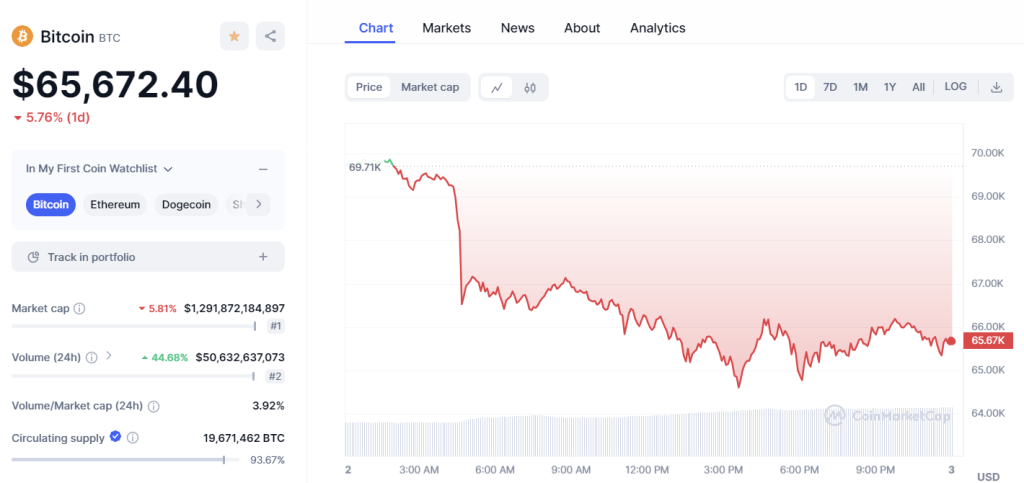

Bitcoin has dropped around 6% today and is trading around $65,500 with only 17 days left until the highly anticipated next Bitcoin halving event. The price decline has caused some concern among investors as to what is driving the sell-off so close to the supply squeeze.

Popular crypto analyst Ash Crypto, with over 1 million followers on X, highlighted 4 key reasons why he believes Bitcoin has been dumping in his latest tweet:

- Grayscale Bitcoin Trust (GBTC) Outflows

Ash points to the $302 million outflow from Grayscale’s Bitcoin product yesterday along with net outflows across Bitcoin ETFs. He states “There is still some major GBTC selling happening, probably from Genesis, and once it settles, BTC will resume its upward momentum.”

The GBTC premium/discount has been a driver of Bitcoin buying and selling from arbitrage traders. Heavy discounts can lead to selling of the underlying Bitcoin.

- Excessive Leverage

“Whales always love to liquidate high-leverage longs and shorts,” according to Ash. He notes that open interest (leverage) is currently at new highs while the funding rate is positive, “which indicates that there are more longs than shorts.”

This creates an opportune setup for whales to trigger cascading liquidations of overleveraged longs to drive the price down.

- Pre-Halving Correction

Ash notes the pattern of “BTC always goes down before halving, and the same thing is happening now.” This could be due to traders taking profits ahead of the issuance slowdown or minor panic selling on volatile moves.

- Macro Factors & Correlation

The analyst cites the “negative correlation between Bitcoin and the 10-year US Treasury yield” which has reached -90%. He states “This means whenever the 10-year Treasury yield is rising, BTC is dropping. Yesterday, it rose by 4.3%, and thus BTC dumped.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The rising rates put downward pressure on risk-assets like Bitcoin. Macro traders may be pricing in further Fed tightening.

While never easy for investors, Bitcoin price dips are common ahead of key events like halvings. Whale games around leverage, coupled with macro forces and technical patterns, seem to be the key drivers according to one of crypto’s premier analysts.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.