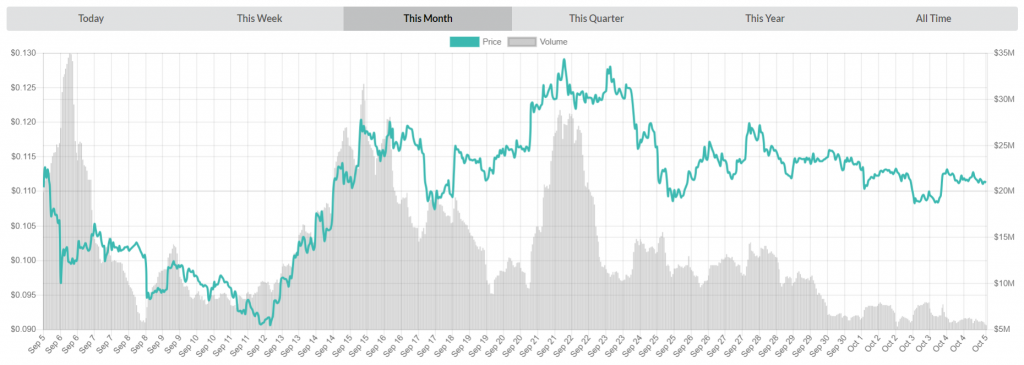

BitShares price action has been somewhat wild throughout the past month. After reaching $0.1134 on September 5th, the currency dropped sharply with some high daily trade volume (reached $34,949,159 on 6th) and reached a monthly low of $0.0905 on September 12th. BitShares bounced with intention from this low, going on a run which would eventually end with the price of $0.1290 and bring the trade volumes back to $30 million. Ever since, the currency has seemingly entered a slow and bloody downturn which led it to its today’s values.

Furba gives a short overview of the currency’s technicals:

“BitShares is at the end of the triangle. Considering the long history of the project and also the fact that it one of the highly rated blockchains by Chinese ranking, 300% returns Bitcoin-wise against 50% loss risk may be not that a bad trade.“

Check out his graphical presentation here.

Bitshares project publishes a weekly report blog titled Bitshares State of the Network (BSotN) report. As the blog publishers explain, “The Bitshares State of the Network Reports seeks to combine raw data from a wide range of metrics and combine them into meaningful information to identify emerging trends and changes in the Bitshares network.” The latest rendition of this publication was 103rd in a row.

Among the observations made, one thing stands out. BitShares for payments got a big update with PalmPay being built on the BitShares blockchain and available in the Google Play Store. The app uses BitShares bitAssets like bitUSD to provide various merchants (retail, café/bars, restaurants, gas stations, grocery, delivery etc.) to accept payments in almost any digital currency available on the market. PalmPay recently saw a v1.3 update released, which includes street-value currency API’s, redundancy features, network efficiencies and additional input coins. You can read more about this update and other project-related observations here.

?What does HODL mean?

Bitshares token holders were recently greeted with some negative news regarding the liquidity of their holdings. Bittrex, one of the biggest cryptocurrency exchanges on the market, confirmed that it intends to remove BTS token from its trading platform, alongside Bitcoin Gold and Bitcoin Private. Bittrex claims that there simply isn’t enough demand for the currency on the market at the moment. Judging by that, Bittrex clearly feels that their resources could be spent more effectively by hosting some other, more liquid currencies.

BitShares hasn’t really been showing many signs of growth lately and Bittrex decision seems understandable. The expected delisting will happen on November 5th but data indicates that Bittrex already suspended BTS trading. BitShares holders are advised to move their bags from the Bittrex platform by that date; otherwise they won’t be able to recover them ever again.

Overall it’s been a mixed bag for the BitShares project. We saw some positive and some negative news regarding this tokens liquidity. While the naysayers claim the currency doesn’t have enough liquidity or demand, the defenders claim this is propaganda by centralized exchanges and list the fact that several DEX protocols are using BitShares as their underlying protocol.

BitShares is the underlying blockchain that enables all these exchanges. @OpenLedgerDEX @rudex_bitshares @SparkDEXdotio @CryptoBridge @EasyDexOfficial @TheGDEX @deex_exchange @EscodexOfficial @XBTS_EXCHANGE @eubxio @winex20 @hellobtscom

— BitShares (@bitshares) September 19, 2018

The situation is strange but the latest Bittrex delisting definitely won’t help. We’ll just have to wait and see how the project recovers from that.