The bot trading landscape has undergone a seismic shift. As the dust settles, many have fallen by the wayside, but one titan stands tall: Unibot according an analyst Louis Cooper.

With the introduction of Unibot X, it’s evident that the future of DeFi trading has been irrevocably altered. If the trajectory set by @TeamUnibot remains consistent, mainstream adoption is inevitable, growing stronger with each iteration.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So, what fuels this optimism? Let’s dive in:

What you'll learn 👉

1. Key Metrics

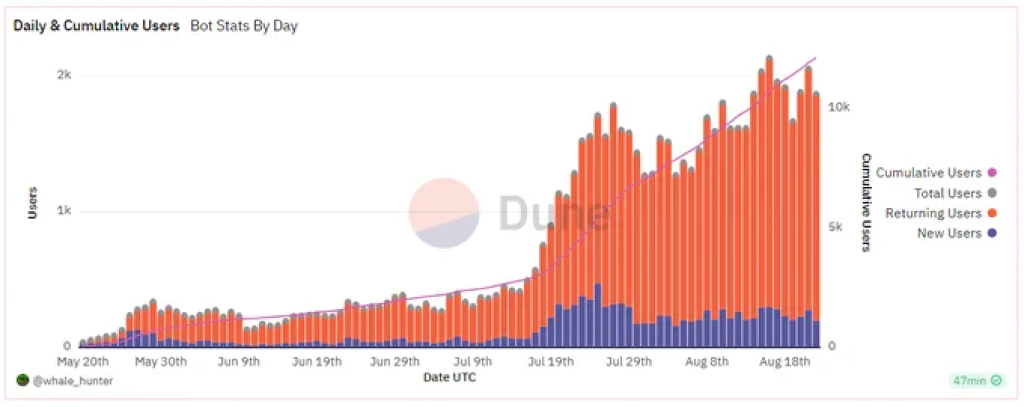

User Engagement: The true testament to a product’s viability is its user base.

- Is there a genuine demand for the product? Absolutely.

- Does this demand persist irrespective of token valuation? Undoubtedly.

Despite a more than 50% retraction in $unibot’s value, the platform consistently records new all-time highs in user count. This trend underscores a dual assurance:

- New users are continually onboarded.

- Existing users remain loyal.

In the vast ocean of bot trading, user retention distinguishes enduring investments from fleeting trends. Such impressive user metrics aren’t a result of mediocrity but a testament to excellence.

Additional Metrics:

- 2,000 daily active users executing 8,000 trades daily.

- Imminent $2m in bot revenue (excluding taxes).

- A staggering lifetime volume of $220m, albeit dwarfed by Uniswap v3’s daily volume.

- A lucrative annualized APY of 30% for Unibot holders.

2. The Team Behind the Vision

The DeFi space has witnessed its fair share of lackluster teams. However, the Unibot team stands in stark contrast. Their rapid development pace, unwavering confidence substantiated by data, and transparent communication set them apart.

Kudos to the stellar team:

- @TeamUnibot

- @xcurveth

- @0xKawz

- @MarkHannaWCM

- @cryptowhail

- @Reethmos

3. The Underlying Thesis

Strip away Unibot’s impressive metrics, and you’re left with a foundational belief: mass adoption hinges on simplicity. The team envisions Unibot as the quintessential DeFi/crypto trading hub, seamlessly integrating with various platforms, blockchains, and assets, ensuring universal accessibility.

Consider this: a mere 5% of Uniswap’s volume equates to a $400m valuation. Ponder on that. @0xKawz

Future Projections:

- Collaborations with centralized platforms to usher in a deluge of web2 users.

- Streamlined asset management with intuitive on/off-ramps.

- Transitioning from wallets to user accounts.

(Note: These are speculative insights, devoid of any insider information.)

It’s crucial to recognize that during bullish phases, the majority aren’t DeFi aficionados. Their primary concern isn’t self-custody, as highlighted by @FroyoFren.

Adoption By The Numbers:

Understanding user preferences is pivotal. Catering to these needs ensures that even novices find Unibot user-friendly, translating to hassle-free revenue generation.

Current Metrics:

- 2,000 daily Unibot users.

- Daily bot fees amounting to 50k. @whale_hunter

An often overlooked metric: with over 12,000 unique users, the average fee per user hovers around 0.1 ETH or $160. This can be perceived as the LTV (lifetime value) of a user, which is likely to diminish as the user base expands.

Projected User Base Valuation:

- 100,000 users = $16m

- 1m users = $160m

- 10m users = $1.6bn

Even during bearish phases, Unibot has achieved 12% of the 100k user milestone. The potential during bullish cycles is boundless.

Increased adoption translates to heightened volume and revenue, culminating in fee accumulation. This, in turn, results in revenue sharing. Investing in Unibot not only ensures a share of this revenue but also capitalizes on the limited supply of Unibot tokens. The outcome? Enhanced wealth, with revenue directly transferred to your wallet, devoid of staking or risks.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.