PayPal is the original commercially viable internet payment service which allowed people and companies to make their transactions online in a very short period of time. However, one thing they always had going against them were the platform’s high fees and costs of converting the currencies, which users begrudgingly paid knowing that their payment options were limited. At the same time, competitors like Google and regular exchanges had similar fees which resulted in people staying with PayPal. However, a recently introduced change to their fee policy could and has already made many people unhappy, and could result in them moving to alternate means of payment in the near future.

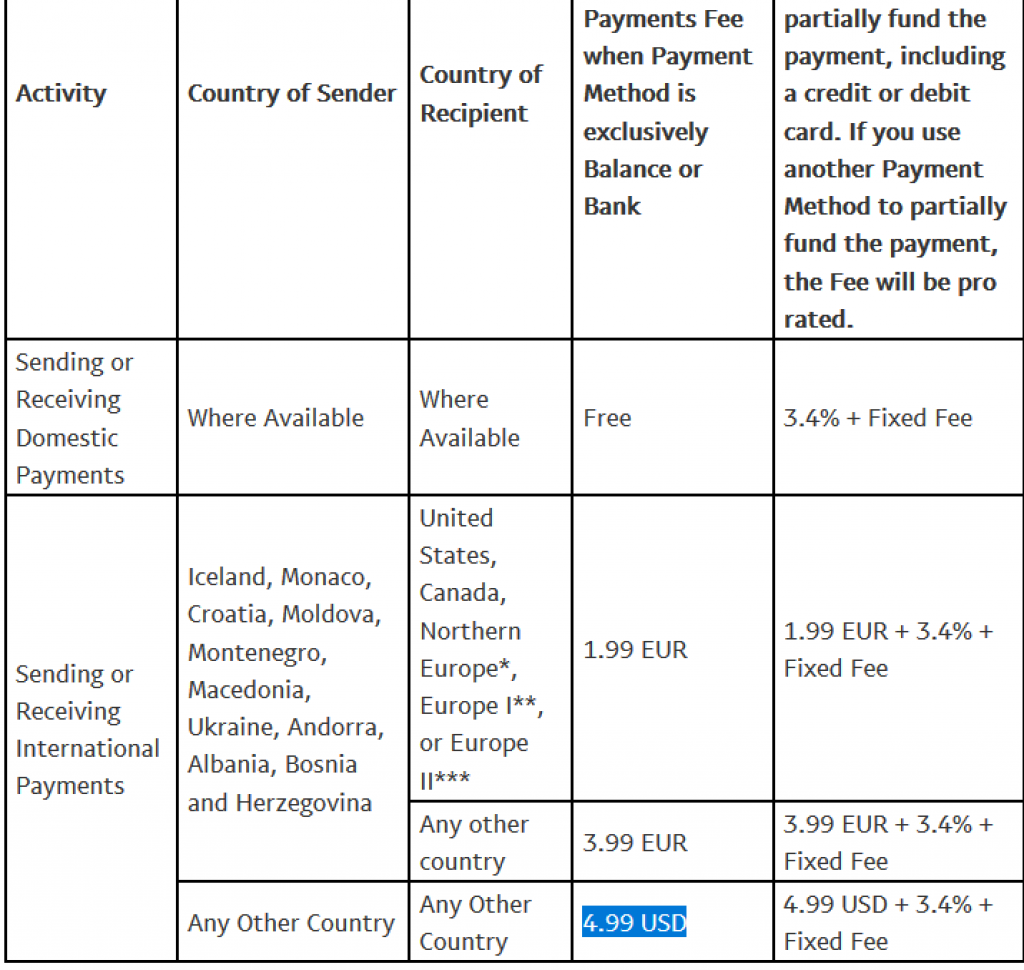

Starting in May, international and regular transfers became even more expensive than they were previously. In place of its long-standing ‘variable rate pricing’ scheme, the company is now deploying a new financial model wherein a flat fee of $2.99 or $4.99 will be imposed on all transactions (US-based transfers will employ a different fee structure). Along with that, a flat fee will be charged when transferring money from a debit/credit card to a foreign user. An added surcharge of 2.9% will be added to each transaction, along with a fixed fee which will depend on the currency you are using. Full list of fees can be seen here.

Some countries will suffer more than others, especially the ones that aren’t in the US, Canada, or so called Northern Europe, Europe I and Europe II.

The response was less then favorable, with crypto community satirically praising it. This praise came from a realization that such fee issues are part and parcel of using centralized payment operators. The fact of the matter is that cryptocurrencies were invented to prevent exactly this: having third-party middlemen handle your money and charge you exorbitant fees for their services. Some people were more direct with their critique, as a reddit user BryanPenfound simply commented:

“Load gun. Point at foot. Shoot.” A user named kidbid responded by saying “It’s almost like they’re making PayPal fail so that a crypto replacement can take its place. Either that or they’re just squeezing what’s left of their business model before meeting its foreseeable end.”

For comparison, if we look at Bitcoin right now, we can see that its transaction fees are currently below 2 dollars, no matter where the user is located. Other coins offer low transaction fees as well; just recently, in April 2018, a transaction worth 99 million dollars was made using Litecoin for a miniscule fee of 0.4 dollars. It is clear that these fees are much more tolerable than the fees which PayPal and similar centralized services offer; however, there are still a couple of issues standing in the way of cryptocurrencies achieving commercial adoption.

On average, people value comfort more than considering how much accumulating fees will cost them in the long run. Using debit/credit cards is very comfortable, as you can be sure (well mostly sure) that your money is safe in a bank and that it’s readily available anywhere you go. Cryptocurrencies are still some way from fitting that description. A lot of research and personal security measures are required to become a cryptocurrency owner, and most people will rather get ripped off by a bank than go through the hassle of setting up a cryptocurrency wallet. Another issue is the lack of merchants and vendors that accept cryptocurrencies as valid payment options.

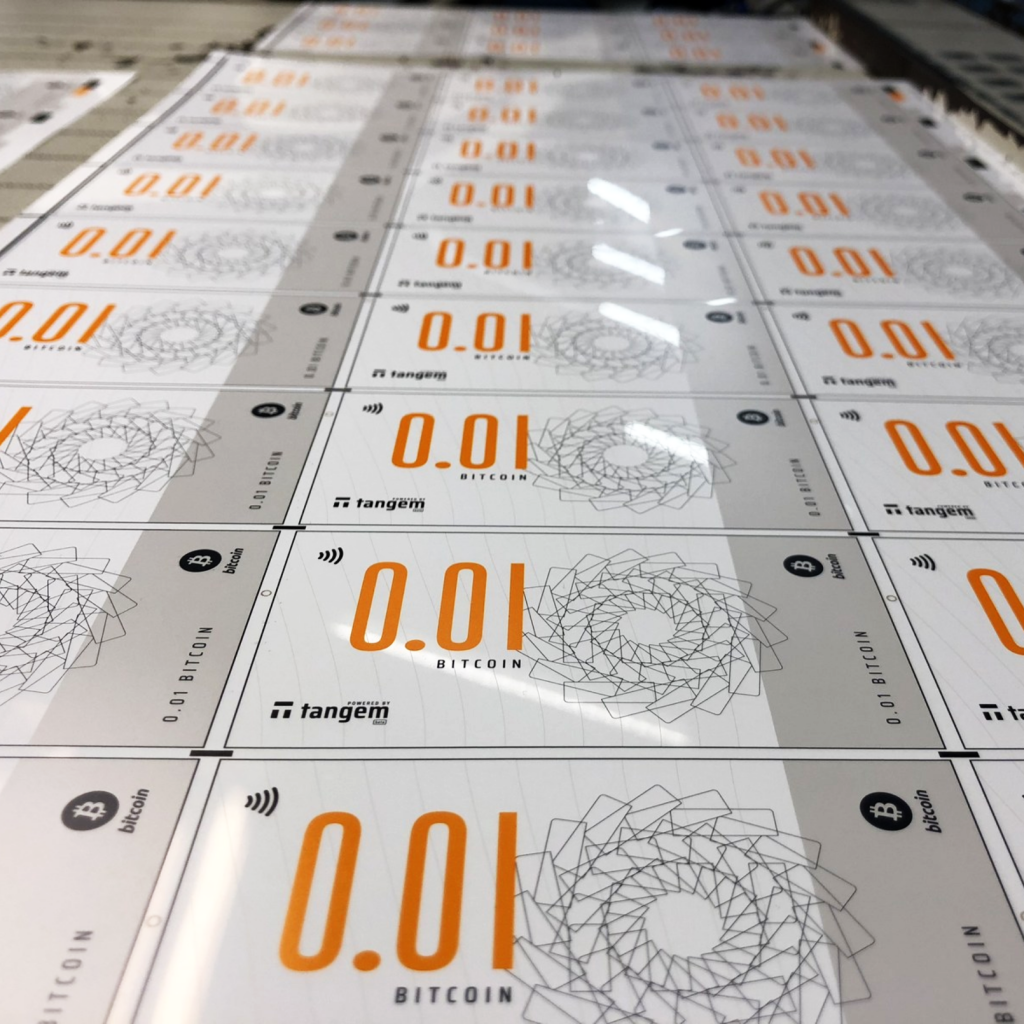

Still, there are clear signs that these issues are being ironed out. Wallets are becoming more “light” and user friendly, and methods of paying with cryptocurrency are expanding. Paper wallets, Bitcoin ATM’s and even Bitcoin banknotes have all became a reality recently, and there are many more good things yet to come.

Bitcoin banknotes

Another problem that is currently facing the cryptocurrency world is its inability to handle large transaction loads. Ethereum was perhaps the most famous victim of the issue, when the launch of Cryptokitties cause the entire network to shut down for a short period of time. They were the first to suggest the introduction of a proof-of-stake algorithm which could fix the throughput issues. Sophisticated protocols like sharding and side chains are also being considered.

Ultimately, PayPal and similar services aren’t about to be dethroned just yet; however, if the balance keeps shifting the way it currently does, centralized payment options might be in for some rough times up ahead.