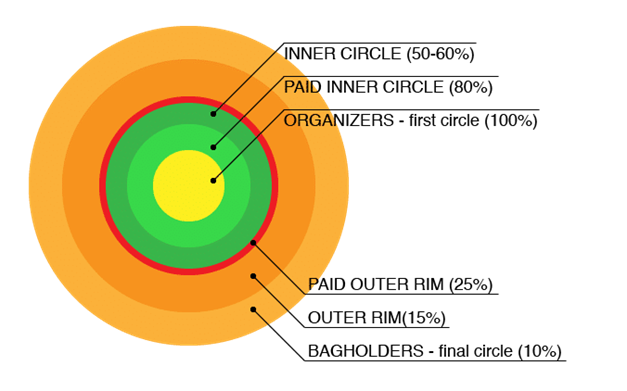

Pump and dump groups, while promising excellent profits to its members, are most likely going to take advantage of them. Group leaders and insiders usually pre-buy and pre-pump the tokens, leaving the outer circle of users to either pick up crypto crumbs or flat out lose money if the insiders start dumping before the “official” target.

It is highly recommended that you never join a group like this, as you will either get conned or will end up performing some rather unethical actions for miniscule gains. Heavy government regulation is about to drop down on such groups, so there is that to consider as well.

Exchanges

Exchanges are the life-line of the crypto markets, as they provide a platform which people can use to meet and trade their cryptocurrencies on. However, they do come with some issues and can at times have very malicious intents.

Exchanges have an issue of being centralized, which exposes them to potential hacks. Malicious players can take advantage of this and gain access to the inner exchange operations. Once they do so, the funds will start disappearing. When assessing an exchange, be mindful of their management practices and potential gaps in security (like a lack of cold storage wallets or 2-step authentication measures). Everyone remembers the DAO failure or the most famous exchange collapse that happened with Mt. Gox. If anything, these failures are a testament that it is never a good idea to keep your funds on an exchange wallet as you are just one hack away from losing them forever.

Another important thing to consider are intentionally malicious exchanges. We have seen numerous exchanges springing up overnight and swooping in on the market with aggressive promotion tactics like giveaways or ads, just to disappear a month later with all the money that investors left on their wallets. 01crypto, Btc-cap, Capital-coins, Coinquick, Cryptavenir, Crypto-banque, Crypto-infos, Cryptos.solutions, Cryptos-currency, Ether-invest are among many confirmed scams that polluted the crypto markets.

The best strategy to stay safe when it comes to exchanges is to use the widely accepted ones that have a history of quality service. Sometimes it’s hard to do so, especially if you notice a good coin that has a lot of potential but is being traded on a suspicious exchange. Usually this should divert you from the coin itself but if you are hell-bent on purchasing it, the best option is to keep your funds for as short as possible on the exchange wallet.

Wallets

Cryptocurrency wallets are meant to store your cryptocurrency and keep it safe from hackers and thieves. Most of the time they will perform this service admirably. However, sometimes there is a malicious intent behind a wallet and this can endanger your funds.

The internet is chock full of fake wallets that are looking to catch newcomers off guard and snatch their hard earned cryptocurrency. Picking random wallets as the keepers of your funds is never a good idea. Most of the times these fake wallets promise you’re the wallet seed and control of your private funds. However, this seed will either be fake or there will be a backdoor installed by the wallet creator which allows him to swoop in and steal your funds. This scam has claimed many victims, especially around launches of cryptocurrency hard forks.

It is usually a good practice to download the industry standard wallets like Electrum or to use trusted web wallets like MyEtherWallet to store your cryptocurrency. If you are planning to claim tokens off a hard fork, it is a good idea to check if the fork is supported by the community. If it is, there is usually an official wallet platform that will help you collect your forked coins easily.

Paid promotion

Anyone who wants to become a part of the crypto community has at some point looked up what some popular crypto figures think about a coin. From McAffee over Buterin to the average Joe that has a couple of Twitter followers, everyone likes expressing their thoughts on new projects and tokens. What most people aren’t aware of is that sometimes projects pay good money to these people to promote their product. Some laws require that paid promotion is clearly disclosed but they are still in the early phases of their implementation.

More often than not people with decent social media followings will contact new projects directly and offer their promotional services. Most crypto projects are very “bullish” on hype and can experience massive price spikes as a result of proper people calling them out. This means that crypto projects themselves will seek out influential people and pay them to have their projects promoted. Therefore it is best to not listen to people who blankly praise new tokens. Bitconnect had plenty of paid promoters who have since went underground or are waiting for their trials. If anything, seek advice from people who make it a point to never do paid promotions. Ultimately it is best if you do your own research and determine for yourself if a project has enough potential to warrant your investment.

Phishing attacks

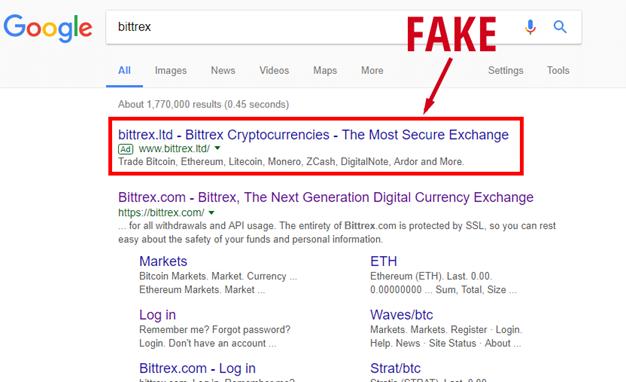

Phishing attacks are very common. Phisher will purchase an internet domain which spells out similarly to a popular crypto service.

For example, he will purchase the bittrex dot ltd domain. Then he will launch a bogus website that will imitate the original Bittrex website. They will then put out ads to promote their bogus website. As Google tends to put ads in the first place of your searches, an unaware user will click on the first link without realizing that the link is fake. Once the page loads, the interface will look like the original Bittrex interface. The fake website will offer you a chance to enter your login data, and once you do so, it will direct you to the official Bittrex website. Most people won’t be aware of what happened and will feel like the Bittrex website has simply glitched. What they don’t know is that the fake website has logged their user name and their password and that their funds are in danger.

To prevent falling victim to this scam, make sure to always visit the proper crypto-related links. Type in the entire URL or bookmark it if necessary. Finally, have some type of 2-factor authentication enabled.

In conclusion…

There isn’t a clear way of staying completely safe in the crypto world. Slip-ups can happen and your money can end up in the hands of malicious people. The best course of action is to promote digital, financial education and ethical investment practices. Relying on government regulation is a decent crutch but too much regulation can stifle market innovation and growth. Educating yourself is the most effective way of protecting yourself and your money. Learn how to evaluate projects and spot red flags commonly associated with scams. Ultimately you will need to trust your intuition and make the investment decision yourself. A good rule of thumb to follow says: If it looks like a scam, walks like a scam and quacks like a scam, it is almost definitely a scam.