Another day, another Bitcoin drop. The price did recently bounce from 6400 USD to 6700 USD levels, seemingly reacting positively to a whole host of SEC officials confirming that Bitcoin and Ethereum will not be treated as securities. Still, most of the market feared that this recovery will be a short lived one. And it indeed was, as another day of red greeted us on June 22nd. Bitcoin sharply fell 600 USD in a very short timeframe and has settled down around 6100 USD. At one point, exchanges like Bitmex witnessed their prices go down even beyond the 6000 USD psychological barrier. Currently we have a period of bears and bulls battling it out just above the mentioned line and it seems like Bitcoin is holding by a thread, looking to avoid any further drops.

The battle for the Bitcoin bottom seems to be far from over. The market cap dropped to 250 billion, with 41% of it belonging to Bitcoin, and experts feel it might be going even further down. And while we can still fall of quite a lot, the feeling is that sellers are slowly becoming exhausted and that the bottom is slowly forming.

Bill Baruch, president of Blue Line Futures, just recently wrote down his Bitcoin predictions for CNBC. His predictions mirror the general market sentiment, as he writes:

“Ultimately, after its volatility has become this depressed and the cryptocurrency has lost as much as 70 percent from its December peak, I believe the selling has become exhausted, and a bottoming process can begin.”

Baruch feels that the introduction of Bitcoin futures led to the currency and the market in general making a “big step” towards their maturation. He adds that the bottom isn’t a set price but rather a process, one that has clearly begun. He points out that short term bottom is set around 6000, with the 100-week moving average implying that we could go as low as 4550 USD.

In the long run, Baruch thinks we are in for a “significant upside.” Short term, if we go above 8500 USD, we should be breaking the near-term downtrend. He feels that 10000 USD is the “crucial line in the sand”, and even advises that you sell against it once it is reached. Ultimately, the six-month downtrend is intact until the coin closes above 11300 USD.

The rest of the market, for the most part, agrees with these predictions. Ever since Tone Vays posted his “optimistic bearish” target for Bitcoin which saw it reach 4975 USD by mid July, more traders started to accept this target as a reality. Janine Wolf of Bloomberg stated something that confirms the negative sentiment, saying:

According to the Directional Movement Index, Bitcoin is on its strongest negative trend since the sell-off earlier this year. The index’s ADX line is currently at 39.3. Anything above 25 is considered a strong trend. Meanwhile, the index’s DVAN trend line, a divergence analysis that measures buying or selling pressure, is also giving off ominous signals.

There are a few remaining bullish people regarding the short/mid-term market. Most of them agree that the latest positive signs from central banks and regulators do raise positive sentiments for the future. They do however agree that the markets are still too immature for a larger influx of investment, even though giants like Nasdaq and Goldman Sachs have been making crypto related moves as of late. Ultimately, the regulations will need to be clearer and the products will need plenty of improvement before major investors decide to move in.

Bitcoin market has been on a bear run since December of 2017. Professional analysts and casual investors alike (us included) jumped the gun and declared the bottom at each new dip. All we know for now is that no one can be sure what the actual bottom price of this run will be. Mitoshi Kaku puts it nicely:

“One thing that makes me wonder about the state of the price for $BTC now is that usually there’s a consensus on the bounce level for the price but I’ve been reading for weeks many random targets from good TAs. 5800, 5500, 5300, 5000, 4800, 4500, 4000, etc… I wonder why.”

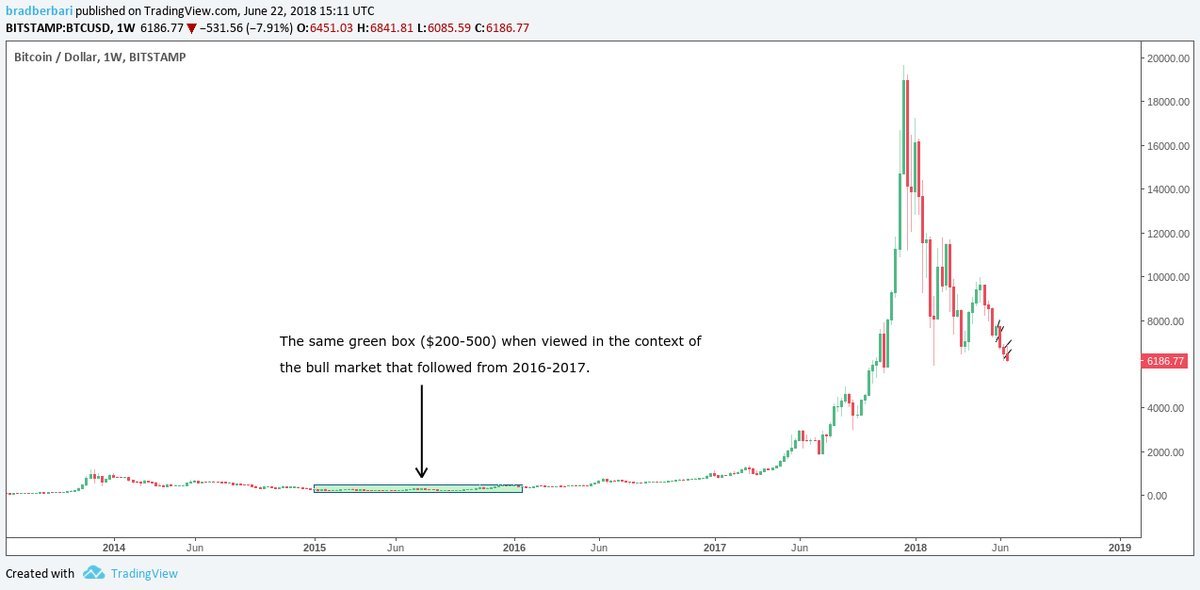

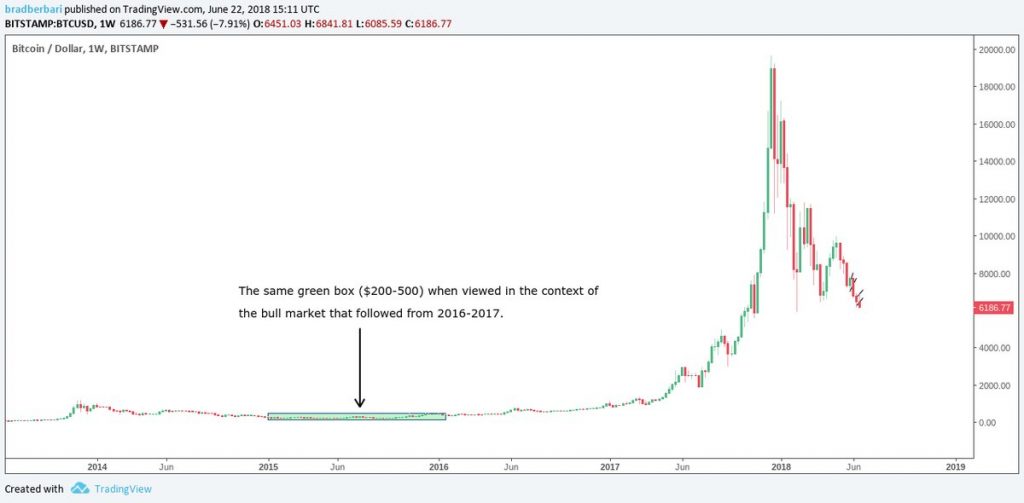

This is something new traders need to understand sooner rather than later. You will almost certainly not guess the correct bottom, but you can always figure out when the bottom is near. Prices in crypto have fallen by 80% since the turn of the year. This can be intimidating but one needs to realize that this drop-off came after an impressive 10000% increase in the price of Bitcoin which started around 2016.

The point is that traders should stop trying to “catch the knife”, as entering the market slightly higher than the actual lowest point of a bear run won’t mean much when the bull run comes around. The best tactics that one trader can use in this environment is to wait for a significant increase in buying volume and then “pre-FOMO” in or to simply buy at current near-bottom prices and HODL.