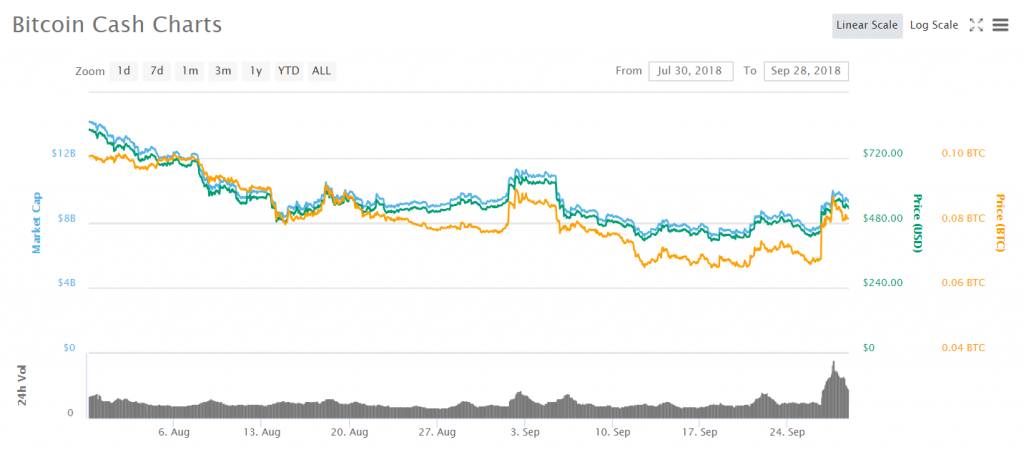

Bitcoin Cash’s performance in the last couple of weeks was better than most of other coins. Peaking at $770.35/0.1 BTC on August 1st, the currency fell to monthly lows of $485.71/0.07949 BTC on the 14th. We saw one “bart” moment on the chart which lasted from September 1st to 5th, when BCH peaked at $648.25/0.08991 BTC. After dropping off a cliff on the 5th, the currency fell to a monthly low of $421.23/0.06729 BTC. Moving sideways afterwards for a while, Bitcoin Cash peaked on the 27th at $580.63/0.08928 BTC on the 27th.

One BCH can be purchased for $537.99 USD (-0.86% drop in the last 24 hours)/0.08179557 BTC (-0.95% drop in the last 24 hours). Daily trade volume is sitting at impressive 110,289 BTC, with BitForex (23%), OKEx (6%) and Huobi (4%) leading the platforms that exchanged the coin during the last day. With a market cap of $9,294,589,504, Bitcoin Cash is currently the 4th most valuable cryptocurrency on the market.

Trader LudwigStirner provided the technical analysis of the cryptocurrency:

“I think the BCH price is so hot right now, so I cannot recommend opening long-term position because if you open the 1-day TF you will see the strong resistance line (100EMA) @0.093. However, I think this action on the card is a good sign to build small position for a long-term period.

The MACD: bull trap. The RSI is at overbought zone. The EMA lines: you see a very popular phenomenon called “Golden Cross”, when it happens the price revers its trend and in this case we are looking at the emergence of the new uptrend with big potential.”

Check out the complete analysis for a detailed graph and the trader’s entry prices.

Bitcoin Cash, the “peer-to-peer electronic cash that Bitcoin was supposed to be”, had a couple of positive updates in the previous period which likely led to the mentioned price spike on the 27th. The biggest news was the report that Bitmain Technologies Ltd., the world’s largest company focused on producing ASIC mining devices and a company that allegedly owns 1 million BCH coins, will be going through with their plans of releasing an initial public offering (IPO).

The intention of going through with the IPO was revealed by Bitmain’s financial statements, which were recently released in a 438-page filing with the Hong Kong stock exchange. The IPO could potentially raise billions of dollars for the company at a time when Bitmain reported a $330 million loss after selling most of its Bitcoin (BTC) holdings and replacing them with Bitcoin Cash. This could potentially inject new capital into a company that has reportedly struggled with operating in profit as of late.

Marouane Garcon, the managing director of the Amulet crypto startup, told Forbes that the aforementioned IPO filing will have an effect on the price of BCH:

“[The filing] definitely influences the price. It has been no secret that Bitmain holds massive amounts of BCH, but now that they are going public they are going to fill their already immense treasure chest with more money, and I’m confident a good chunk of it will go towards the development of BCH. Exciting times ahead for Roger and Jihan.”

There were a couple of other notable updates in the ether. Bittrex announced its planning to launch a USD market for Bitcoin Cash on October 3rd. Gemini also confirmed that they’ve received all the regulatory approval required to launch BCH trading pairs but haven’t given an actual date. Bitcoin SV (for “Satoshi’s Vision”), a project designed to ensure Bitcoin Cash remains a “trustless, decentralized system”, seems to be picking up the pace as over 200 BCH miners pre-registered their accounts on the SVPool. In November, mining nodes running Bitcoin SV will activate a short list of upgrades on the BCH network, most importantly an increase of the default max block size from 32MB to 128MB. Jimmy Ngyen and Craig Wright discussed the “Bitcoin SV vision” at a recent future of blockchain summit in Thailand.

Of course, the story of the month was the “return of favor” that a Bitcoin Cash developer did to his colleagues from Core as he found and privately disclosed a critical bug in their software. This came only couple of weeks after a similar situation happened with roles reversed – Core dev found and disclosed a bug on BCH client implementations. The community is not too happy with the reaction from Core devs and paint them to be too arrogant to show real appreciation for the gentlemen gesture a BCH dev did towards them. Still, it is a praiseworthy behaviour from both devs who found and disclosed the bugs in the safest possible manner to avoid potential catastrophic consequences of the bugs.

Putting aside the dubious actions of its leading men, Bitcoin Cash has been busy working in the previous period. With work being done on implementing the increased block sizes the BCH network will increase its network’s ability to handle even larger transaction throughputs than it does now. Bitmain news were a welcome sight as well, as you can see from the brief but short price spike. We’ll see if the project’s future actions lead to similar movements.