The widely followed crypto strategist Benjamin Cowen cautions his 787,000 YouTube subscribers that Cardano (ADA) seems poised to break below a key support level on the weekly chart. Cardano has repeatedly retested this level since December 2022, which tends to weaken support as buyers become exhausted.

Cowen states, “It’s hard to imagine that it [Cardano] will just stay here [above the $0.240 support level] for the rest of the year and not make a decisive move. I think there will be a decisive move before the end of the year. I think it’s going to be down.”

According to the prominent crypto analyst, Cardano will likely plunge due to decreasing net liquidity. Cowen demonstrates how ADA basically mirrors the rise and fall of global net liquidity.

“ADA, it’s just basically tracking net liquidity here… So to me, it should not really be that surprising that altcoins are performing in this way because net liquidity is going down,” explains Cowen.

He defines net liquidity as the combined balance sheets of central banks including the US, Canada, Europe, UK, China, Japan, Australia, and New Zealand, subtracting out the Treasury General Account and reverse repo.

Benjamin Cowen believes the crypto market will soon reveal whether bearish or bullish predictions are correct this year. “We should know the outcome of this sooner rather than later right whether the Bears are right whether the Bulls are right we should know the outcome likely this year,” he says.

Cowen predicts, “Eventually, when liquidity comes back, you might expect altcoins to sort of mean revert back up higher. And that’s where those oversized gains that a lot of people are looking for come from. Unfortunately, they do not come oftentimes in the pre-halving year. The altcoin market just simply gets wrecked. So when you go look at ADA/USD, we have to be just reminded of the fact that it really is a function of excess liquidity.”

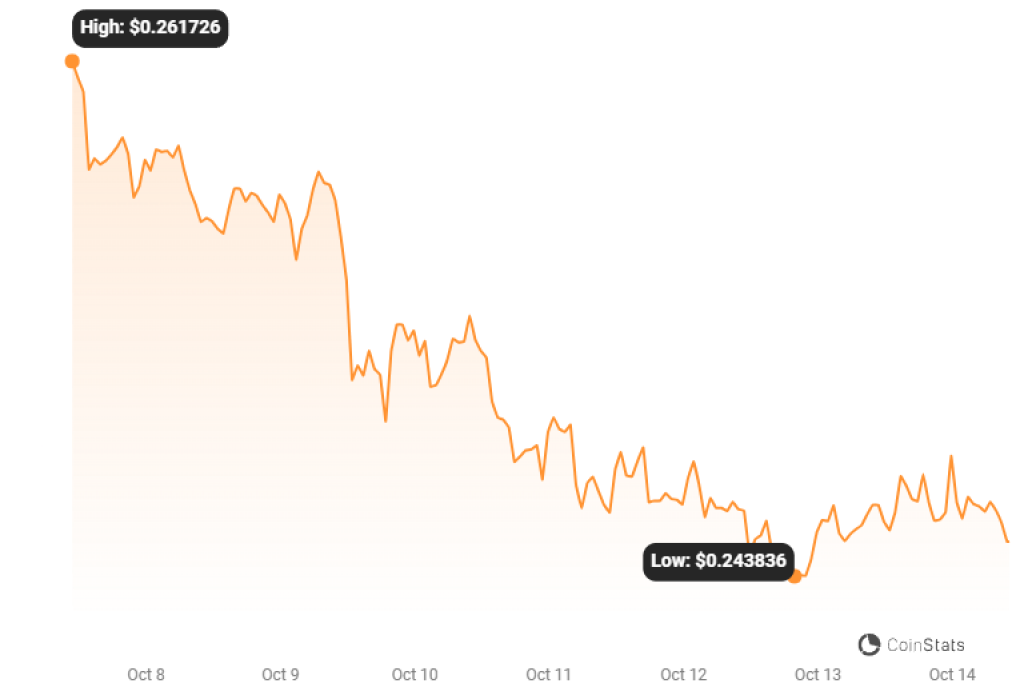

ADA is trading at $0.246 currently.

In summary, the crypto analyst believes Cardano will likely see a steep drop soon due to decreasing global liquidity, but could surge again when liquidity returns to the market.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.