Chainlink’s native LINK token continues to power to new recovery peaks, now trading around $19. According to multiple expert perspectives, the momentum surge may presage a steep continuation towards ambitious upside targets.

What you'll learn 👉

Supply Wall Must Get Cleared

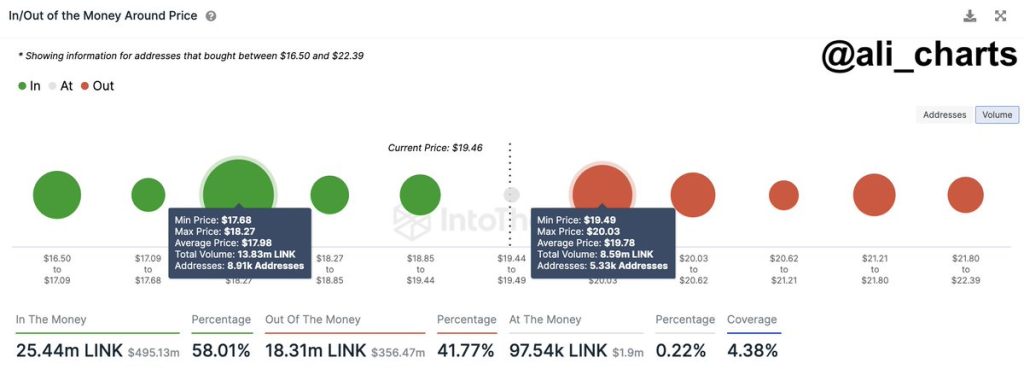

Crypto trader Ali highlights major supply resistance between $19.40 and $20.03 from over 5,330 addresses holding 8.59 million LINK. Breaking this barrier opens up upsides towards $26.87 (38% increase).

Analyst Rekt Capital asserts LINK is successfully breaking out of its consolidation range. Any short-term dips are likely to be bought for continued upside rather than reversing the confirmed breakout.

Low-Risk Rally Favors Sustainability

Upside-Down Crypto Data notes that the rally emerged from relatively low risk levels historically. These conditions tend to spur sustained legs higher, especially when surging to new YTD highs.

Trader CryptoHotep sees $19.50 proving support for LINK’s next “leg up” on any pullbacks. But $17.50 and levels below remain crucial to avoid negating bullish momentum.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Institutions Stealthily Accumulating

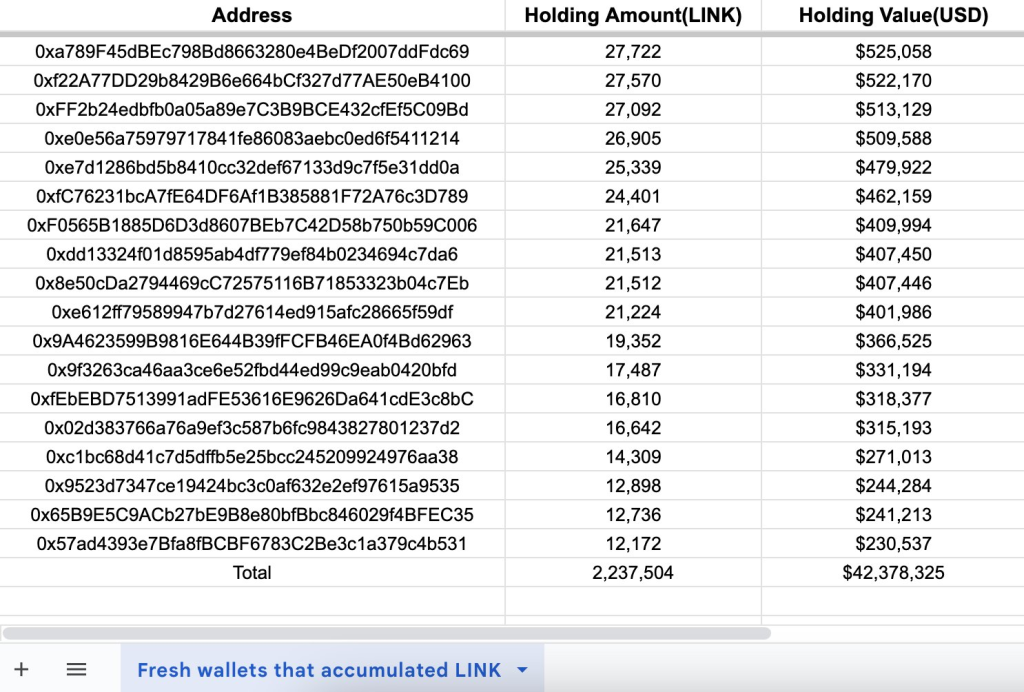

According to Lookonchain, a mysterious whale/institution is accumulating LINK, with over $42 million withdrawn from Binance lately into newly created wallets. This signals significant conviction around current prices. A total of 47 fresh wallets withdrew 2,237,504 LINK.

So in essence, LINK appears perfectly positioned technically and fundamentally for additional parabolic upside. The surging adoption of its cross-chain oracles matches elegantly with historical analysis favoring sharp rallies after low-risk breakouts.

Yet LINK must still overcome short-term limitations around the supply wall. While risks endure amid the tentative environment, LINK continues to assert itself as an outlier bucking bearish trends, making it an extremely attractive opportunity around current bargain levels.

You may also be interested in:

- Why is Arcblock Price Up By 140%? Analyst Warns ABT Investors Of This Metric

- Why Ronin’s Price Tumbled After a Major Exchange’s Listing Mix-Up: Will the RON Listing Lead to a Rebound?

- Presale grows and grows – Ripple (XRP) & BNB (BNB) holders continue the bull run in Pushd (PUSHD) presale as 2024 shows big rewards

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.