Chainlink’s 200% year-to-date price explosion has been nothing short of staggering. However, multiple on-chain and technical indicators now point to LINK being overextended and due for a cooldown.

What you'll learn 👉

Whale Rebalancing On-Chain Liquidity

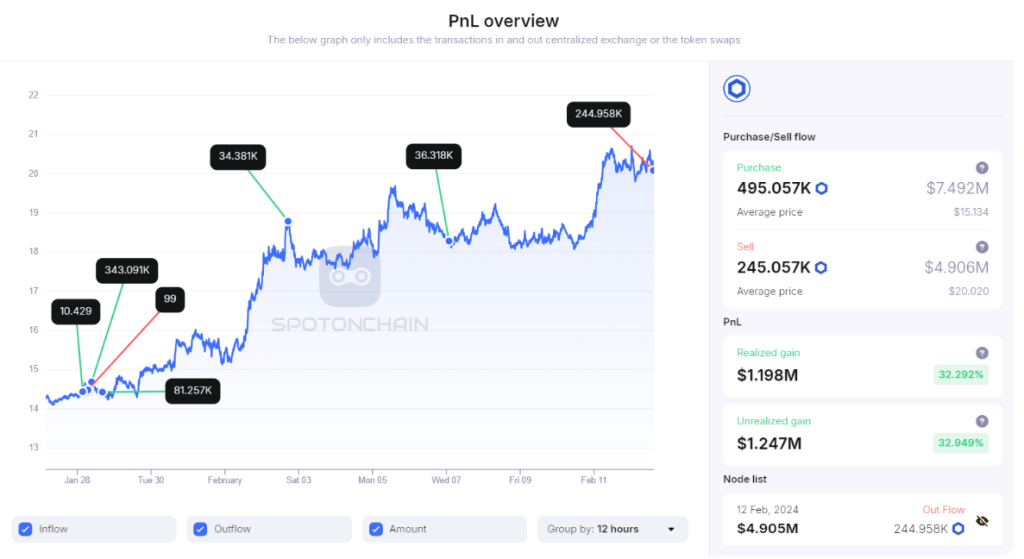

According to analysts SpotOnChain, a whale wallet labeled “0x2a1” shifted 245k LINK worth $4.9 million back onto Binance. Between January 28th and February 7th, this entity withdrew a total of $7.5 million worth of LINK from the exchange at $15.13 per token on average.

With LINK reaching highs of $20.8 over recent days, this whale is now sitting on an estimated 35% profit of $2.5 million. The intention seems to be to lock in gains as on-chain analytics tools track the movement.

Notably, even after depositing back to Binance, this wallet would still hold 250k LINK valued at around $5 million, indicating a long-term conviction. Still, redistributing tokens likely signals a reduced appetite at current prices.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Daily RSI Screams Overbought

Analyzing LINK’s daily price chart, the relative strength index (RSI) currently sits at 69 after hitting 71. An RSI reading over 70 typically suggests an asset is overbought in the short term and due for a pullback.

Traders tend to cool off profit-taking above 75 RSI, but we’re likely not far away from witnessing selling pressure kick in. The next couple days may see traders rattled by shrinking open profits and portfolio rebalancing like the whale above.

Facing Repeated Rejection at Crucial Resistance

Zooming into the price action, LINK managed to hit highs of $20.82 before rapidly plunging 5% back to the $20 level. This highlights the strength of resistance around $21, which LINK attempted to break past multiple times recently without success.

With the altcoin rally charging forward, LINK finds itself an outlier – down almost 1% over the past 24 hours. This relative weakness adds credence to the technical evidence pointing to an overheated token.

In conclusion, given the confluence of signals identified on and off the blockchain, traders must prepare for an imminent pullback in LINK’s parabolic uptrend over the coming days. Savvy traders can look to time entries during temporary dips by keeping a close eye on whale movements and RSI support levels.

You may also be interested in:

- Dogecoin On Chain Activity Raises Questions But Expert Predicts ‘Upward Rally’ for DOGE

- Why is QuickSwap (QUICK) Price Pumping?

- DeeStream (DST), Binance Coin (BNB), and Solana (SOL) make gains but why is new streaming presale stealing the headlines?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.