The cryptocurrency market has been on a rollercoaster ride recently, with Bitcoin (BTC) hitting a new all-time high before plunging to $59,000 within a matter of hours. This volatility has had a ripple effect on altcoins, with two prominent projects, Cardano (ADA) and Polkadot (DOT), experiencing significant price drops over the past 24 hours.

What you'll learn 👉

Cardano (ADA) Falls 8.2%

Cardano, the smart contract platform founded by Charles Hoskinson, has seen its native token, ADA, drop by 8.2% in the last 24 hours. ADA is currently trading at $0.7156, down from its 24-hour high of $0.7791.

The recent price drop can be attributed to several factors, including a breakdown of the ascending channel pattern that ADA has been following. As the price broke below the channel’s support, it triggered a sell-off, exacerbated by the overall market volatility caused by Bitcoin’s sharp decline from its all-time high.

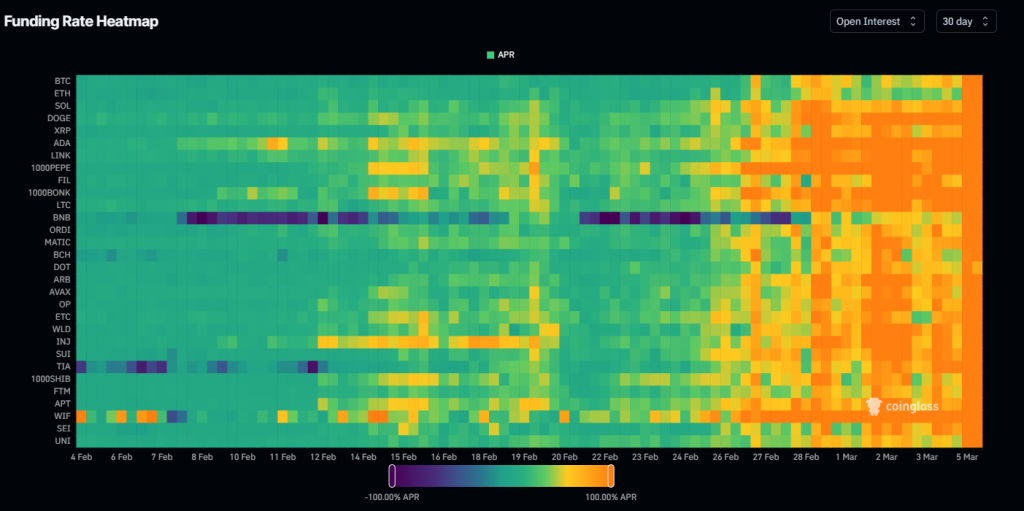

Moreover, data from Coinglass reveals that funding rates for ADA have been at elevated levels for the past few days, indicating an overheated market. The recent price drop has led to a reset in funding rates, which could help stabilize the market in the short term.

Polkadot (DOT) Mirrors Cardano’s Decline

Polkadot, the multi-chain ecosystem founded by Ethereum co-founder Gavin Wood, has experienced a similar fate to Cardano. DOT, the native token of the Polkadot network, is currently trading at $9.89, representing a 5.3% drop in value over the past 24 hours. DOT’s 24-hour high stands at $10.55.

Like Cardano, Polkadot’s price action had been following an ascending channel pattern before the recent market turbulence. The breakdown of this pattern, combined with Bitcoin’s sharp decline, has led to a significant sell-off in DOT.

Coinglass data also shows that funding rates for DOT have been at higher levels in recent days, suggesting an overheated market. The current price drop and funding reset could help cool down the market and provide a more stable foundation for future growth.

Bitcoin’s Volatility Impacts Altcoin Market

The recent price drops experienced by Cardano and Polkadot can be largely attributed to the overall market volatility caused by Bitcoin’s sharp decline from its all-time high. As the world’s largest cryptocurrency by market capitalization, Bitcoin’s price movements often have a significant impact on the entire crypto market.

In addition to the impact of Bitcoin’s volatility, the recent price drops in Cardano and Polkadot can also be attributed to profit-taking and consolidation. As both projects had experienced significant gains in recent weeks, some investors may have decided to lock in profits, leading to increased selling pressure.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Moreover, the market may be undergoing a period of consolidation following the recent bullish run. This consolidation phase could help establish a new support level for ADA and DOT, providing a foundation for future price appreciation.

As the cryptocurrency market continues to mature and evolve, investors should remain vigilant and prepared for periods of volatility. By understanding the underlying factors driving price movements, such as market sentiment, technical patterns, and funding rates, investors can make more informed decisions and navigate the complex world of digital assets more effectively.

You may also be interested in:

- Top 7 Token Unlocks to Watch This Week: Ethereum Name Service(ENS), Near Protocol (NEAR), and More

- Theta Network’s (THETA) Price Rallies: Expert Highlights Potential Retest Level, But There’s a Catch

- Advertising Potential Propels DeeStream (DST) Presale As 100X Rumours Circulate Post Binance Coin (BNB) & Cardano (ADA) Whales Buy-In

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.