The cryptocurrency markets are presenting a mixed picture this week, with some altcoins showing signs of recovery while others face the risk of further declines. One asset in focus is NEAR Protocol (NEAR), which has started to rebound after a bearish move that saw its price drop from $7.9 to $6 over the past seven days.

Based on technical analysis, NEAR’s price action remains tricky as the bulls strive for a sustainable recovery. Although the price has begun to gain traction, it needs to break above a falling trendline currently acting as overhead resistance before it can move further upward. Additionally, the Fibonacci Retracement levels suggest potential resistance at $7.4 (0.5 Fibonacci level) and $7.8 (0.618 Fibonacci level).

Fibonacci Retracement is a technical analysis tool that identifies potential support and resistance levels based on previous price movements. In this case, the 0.5 and 0.618 Fibonacci levels correspond to prices where NEAR may face selling pressure as it attempts to recover.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Fetch AI (FET) Risks Further Dip

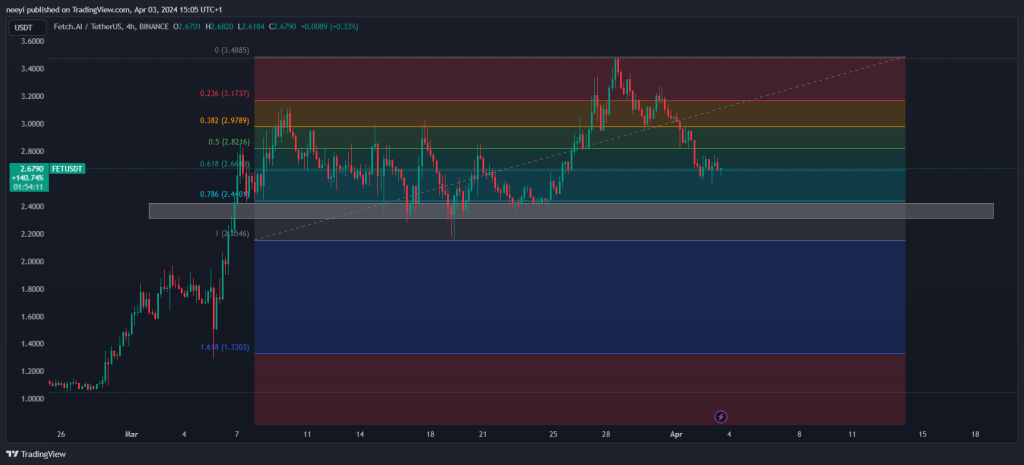

On the other hand, Fetch AI (FET) has continued on a bearish trajectory for the past week. The price has been clearly in the red for the last three days and is currently trading at $2.6, breaking below the 0.681 Fibonacci Retracement level. A close below this level could see FET’s price dip further to the next support area between $2.3 and $2.4.

For Fetch AI, holding crucial support levels is essential for a potential price recovery. If the selling pressure persists and the price breaks below these key support areas, it could signal further downside for the cryptocurrency.

As the markets continue to fluctuate, investors are advised to exercise caution and conduct thorough research before making any investment decisions. It’s crucial to understand the risks associated with cryptocurrency trading and to manage positions accordingly.

You may also be interested in:

- Why is Ethena (ENA) Token Price Surging?

- Here Are 4 Reasons Why Bitcoin Price is Down Ahead of BTC Halving

- Bonk (BONK) Nemesis BUDZ Gains BONK Investor Support For 420 Launch

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.