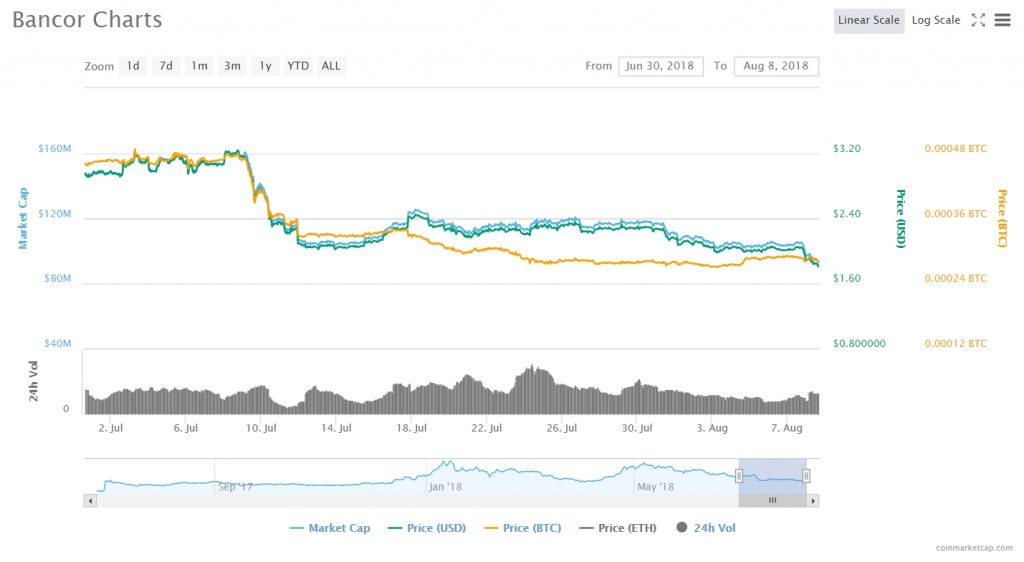

Bancor’s price has been going through some rather unspectacular motions as of late. Previous month was somewhat uneventful, as the price fell off hard from the highs of $3,20 USD/47583 satoshi to the lows of $2,02 USD/33019 satoshi in just a couple of days. Ever since the coin has been stuck in a perpetual sideways rut, staying barely above $2 USD up until a couple of days ago.

The coin managed to drop below $2 USD and is currently valued at $1.72 USD, recording a drop of 8,01% in the last 24 hours. BTC plunging hard below 7K upon the news of its physical ETF’s being postponed had a lot to do with this drop. This can be easily confirmed if we observe the coin’s BTC value, which dropped only 1,58% in the same timeframe to its current value of 28491 satoshi.

BNT maintains a rather low daily trade volume of 800 BTC. Its market cap sits at $88,802,575 USD, making BNT the 74th most valuable cryptocurrency in the world.

Bancor is a standard for creation of cryptocurrencies with built-in convertibility directly through their smart contracts. A basic Bancor-style contract functions as both an exchange, and a self-balancing ETF.

Recently this protocol suffered an attack (which we wrote about already). During this arrack, the malicious entity managed to steal around $23,5 million USD worth of cryptocurrency. The platform has been known in the past for having some rather centralized features, which include an Anti-Theft Override system. While the naysayers were rather critical of the levels of centralization present on the exchange, the mentioned theft turned out to be a perfect occasion to showcase why said features were necessary. Bancor, upon catching wind of the theft, immediately utilized the Anti-Theft Override tools to freeze and restore stolen funds.

Learn more about Cex.io in our Cex.io echange detailed guide and review.

The company as a whole rejects the notion that centralization is bad. Eyal Hertzog, Product Architect at Bancor, explained under which circumstances centralization can be a good thing:

“So long as the existence and use of emergency control functions are fully transparent to the world, and users have the ability to easily fork networks if they disagree with their governance structures or execution, networks remain decentralized and censorship-resistant — a tremendous leap forward from the systems that dominate our online and offline worlds today,” were his words. He further added that Bancor has all the attributes of a system that cannot suffer from a single entity exerting monopoly power over it:

- Open source code

- A fully transparent database — every action on the network is open and verifiable

- Self-sovereign authentication — users are responsible for their own security (private keys) rather than a central entity that can reset their password

So we can all agree that his points do ring true here; as long as the network is transparent and open about their actions, similar acts of governance won’t hurt anyone.

After the funds were recovered, the team went about repairing the damage and plugging the loopholes that originally led to the weakness in the network. They bounced back strong, as the first post-hack week saw the platform process $30 million USD worth of conversions. They also initiated a program they titled Alliance of Crypto Defenders, which will have a number of major exchanges, token projects and crypto security firms working on securing the crypto world from criminal activities.

“Members will collaborate on mechanisms to warn and assist each other in times of peril, coordinate around shared blacklists, and develop open-source tools aimed at stopping thieves in their tracks. One such tool, to be released in the coming weeks, maintains a real-time multi-chain list of accounts involved in fraudulent transactions, as well as a public interface to allow blockchain users to visualize and understand the movement of their funds,” claims the official July activity update of the project.

Other updates mostly regarded new tokens and projects that decided to start cooperating with the Bancor network in order to increase their liquidity. Flixxo (FLIXX), Spindle (SPD), Mainframe (MFT), Metal (MTL), LockTrip (LOC), Unblocked Ledger (ULT), Nexo (NEXO), Data Choice (DCT), Arizn (AALT), Trecento (TOT), Real Estate Asset Ledger (REAL) and URUNIT (URUN) are just some of the tokens that have been integrated with the Bancor protocol recently.

Bancor’s staff and creators have been active as well. Bancor’s Director of Community Currencies, Will Ruddick, is currently overseeing a community currency initiative on the ground in Kenya, in partnership with his local non-profit Grassroots Economics. Grassroots’ Director Caroline Dama recently visited the White House as a finalist in the WomensConnect USAID program. Finally, Eyal Hertzog cooperated with LiquidEOS (a company he is currently a shareholder of) visited Korea to discuss solutions to the EOS’ RAM allocation problems. His write-up on the topic can be found here.

All in all, Bancor has begun recovering from the hardships of mid-July and is seemingly making all the right moves that will ensure its future growth. They claim that the hack they experienced will serve as motivation to work even harder in the future so it should be interesting to follow how they plan on dealing with the challenges ahead.