As the crypto markets enter a period of heightened uncertainty, traders closely monitor key developments across major protocols and DeFi disruptors to identify emerging opportunities.

According to crypto analyst Miles Deutscher, this choppy environment allows long-term focused investors to treat sizeable pullbacks in quality assets as gifting buying chances.

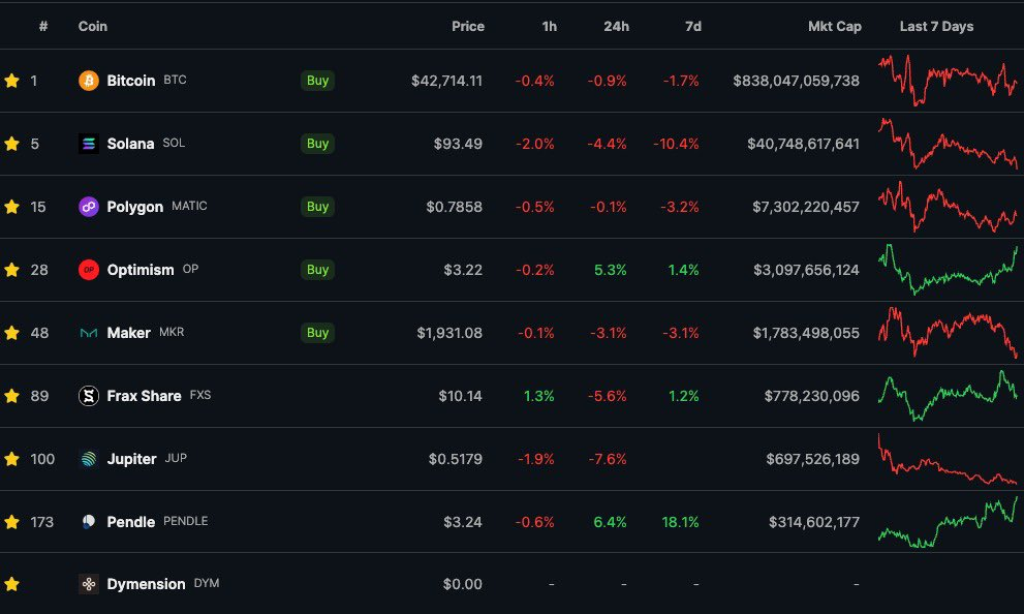

In his latest weekly watchlist report, Miles outlines the most compelling blockchain narratives and token catalysts he has his eye on during this volatility. Let’s examine some highlights.

What you'll learn 👉

Bitcoin (BTC)

Genesis Trading intends to sell $1.4 billion worth of GBTC, which has fueled GBTC outflows over the past 2-3 weeks. Miles is watching to see if the latest Genesis flows will impact market sentiment around Bitcoin.

Pendle (PENDLE)

Pendle continues trending higher, combining multiple DeFi narratives like liquid staking, RWAs, and yield farming. With Pendle’s TVL hitting all-time highs, Miles views any pullbacks as buying opportunities.

Jupiter (JUP)

The 7-day token sale period for Jupiter’s team is nearly over. With the FUD subsiding, Miles believes $JUP has likely found a price floor. Jupiter’s CEO hinted at future airdrops for stakers, adding upside potential.

Solana (SOL)

Despite Solana’s outage, rumors speculate that more airdrops are coming soon. Miles sees any retests of $80 as buying opportunities for SOL.

Optimism (OP)

As solutions emerge following Solana’s outage, interest increases around Ethereum competitors like Optimistic Rollups. Alongside momentum across Ethereum Layer 2s, Optimism also benefits from potential airdrops and upgrades soon.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Polygon (MATIC)

Polygon’s token rebrand this month could lift sentiment. Meanwhile, the next significant upgrade of Polygon’s zkEVM scaling solution is nearing launch. With the MATIC/BTC pair appearing bottomed, Miles is closely watching.

Frax Share (FXS)

Frax Share could see a speculative boost around Frax’s rumored new L2 chain, Fraxtal, launching Wednesday. Airdrops to $FXS stakers may also spark interest.

Maker (MKR)

At the key $2,000 level, discussions build around Maker’s potential token rebrand and split. Upcoming DeFi app launches could also increase lending demand and thus Maker’s revenue.

Dymension (DYM)

As Dymension’s token goes live soon, Miles notes fractals suggest an initial listing pump, slight retracement, and continuation higher are common among new token projects.

In conclusion, while bearish sentiment permeates more speculative corners of crypto amidst this bout of directionless ranging, Miles remains attuned to the market leaders exhibiting continued strength.

You may also be interested in:

- Cardano’s ADA Can ‘Easily’ Hit $5 Says Top Crypto Analyst – Here’s When

- Why is Monero’s XMR Token Price Crashing?

- Twitch Gets Nervous as DeeStream (DST) Platform Sees Huge Investment from Avalanche (AVAX) & Chainlink (LINK) Investors.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.