Rekt Capital’s latest newsletter discusses the Blur token and Pepe meme coin. The analyst uncovers what is going on with their prices and their future potential.

Based on the analysis, BLUR is in the process of retesting the top of a historical demand zone as new support after deviating from that level some weeks ago.

If there is a weekly close above the red box, which is around $0.17 and $0.18, it confirms a successful retest. This could then spark a move to the descending trendline for a chance to make a decisive breakout.

This downtrend has plagued BLUR price since late February, and so a breakout beyond the downtrend would enable a multi-month uptrend, with the blue level at $0.34 likely being the first major resistance in the new trend.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +For this to be further supported, we need to see Blur close above $0.17 at the monthly timeframe. This would mean that historical monthly support has continued to act as support, and this could trigger a lot of buying that could push the price up.

PEPE Meme Coin Must Reclaim the Critical Level

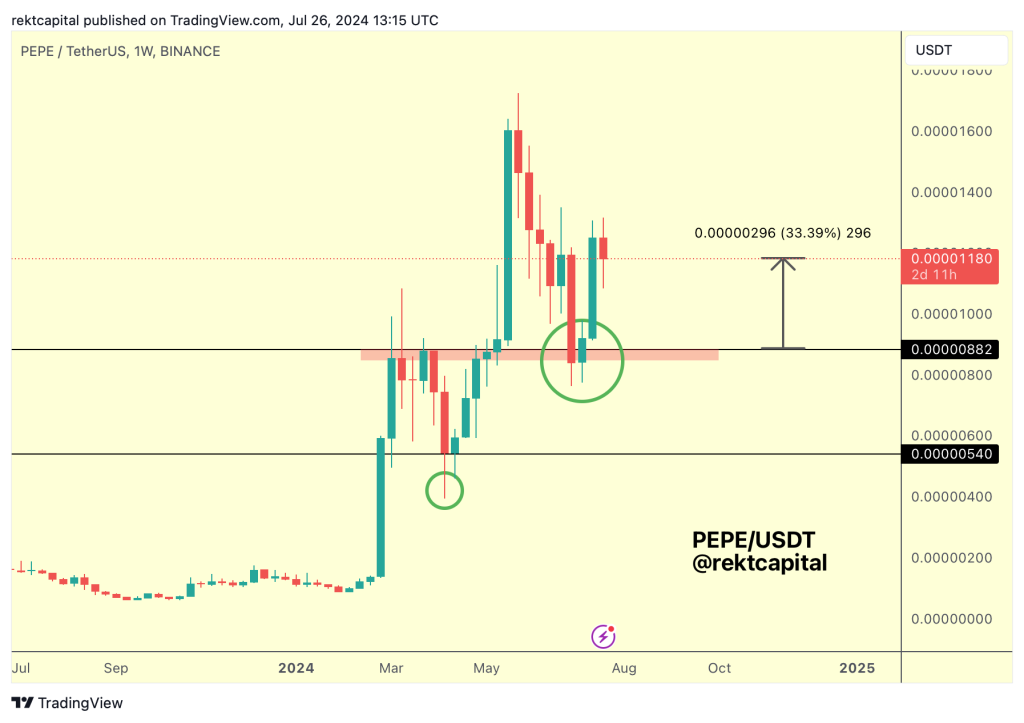

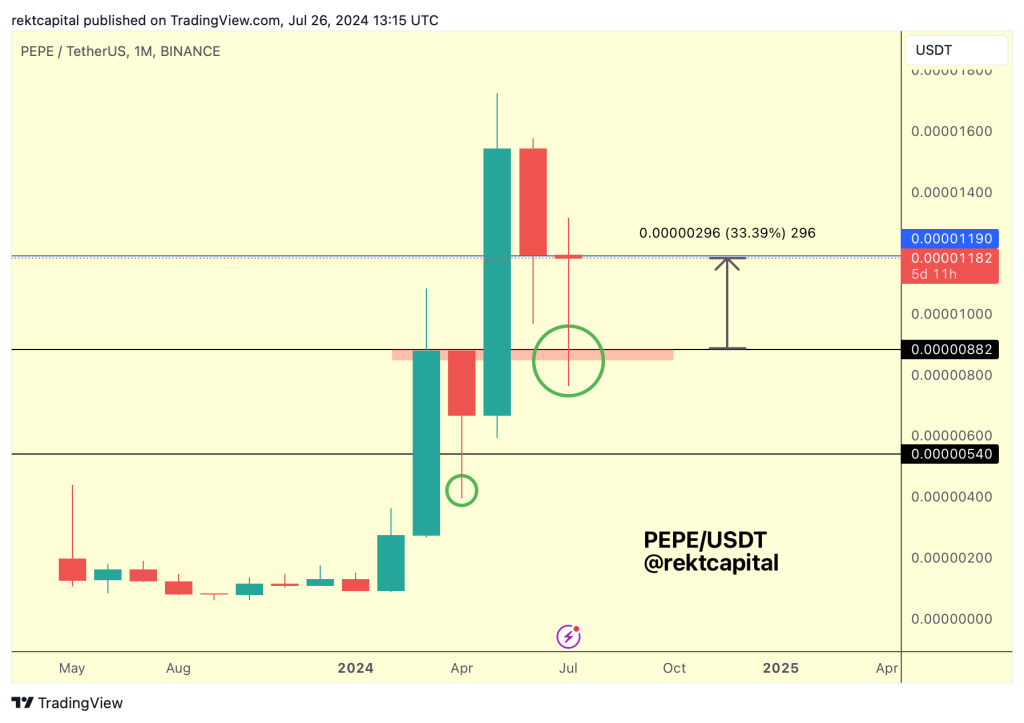

The newsletter covered PEPE analysis in late May. The analyst was anticipating a retrace and expecting a retest of its post-breakout range:

Almost two months later, PEPE pulled back to retest the top of that post-breakout range as new support. This points to a successful retest, followed by a more than 30% rally.

Read Also: THORchain (RUNE) Price Analysis: No ‘New Low’ Expected; BONK Meme Coin May Resume 2x Rally Next Week

Now, with the monthly close just around the corner, here is what PEPE needs to do to continue building on its newfound bullish momentum:

The recent price support that formed a bottom is also reflected in the monthly timeframe. Thus, PEPE needs to close on the monthly timeframe above the blue resistance level of around $0.00001190, which represents last month’s price low.

A monthly close like this would mean that PEPE meme coin may be ready to form a base at the June lows, despite July’s downside wicking deviation, which could then improve PEPE’s chances of revisiting the orange highs over time.

In short, if PEPE Monthly Closes above the blue level, it would likely establish a range between the blue and orange levels.

Of course, PEPE has shown that downside volatility below the blue level could still occur, but the candlebody itself must close above the blue level.

Price closing below the blue level may not necessarily be bearish for the meme coin if the price reclaims the blue level in early August and turns it into support. If not we can expect another drop into the red box region in the chart, a more than 30% dip.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.