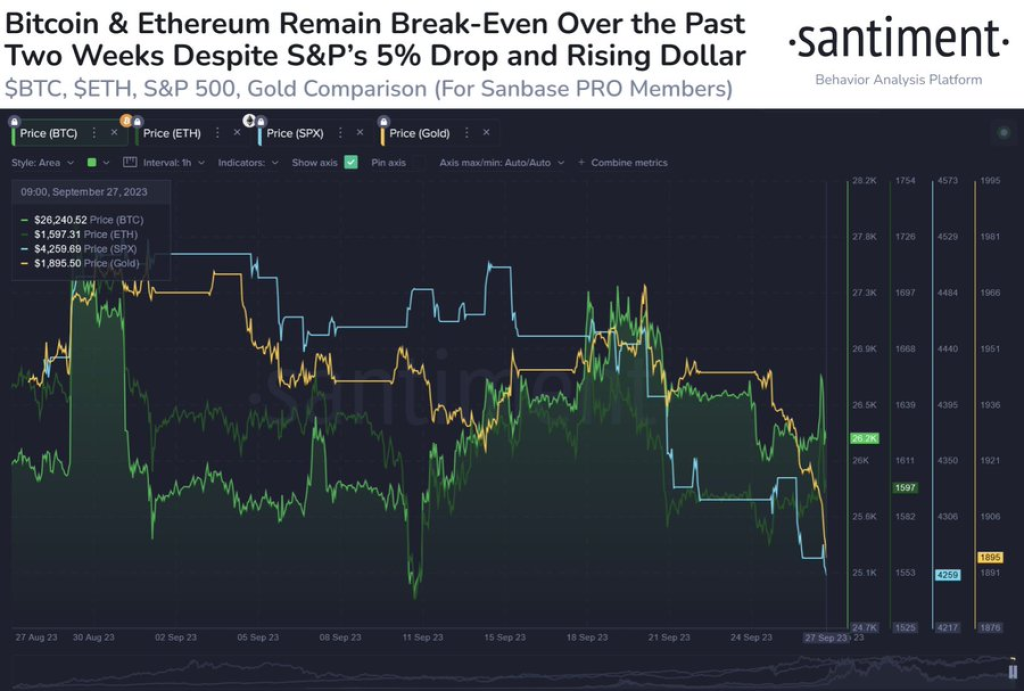

The U.S. dollar index (DXY), which measures the dollar’s value against a basket of major currencies, has climbed to its highest level since November 2021. This rise in the dollar’s strength often acts as a bearish indicator for risk assets like cryptocurrencies and stocks. However, bitcoin has held up relatively well so far, potentially signaling that a breakout rally could occur if and when the dollar’s run cools off.

Source: Santiment – Start using it today

What you'll learn 👉

The Strong Dollar’s Negative Correlation

Since 2021 especially, the dollar strengthening has preceded drops in crypto and equities. When the dollar gains strength, it tends to draw investment away from higher-risk assets. Additionally, a strong dollar makes commodities and investments denominated in other currencies more expensive for American buyers.

For example, the last time the dollar index rose to current levels in November 2021, bitcoin went on to plunge over 50% by January of the following year. The S&P 500 also posted a loss of around 10% during that period.

Bitcoin’s Resilience Could Signal a Change

So far, as the DXY climbed over the past month to its highest point in 16 months, bitcoin has held up relatively well compared to previous dollar surges. While far from immune to the correlation, BTC has managed to hold support around the $19,000 level amid the dollar’s latest streak.

Some analysts believe bitcoin’s ability to maintain its value in recent weeks is a positive sign that a bullish breakout could occur if or when the U.S. dollar finally peaks. The theory is based on the idea that once the dollar rolls over, investments would rotate back into crypto and offer fuel for an upward move.

However, the path forward relies heavily on whether the dollar eases off its highs in the near future. If the greenback continues to appreciate substantially, history suggests downward pressure on bitcoin and other digital assets is likely to intensify.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.