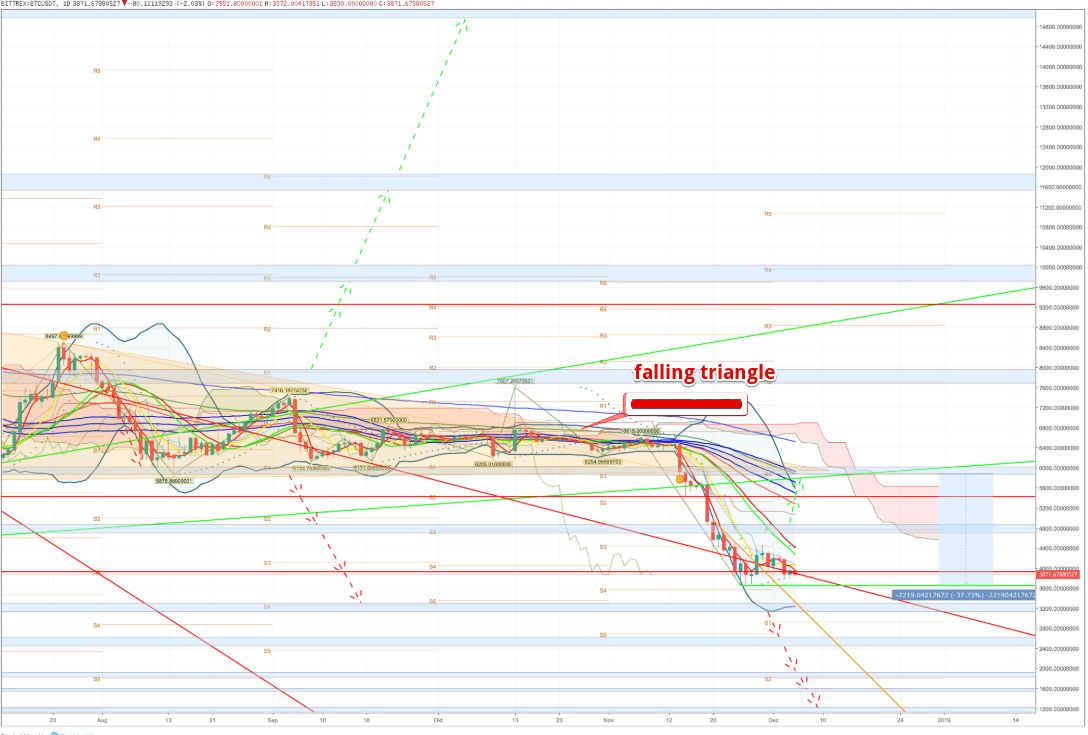

The majority of crypto currencies – and with them Bitcoin – have had to endure violent price drops in recent weeks. Can one slowly speak of the hoped-for bottoming out? Bitcoin is hovering around $3770 and is down 4.37% on the day.

The short-term floor presented at 3,655 US dollars held up well. The counter-movement that started here reached the downward trend of May 2018 and the 78.6 percent Fibonacci retracement and briefly outperformed it.

For now, there was nothing more to be gained. The high for the period to date has been 4,448 US dollars. As long as the Bitcoin exchange rate does not find a way over the 4,872 US dollar, the bearish scenario will not be shaken.

The moving averages still provide an intact sell signal. The cloud of the Ichimoku-Kinko-Hyo-Indicator continues to build up and is a proud 20 percent away from the current price development.

What you'll learn 👉

Bullish variant:

The annual low of the Bitcoin price is not beaten. In the best case, a stabilisation at the current price level can take place on the downward trend from May 2018. This has a supportive effect. The next point of contact is then at the high of 4,448 US dollars. Above this, the path is clear up to 4,701 US dollars. With this movement, the moving averages should be about to negate the sell-signal. In addition, the 61.8 percent Fibonacci retracement is reached. The following targets are set for 4,872 US dollars:

5,428 US dollar

5,877 US dollars

Bearish variant:

The downtrend from May 2018 is confirmed as resistance and left to the downside. The low for the year of 3,655 US dollars is tested again and beaten. The overriding downward target of 3,303 US dollars is set to begin. The sell-signal via moving averages and Ichimoku-Kinko-Hyo-indicator continues to hold. A sustained breakthrough below 3,132 US dollars activates the targets:

2,629 US dollar

1,920 US dollars

1,601 US dollars

1,224 US dollars

Technology front is humming

This year and the next one are going to be Lightning Network marked. Lightning payments are increasingly accepted for real goods and services.

One of the very earliest adopters of the Lightning Network was a prepaid top-up service Bitrefill, in March of this year. CEO Sergej Kotliar has been keeping a close eye on Lightning Network usage since, telling Bitcoin Magazine:

“We’ve processed 2,170 regular Lightning orders at this point, receiving a total of 6.3 bitcoin. The share of Lightning payments is steadily growing and [is] currently at about 2.5 percent of our bitcoin orders. We’re generally waiting on two things for this to take off bigly: more wallets and exchange integration.”