Notable crypto analyst HODL15Capital released an insightful thread on X (Twitter) regarding the dwindling daily supply of new Bitcoin entering the market. He pointed out that as major Bitcoin mining companies hold more coins and daily production decreases, supply squeeze conditions could propel Bitcoin price higher.

“If all miners sold 100% of their coins, that 900 would be the new daily supply. Some miners, sell no coins (ie $MARA in January). In 65 days, the 900 drops to 450,” tweeted HODL15Capital.

He was referring to the 900 new bitcoins mined per day currently. However, some major mining companies like MARA have balanced their selling pressure in January. Additionally, in about two months, Bitcoin’s quadrennial halving will drop daily production to around 450.

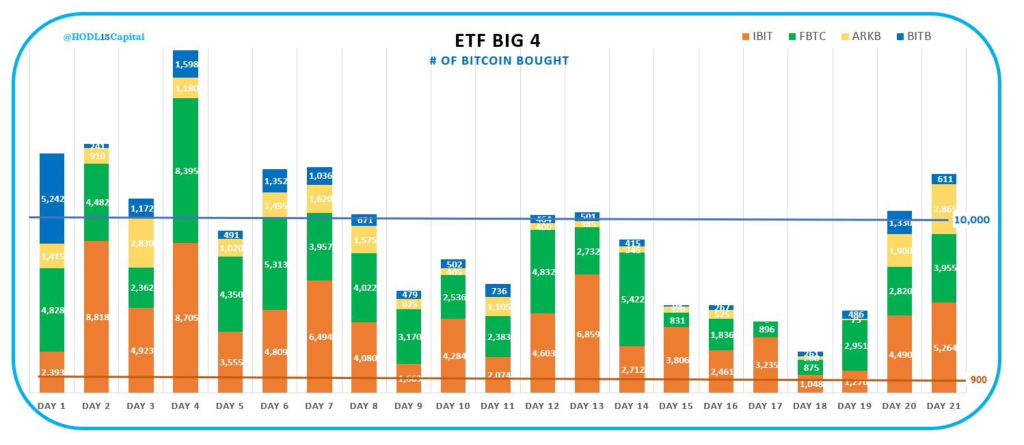

At the same time, HODL15Capital revealed statistics on the aggressive Bitcoin accumulation happening amongst exchange-traded funds (ETFs) that received SEC approval in January 2024.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +“Number of #Bitcoin bought by the Big 4 ETFs each trading day Day 21 = 2/9/24 Only 900 $BTC are mined daily. If you sold any #Bitcoin in the last 30 days, these ETFs bought them & they will HODL it for years to come.”

His analysis leads to a compelling conclusion – with supply tightening from both decreasing production and rampant institutional accumulation, meanwhile demand continues growing rapidly, conditions are ripe for much higher Bitcoin prices by end of year. The next few months may see explosive upside in Bitcoin and the broader crypto market.

You may also be interested in:

- Ripple Is Not Dead: Why You Should Continue Holding XRP Despite Its Free Fall Against Bitcoin

- Leading Crypto Expert Revises Solana and COTI Price Analyses and Predictions

- Next-Gen vs. Established Crypto: How DeeStream (DST), Cosmos (ATOM) and Bitcoin Cash (BCH) Look to Deliver

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.