Crypto debit cards have exploded across the market in the past two years, but very few projects are trying to build something deeper than a spending tool. Most cards are just wrappers around centralized systems, offering crypto-to-fiat swaps, cashback, and a shiny mobile app. Avici approaches the problem from a completely different direction. Instead of building a card on top of crypto, Avici is trying to build an entire decentralized banking experience from scratch.

That mission, combined with unusually fair tokenomics and a fast-growing user base, is the reason Avici has become one of the most talked-about Solana projects of this year. And as more users shift away from custodial card services, the big question is now obvious:

Is Avici positioned to become the best crypto debit card for 2026?

What you'll learn 👉

A New Kind of Crypto Banking Experience

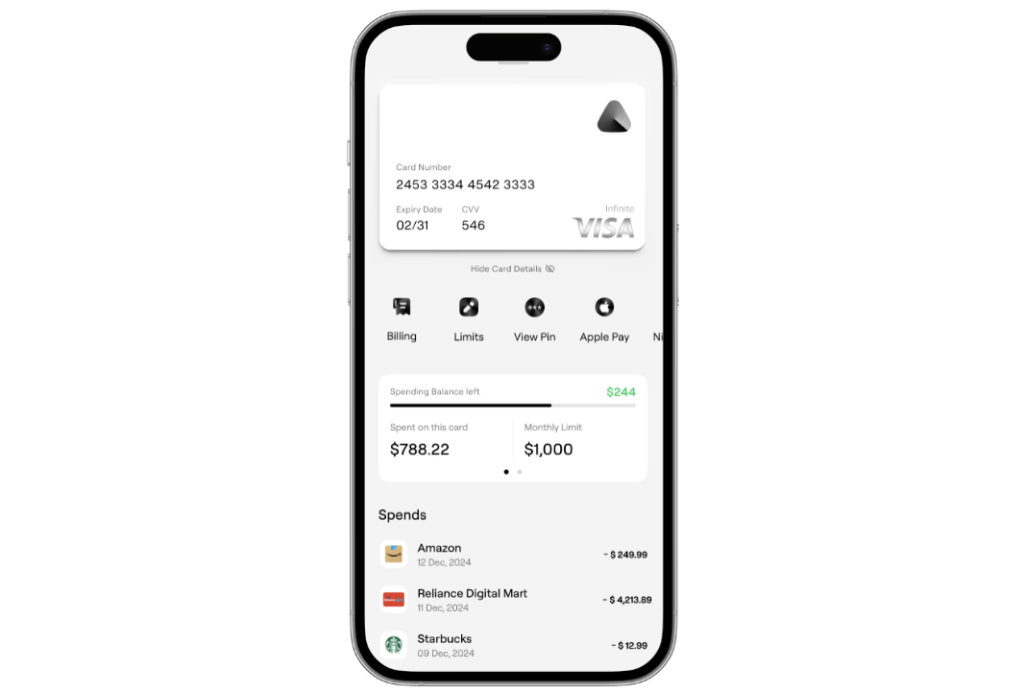

Avici describes its mission as “distributed internet banking,” but the idea becomes much clearer once you open the app. It feels like a Web-native version of Revolut or N26, yet everything behind the interface routes back to a user-owned smart wallet. You can open USD or EUR accounts, move money between stablecoins and fiat, and use a Visa card in more than 100 countries, but the custody layer never leaves your control. It’s a banking experience that preserves crypto’s core principle: the user stays in charge.

What makes this different from most crypto card products is the structure behind the scenes. All financial actions (from deposits to spending) are executed onchain. There is no traditional bank holding your funds, no hidden third-party intermediaries, and no centralized entity that can freeze or block transactions. The app keeps the interface familiar, but decentralizes the parts that matter.

A Smart Wallet Built for Real-World Finance

The Avici smart wallet is one of the most important components of the system. It is not a typical seed-phrase wallet. Instead, it uses a self-custodial smart contract design where users log in with Google, iCloud, biometrics, or a passkey. The wallet eliminates the friction that normally scares new users while keeping control entirely onchain.

Security is handled through programmable policies rather than a single private key. Users can create daily spending limits, restrict withdrawals, set timed approvals, whitelist addresses, and issue temporary session keys for everyday transactions. Combined with Solana’s speed and negligible fees, the wallet behaves more like a modern financial account than a traditional crypto tool. Most of the time, users don’t even notice transaction fees because Avici sponsors gas through its own relayer.

Read also: Best Cryptocurrency Wallets

Onchain Credit Instead of Selling Your Crypto

Where Avici becomes especially interesting is in its credit system. When users load the card, they aren’t selling their crypto to fund the purchase. Instead, the assets are locked inside a smart contract that acts as collateral. The card provider fronts the payment at checkout, and the locked crypto backs the position in real time. If the collateral rises, the user benefits. If it falls, the wallet issues margin alerts and, in extreme cases, automatically closes the position.

This design creates one of the first practical examples of crypto-backed credit that doesn’t rely on centralized custody. It offers a real alternative for users who want spending power without liquidating long-term holdings; something almost no other crypto debit card currently provides.

The Trust Score: A Real Attempt at Web3 Credit

Another standout feature is the “trust score,” an onchain credit model that evaluates wallet behavior instead of relying on traditional bank data. The system looks at repayment consistency, risk management, transaction activity, and the stability of a user’s onchain identity. If the model works as intended, it could evolve into one of the first scalable credit layers in Web3.

Credit remains one of the biggest missing components in decentralized finance, and Avici’s approach suggests a more organic solution than traditional KYC-based scoring.

Choosing Solana was not a coincidence. A banking product built for everyday spending needs fast confirmations, predictable fees, reliable uptime, and a strong wallet infrastructure. Solana is one of the only chains that can deliver all of that simultaneously. For a user who makes frequent small transactions through a debit card, the difference between a fraction-of-a-cent fee and a multi-dollar fee is enormous. Solana’s architecture allows Avici to hide the blockchain layer without compromising decentralization.

Read also:

Tokenomics: A Fair Launch With No VC Overhang

One of the biggest reasons the Avici token grew so quickly was the way the team structured the launch. Avici initially raised $35 million, but later refunded $31.5 million back to VCs and launched the token at a $4.5 million fully diluted valuation. Investors who wanted exposure had to participate in the community sale at the same terms as everyone else. There were no discounted allocations, no vesting cliffs, and no quiet insider deals.

This led to one of the rare situations in crypto where early dumpers didn’t exist. As a result, the token ran from its $4.5 million FDV to roughly $90 million (a clean 20x) driven entirely by market demand rather than early-investor exit pressure. It’s one of the fairest token distributions seen in recent cycles, and it has become part of what defines Avici’s identity in the ecosystem.

Real Usage and Early Growth

Avici is still early, but the adoption numbers are stronger than many established card platforms. The project has processed more than 100,000 transactions in a single month, attracted over 12,000 token holders shortly after launch, and expanded deposits across six major chains including Solana, Polygon, Arbitrum, Base, BSC, and Avalanche. The wallet automatically bridges assets in the background, so users see a unified balance even when deposits come from different networks.

This kind of invisible chain handling is exactly what crypto apps need if they want mainstream users who don’t care about network complexity.

Rewards and Cashback

The Avici Signature Card offers:

- 1.5%–2% cashback on eligible purchases

- No token staking required

- Rewards in USD-equivalent credit or points

- Referral bonuses for inviting friends

Compared to other cards that require staking volatile tokens (e.g., CRO or BNB), Avici’s flat cashback system is easier and less risky for most users.

Security and Regulation

- KYC Required: Powered by Sumsub

- AML Monitoring: For wallet behavior

- Smart Contract Escrow: Your funds can only be used to settle card payments

- Card Issuer: Rain (in partnership with Visa)

- Wallet Tech: Supports passkeys, multi-chain access, programmable security policies

You maintain complete control over your assets with transparent on-chain activity.

Avici Card Fees Breakdown

Avici is transparent about fees, with a focus on minimizing user costs:

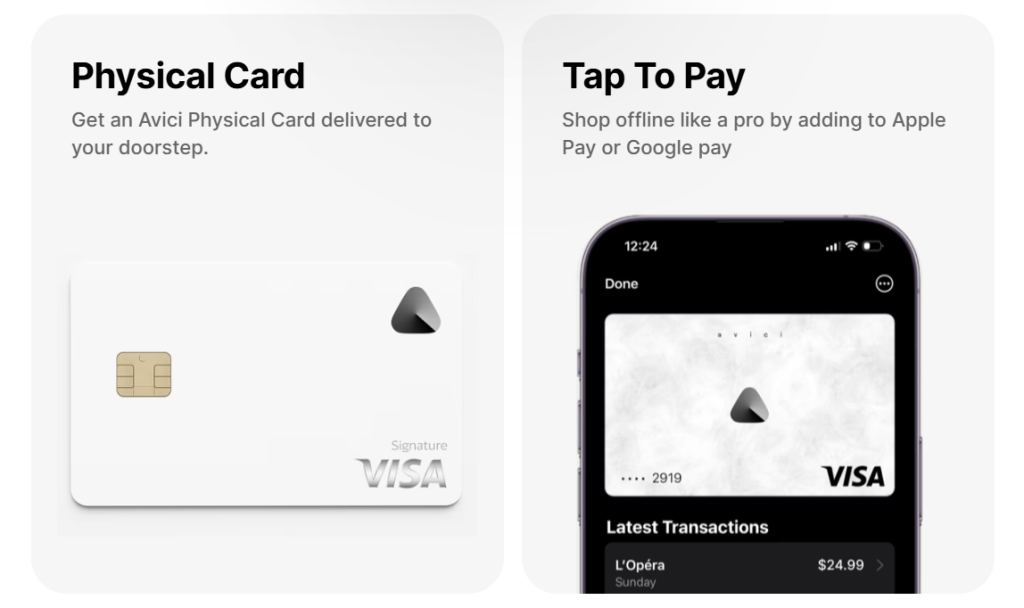

- Virtual Platinum Card: Free for the first one; $10 per additional.

- Virtual Signature Card: $30/year (first year), then $20/year.

- Physical Platinum Card: $50 one-time.

- Physical Signature Card: $75 (first year free), then $20/year.

- Shipping: Free standard; $15 (US) / $50 (international) for priority.

- ATM Withdrawals: $1 + 0.65% per withdrawal; max $250/day per card.

- Foreign Exchange: 0% markup by Avici. Visa may charge a small FX fee (~0.5%-1%).

There are no fees for:

- Top-ups

- Card transactions

- Wallet withdrawals

- Maintenance

This makes the Avici Card one of the most cost-effective crypto cards currently on the market.

Avici Card Supported Countries

The Avici Card is globally accessible with a few regional exceptions. Supported regions include:

- North America: USA (except a few restricted states)

- Latin America: Argentina, Brazil, Mexico, and more

- Europe: Most EEA countries, UK

- Africa: Nigeria, Kenya, South Africa, Ghana

- Asia-Pacific: Japan, Philippines, Australia, New Zealand

Prohibited countries include India, China, Russia, Venezuela, Iran, and others under international sanctions.

Below is Competitor Comparison Table:

| Feature | Avici | Nexo Card | Crypto.com Card | Binance Card |

|---|---|---|---|---|

| Custody of Assets | Fully self-custodial smart wallet | Centralized | Centralized | Centralized |

| Credit Model | Onchain, collateral-backed, no selling | CeFi credit line | CeFi credit line | CeFi credit line |

| Login / UX | Passkey, biometrics, Google/iCloud | Traditional app login | Traditional app login | Traditional app login |

| Supported Chains | Solana, Polygon, Arbitrum, Base, BSC, Avalanche | N/A | N/A | BNB Chain, limited |

| Gas Fees | Sponsored by Avici (near-zero) | Not applicable | Not applicable | Not applicable |

| Card Network | Visa (global) | Mastercard | Visa | Visa |

| Self-Custody Protection | Smart contract policies, session keys, whitelists | None | None | None |

| Token Launch Model | 100% fair launch, no VC discounts | Private allocations | Private allocations | Internal ecosystem |

| Ideal User Type | Web3 users wanting banking + self-custody | CeFi yield users | Cashback seekers | Binance ecosystem users |

A Roadmap That Goes Beyond Payments

The long-term vision stretches far beyond debit cards. Avici plans to build onchain savings accounts, global payroll systems, lending markets, a stablecoin-based banking layer, merchant payment tools, and even a DAO-governed reserve currency. Not all of this will arrive quickly, but the direction is clear: Avici wants to build a full, decentralized financial stack that feels familiar to everyday users.

Is Avici the Best Crypto Debit Card for 2026?

Avici is still developing, but few projects are trying to solve problems at this scale. It combines the familiarity of neobanking with the control of self-custody, the efficiency of Solana, the safety of programmable wallets, and a credit model that doesn’t rely on selling crypto. Add one of the fairest token launches of the cycle, and Avici becomes more than just another crypto card, it becomes a contender for a fully decentralized banking layer.

Whether it becomes the best crypto debit card of 2026 depends on execution, but the foundation is stronger than most competitors. If the team delivers even half of the roadmap, Avici is positioned to become one of the most important consumer-finance projects on Solana.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.