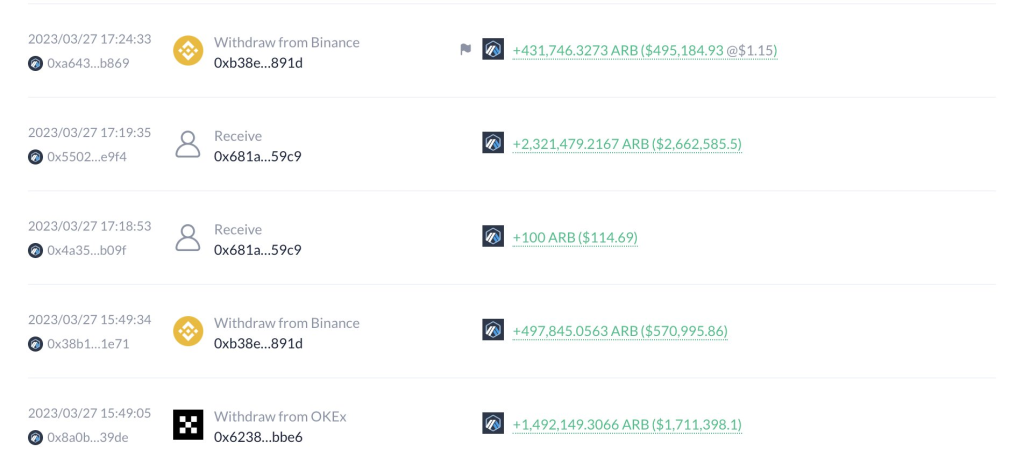

In a shocking move that has sent shockwaves through the crypto community, a massive whale has removed a staggering 5.56 million $ARB ($5.66 million) worth of liquidity from the popular decentralized exchange, Uniswap. What’s more intriguing is that this whale proceeded to sell 3.92 million $ARB for 2,262 ETH ($3.97 million), at an average selling price of $1.01.

The sudden sell-off comes as a surprise, considering that the whale initially acquired $ARB on March 27 when the price stood at $1.15. The panic-induced selling at a loss raises eyebrows and leaves observers speculating about the motives behind this unusual behavior.

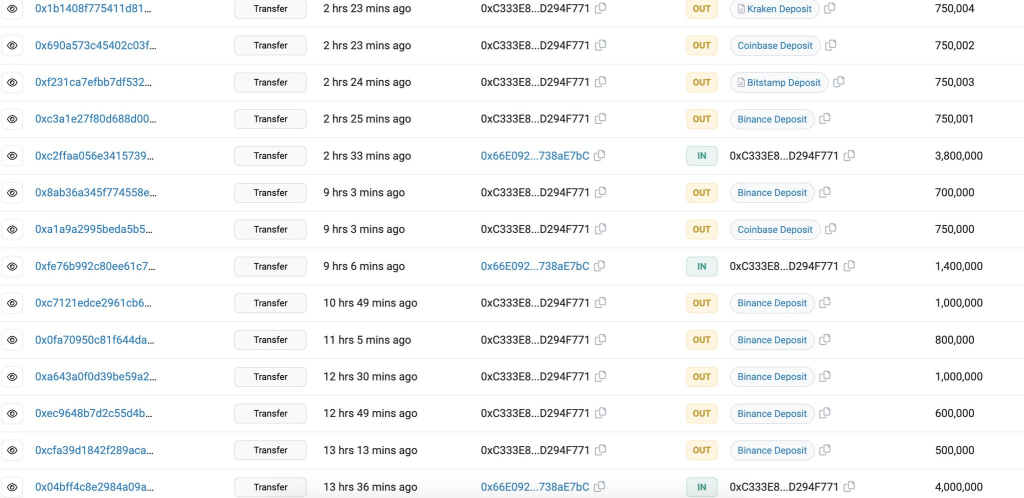

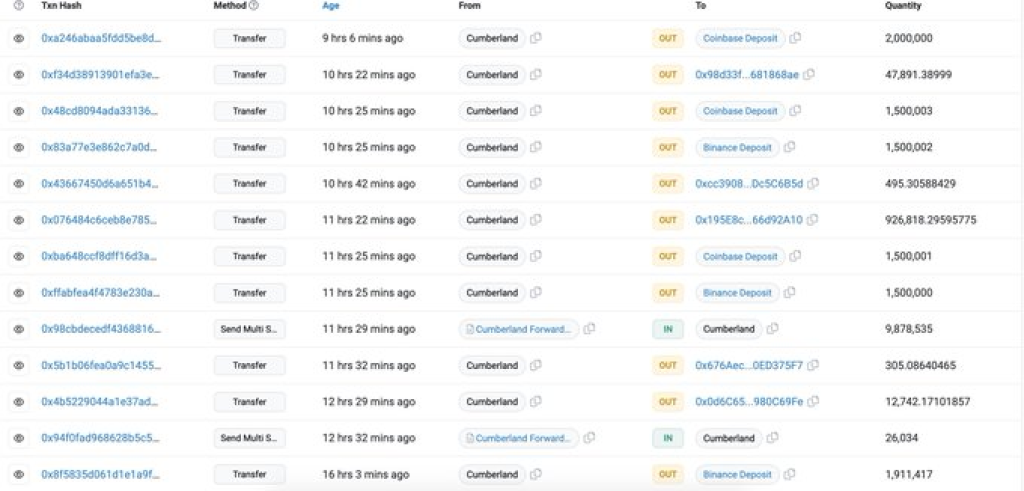

Meanwhile, another whale associated with Robinhood, Jump Trading, and Cumberland has made significant deposits of 9.4 million $MATIC to exchanges within the past 15 hours. This move has sparked concerns that whales and institutions are now offloading their $MATIC holdings, causing a massive dip in its price.

Over the course of 16 hours, Cumberland alone deposited a staggering 9 million $MATIC ($6.3 million) into Binance and 5 million $MATIC ($3.5 million) into Coinbase. The cumulative effect of these deposits amounted to a total of 14 million $MATIC ($9.8 million) being injected into exchanges. Consequently, the price of $MATIC plummeted by approximately 29%.

It is worth noting that the Securities and Exchange Commission (SEC) recently classified 61 cryptocurrencies as securities, and one of the affected projects is none other than $MATIC. The SEC’s decision stems partly from Polygon’s deflationary model, which involves burning MATIC tokens accumulated as fees, ultimately decreasing the token’s total supply. However, critics argue that the SEC’s understanding of blockchain mechanics falls short, as they fail to recognize the intrinsic significance of such mechanisms.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +As the crypto market continues to experience fluctuations and surprises, it remains to be seen how these developments will impact the overall sentiment and stability of the industry. Only time will reveal the true motivations behind these whale movements and shed light on the future of these intriguing tokens.

Should You Buy or Dump? Experts Advise Patience and Strategic Moves

While the volatility and panic selling may tempt some to follow suit, experts are advising caution and strategic decision-making.

For those considering an entry into these tokens, it is advisable to exercise patience and wait for a bottom to form. This means observing the price action and market trends to identify a potential price floor. Buying dips in phases can be a wise approach, as it allows investors to accumulate assets at lower prices while minimizing risk.

On the other hand, existing holders of $ARB and $MATIC may be tempted to join the panic selling. However, it is essential to remember that selling at a loss is rarely a prudent strategy. Instead, experts suggest evaluating the long-term potential of these tokens and weighing it against short-term market fluctuations. Selling in a panic may lead to regret if the tokens rebound in the future.

As always, it is crucial to conduct thorough research, seek advice from reputable sources, and make informed decisions based on individual risk tolerance and investment goals. The crypto market can be unpredictable, but with careful analysis and a strategic approach, investors can navigate these uncertain waters and potentially seize opportunities for long-term gains.