The cryptocurrency market has been struggling lately, with Bitcoin, Ethereum, and many other major, mid-cap, and low-cap currencies experiencing declines or only minor gains. This downturn can be attributed to several factors, including negative sentiment towards the top cryptocurrencies and low trading volumes across the board.

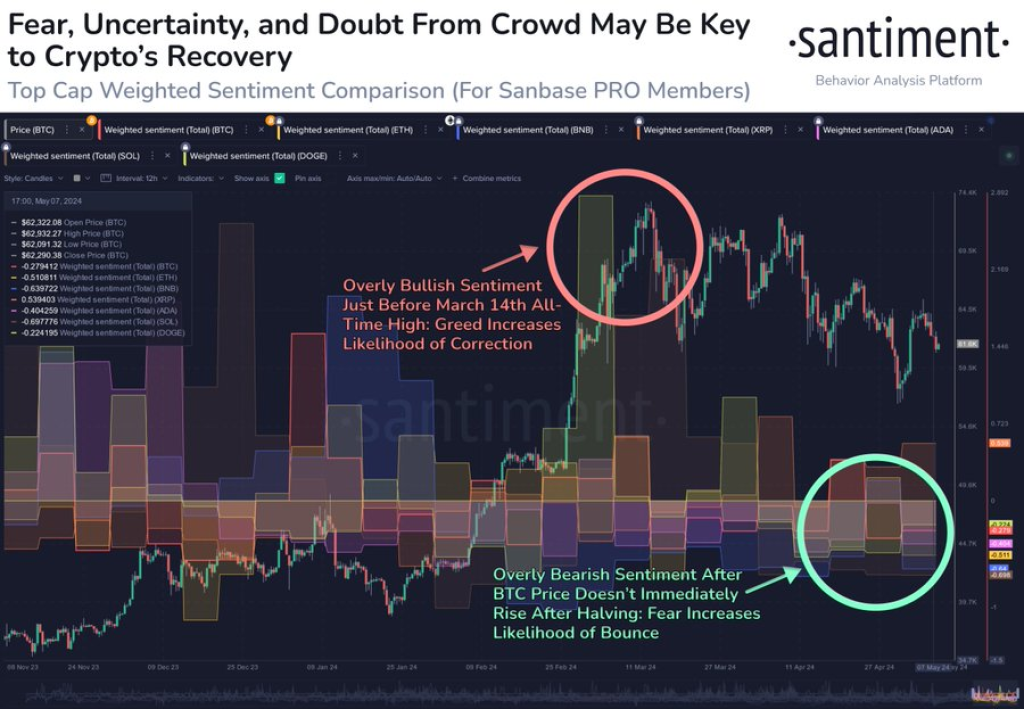

According to data from Santiment, a prominent cryptocurrency analytics platform, the sentiment towards the top cryptocurrencies has been negative since the highly anticipated Bitcoin halving event on April 19th failed to immediately boost market caps across the crypto space. Santiment notes that with uncertainty running high, a potential exit of small wallets from the sector may be necessary for Bitcoin and altcoins to experience steady recoveries leading up to the summer.

Trading volumes have also been lackluster, with Bitcoin seeing only a 1% increase in the last 24 hours, Ethereum at 0.23%, Cardano at -1.71%, Solana at 1%, and Litecoin at 0.14%. Low trading activity often signals a lack of investor interest and can contribute to further price declines.

On the Ethereum network, gas fees have reached record lows in 2024, hovering around $1-2 per transaction, down from over $200 in March. While lower fees are generally welcomed by users, they have led to a decrease in Ethereum burns, the primary mechanism by which the asset reduces its supply. The network token burn has reached a low of only 670 ETH, a new low for 2024, down from an average of over 2,500 in the first four months of the year.

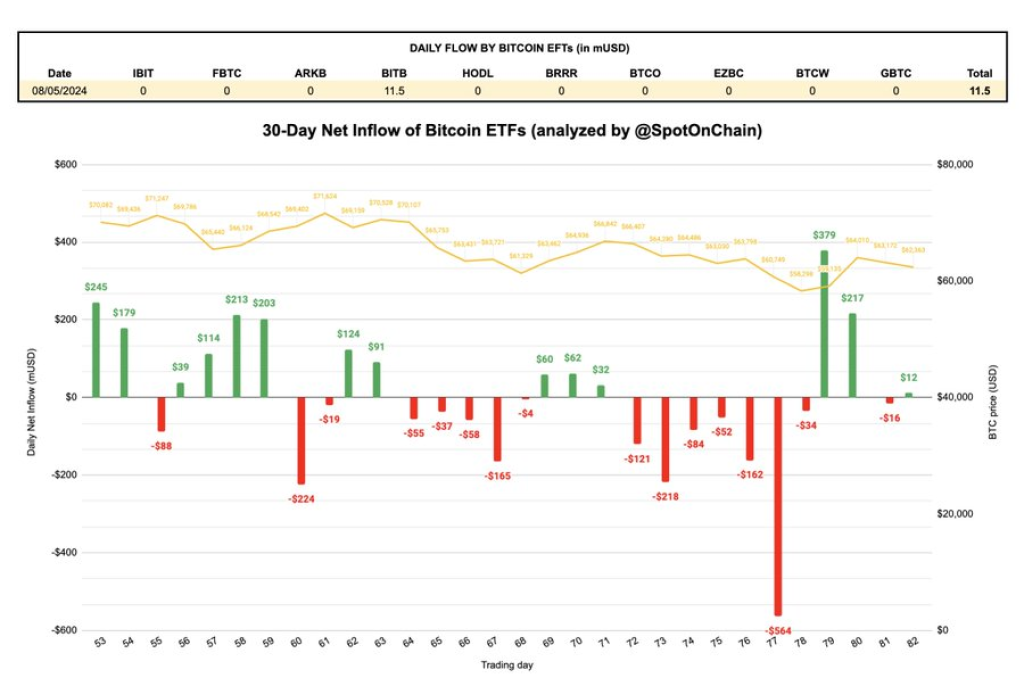

Bitcoin ETF inflows, which are often seen as a barometer of institutional interest, have also been sluggish. According to data from Spot On Chain, a crypto analytics firm, the net inflow for Bitcoin ETFs on May 7th was negative at -$16M, with Grayscale’s GBTC ETF experiencing a single-day outflow of $28.6M. On May 8th, the net inflow turned positive at $11.5M, but this was driven solely by the Bitwise ETF, with the remaining nine Bitcoin ETFs experiencing zero flows.

Read Also: Do Dogwifhat (WIF) and Meme Coins Face a New Competitor? This Low-Cap Gem Surged 20,000%

The market sentiment towards meme coins, often seen as a gauge of retail investor enthusiasm, has also been underwhelming. While new meme coin sensations like MEW and BOME reached market caps of $500-$600 million during the March pump, the recent meme coin sensation CWIF barely managed to reach a market cap of $25-$30 million.

Research conducted across various Telegram groups, CoinMarketCap accounts, and other crypto media outlets has revealed lower engagement metrics and reduced activity from major influencers and content creators. In the cryptocurrency space, euphoria and high volumes are often necessary drivers of a bull market, and the current conditions suggest a lack of such sentiment.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Overall, the combination of negative sentiment, low trading volumes, decreased Ethereum burns, stagnant Bitcoin ETF inflows, and muted enthusiasm for meme coins paints a bearish picture for the cryptocurrency market. A return to a true bull run may be needed to reignite the necessary euphoria and activity levels to propel the market higher.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.