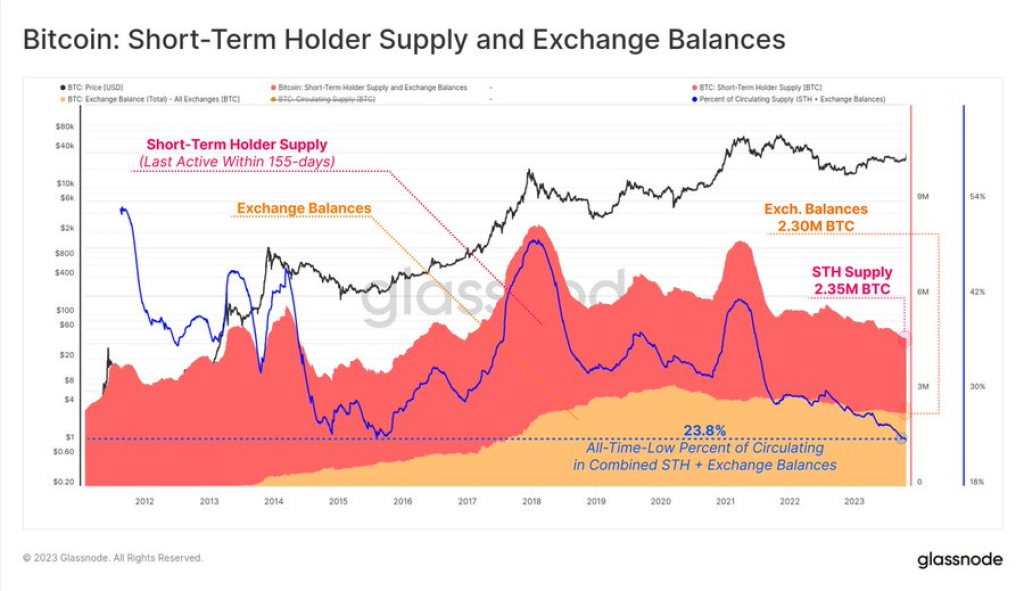

According to a recent post by crypto analyst @moonoverlord, the supply of Bitcoin across all exchanges has hit an all-time low. This scarce supply, combined with impending demand drivers, could catalyze a dramatic surge in Bitcoin prices.

What you'll learn 👉

Impending Bitcoin Spot ETF Approval

The pending approval of a Bitcoin spot ETF by the SEC could drive increased demand for actual Bitcoin to back the ETF shares. As @moonoverlord explains: “If firms like Ishares and Ark Invest buy $1M of Bitcoin from their elected exchange which is Coinbase, they need actual $BTC to back the ETF shares.” With Bitcoin supplies on exchanges at extreme lows, this new demand could lead buyers to pay higher prices to acquire the scarce asset.

Upcoming Bitcoin Halving Further Constraining Supply

The Bitcoin halving, which occurs approximately every 4 years, will take place in just 157 days. @moonoverlord notes that historically, Bitcoin prices have surged dramatically in the 12 months following each halving event: +7,745% in 2013, +460% in 2017, +670% in 2021

With the market already anticipating the typical post-halving price pump, dwindling exchange supplies could exaggerate the move.

Read also:

- Why QUBIC’s 10,000% Explosion Outperformed Even Solana’s Meteoric Rise

- Why is PIVX Coin Pumping? Here Are Reasons Behind the 160% Pump

- Can the Cronos Rollercoaster Soar to $1.00? After Raising $1.5M, Is This the Next Top 100 Crypto?

Retail Investors Incited to Act

In light of these impending supply and demand dynamics, @moonoverlord ends with a call-to-action for retail investors: “So now, will you sell your Bitcoin to the whales or #HODL it for generational wealth?” With exchange supplies drying up, holders refusing to sell could exacerbate the impending supply squeeze.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.