The crypto markets are seeing some turbulence this weekend, with Bitcoin and most major altcoins down around 4-6% over the last 24 hours. Bitcoin briefly dipped below $42,000 on Friday night before recovering back above $43,000 on Saturday morning. Nevertheless, the world’s largest cryptocurrency by market cap is still down around 6% for the week so far.

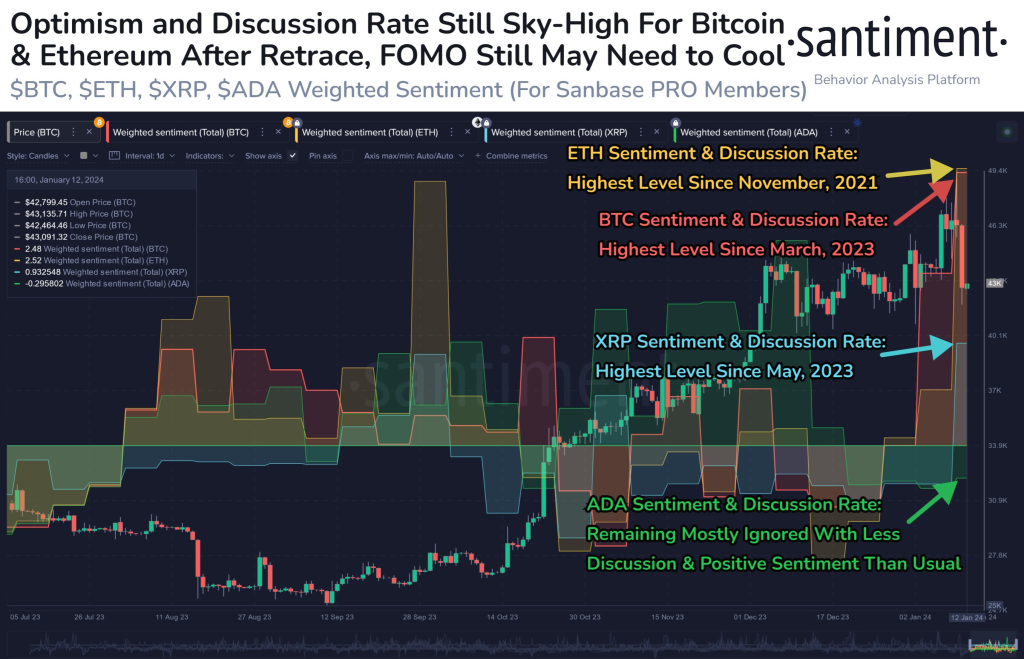

According to the latest analysis from on-chain analytics firm Santiment, trader sentiment remains quite bullish towards many top market cap cryptoassets, likely due to the recent excitement around the SEC approving Bitcoin futures ETFs. Santiment noted particularly high optimism towards Ethereum and XRP at the moment.

“As the weekend has kicked off, sentiment toward top cap assets remain at extremely optimistic levels with spotlights on them following the #ETF approvals. Traders are particularly #bullish toward #Ethereum after its market value climbed above $2,700 for the first time since May, 2022. There is also a notable #bull bias toward #Bitcoin and #XRPNetwork. While traders are discussing the possibility of $ETH or $XRP#ETFApproval possibilities, #Cardano is overlooked compared to its normal level of trader optimism.” noted Santiment.

Ethereum crossed back above $2,700 this past week for the first time since the May 2022 crash, sparking speculation that an Ethereum ETF may also be on the horizon. If approved, this could further boost interest and prices for the second largest cryptocurrency. XRP has also been rallying hard, leading some to wonder if it may be the next in line for an SEC-approved fund.

However, it’s worth noting that ETH price is also in the correction mode after hitting this resistance and is now trading around $2,550.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +While interest is high for coins like Ethereum and XRP, Santiment pointed out that chatter around Cardano has been relatively quiet despite normally having significant trader optimism. The smart contracts platform has lagged the market recently after strong gains last year.

Of course, Bitcoin still drives overall market sentiment more than anything else. If the flagship cryptocurrency can maintain levels above $40,000, appetite for altcoin speculation is likely to remain strong. Traders will be keeping a close eye on BTC price action as we kick off the second weekend in 2024.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.